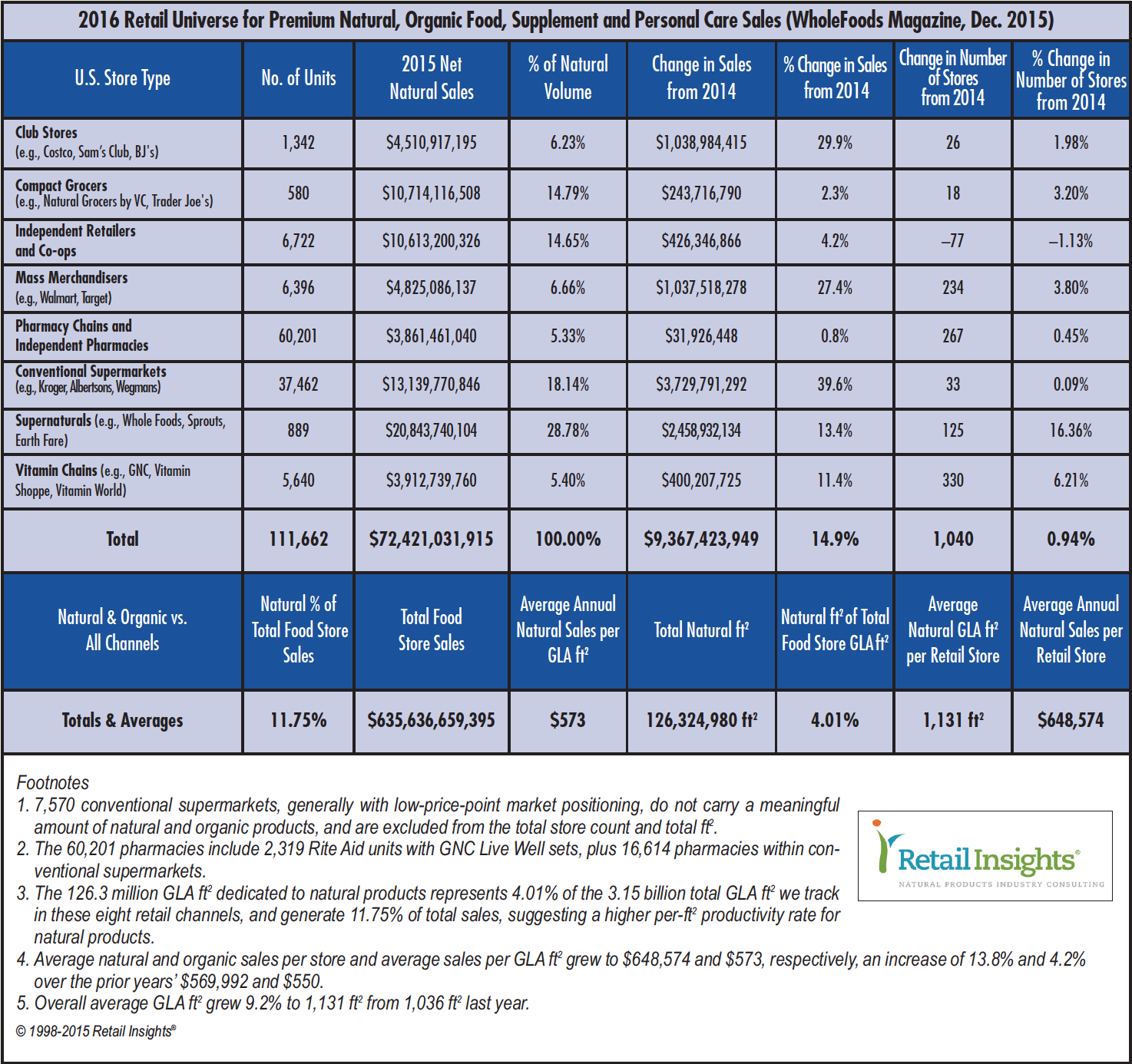

Traction. 2015 was the year natural products gained significant traction outside their core channels of distribution. Overall, natural and organic product sales grew a stunning 14.9%, adding $9.367 billion to total $72.4 billion in sales, and reaching 11.75% of total U.S. food store sales. Perhaps more noteworthy is this fact: total U.S. food store sales grew 3.1%, adding $19.1 billion; meaning natural and organic products growth made up nearly half (49%) of this number. At this rate, the natural products industry is on track to reach one-third of total food store sales within the next generation, or $500 billion of the then $1.5 trillion U.S. food store business.

Who gained most in 2015? Conventional supermarkets, which grew 39.6%, added $3.7 billion in natural sales, led by Kroger’s aggressive push into its private label Simple Truth natural and organic lines. Next, supernaturals including Whole Foods Market, Sprouts Farmers Market, Earth Fare and others clocked in with $2.4 billion in new sales, increasing 13.4% to reach $20.8 billion and an industry-leading 28.8% natural market share.

Club stores rang up the third highest gross dollar increase in sales, $1.038 billion, a 29.9% increase, trailed slightly by mass merchandisers like Target and Walmart, also adding just over $1 billion in natural sales.

The independent natural channel also grew, adding $426 million in sales, although store counts declined by 77 units to total 6,722 stores. Even though store counts slid, total square footage increased: average GLA grew to 3,470 ft2 from 3,300 ft2. What we are seeing is the survival and growth of the fittest independents. Long-time incumbents are expanding their footprint and adding perishables, and are reaping robust sales increases.

The vitamin chain channel, including GNC and The Vitamin Shoppe, swelled by $400 million, and even the pharmacy channel managed a $31.9 million increase.

For those interested in more detail on the “2016 Retail Universe,” please contact Jay@retailinsights.com.WF

Click here to read the 2015 Retaile Survey Overview

Published in WholeFoods Magazine December 2015

Jay Jacobowitz is president and founder of Retail Insights®, a  professional consulting service for natural products retailers established in 1998, and creator of Natural Insights for Well Being®, a comprehensive marketing service designed especially for independent natural products retailers. With 38 years of wholesale and retail industry experience, Jay has assisted in developing over 1,000 successful natural products retail stores in the U.S. and abroad. Jay is a popular author, educator, and speaker, and is the merchandising editor of WholeFoods Magazine, for which he writes Merchandising Insights and Tip of the Month. Jay also serves the Natural Products Association in several capacities. He can be reached at (800)328-0855 or via e-mail at jay@retailinsights.com. Listen to Jay speak at NPA SOHO Expo on Friday, December 4, at 10:15 a.m. Jay will be speaking about the “2015 38th Annual Retailer Survey by WholeFoods Magazine,” covering key findings and analysis from the survey. He will be exhibiting at Booth #307.

professional consulting service for natural products retailers established in 1998, and creator of Natural Insights for Well Being®, a comprehensive marketing service designed especially for independent natural products retailers. With 38 years of wholesale and retail industry experience, Jay has assisted in developing over 1,000 successful natural products retail stores in the U.S. and abroad. Jay is a popular author, educator, and speaker, and is the merchandising editor of WholeFoods Magazine, for which he writes Merchandising Insights and Tip of the Month. Jay also serves the Natural Products Association in several capacities. He can be reached at (800)328-0855 or via e-mail at jay@retailinsights.com. Listen to Jay speak at NPA SOHO Expo on Friday, December 4, at 10:15 a.m. Jay will be speaking about the “2015 38th Annual Retailer Survey by WholeFoods Magazine,” covering key findings and analysis from the survey. He will be exhibiting at Booth #307.