Weight management constitutes a perennial powerhouse in terms of supplement sales, and yet the category is far from settled and predictable.

For one matter, the scrutiny it constantly bears from regulators like the Federal Trade Commission (FTC) and the U.S. Food and Drug Administration (FDA) make it difficult to navigate for marketers and tough to project into the future. It is hard to foresee which way things will turn, as FTC, for example, ratchets up its efforts to protect consumers from deceptive weight product marketing.

Consumers and manufacturers alike must also continue sorting through the fads in weight management to find out what deserves longevity. Manufacturers, meanwhile, continue to engage in research and innovation. They are testing the waters with more complex formulas, and here we’ll discover why some of these work well. We’ll also discuss which classes of weight management products give most people results.

FTC Action and Industry Reaction

Headlines were made recently when the FTC launched “Operation Failed Resolution” to crackdown on deceptive weight loss marketing. The initial action taken by the agency was to exact tens of millions of dollars from a handful of companies that FTC says misled consumers in various ways with weight loss claims. Consumers can claim refunds from pools created by these fines if, for instance, they were among those who bought Sensa Products’ claim that “the powdered food additive Sensa enhances food’s smell and taste, making users feel full faster, so they eat less and lose weight, without dieting, and without changing their exercise regime” (1).

The FTC has vowed this is just the beginning,  but really it’s not a beginning at all. It is just the latest chapter in a history of regulatory efforts, as these agencies have long been hyper-focused on preventing companies from deceptively marketing weight loss products.

but really it’s not a beginning at all. It is just the latest chapter in a history of regulatory efforts, as these agencies have long been hyper-focused on preventing companies from deceptively marketing weight loss products.

But the question is what effect these continued high-profile barrages have on legitimate players in this market. “This year it was ‘Operation Failed Resolution.’ In 2004, it was ‘Big Fat Lie,’ and in 1997, ‘Operation Waistline.’ How many more initiatives, and the bad publicity that follows, will it take to totally ruin our industry?” wonders Mitch Skop, senior director of new product development at Pharmachem Laboratories Inc., Kearny, NJ.

Opinions vary as to the effect this all has on consumer habits. “Weight loss supplements continue to represent important sales drivers, but many in the industry are waiting to see how negative attention will affect long-term category growth,” says Paul Dijkstra, CEO of InterHealth Nutraceuticals, Benicia, CA.

But virtually all agree that the market needs to be cleaned up. “We applaud the efforts to remove companies that use claims that can’t be substantiated or that use unsafe or unproven products, as this helps build a stronger weight loss market for our industry,” says Scott Steil, president of Nutra Bridge, Shoreview, MN.

In agreement is Robert LoMacchio, president of Bio Nutrition, Inc. and vice president of national and international sales for Only Natural, Inc., Island Park, NY. Unfortunately, he says, unscrupulous, fly-by-night companies take advantage of unsuspecting consumers with false claims and low-quality products until regulators catch them. “Many of these predatory companies don’t even use materials that have been tested for purity and potency because their sole objective is to make a profit,” LoMacchio says.

Jay Levy, director of sales at Wakunaga of America Co., Ltd., Mission Viejo, CA, details the modes of deception and unsafe shortcuts such marketers use. Sometimes, a company may actually refer to a human clinical trial, but in doing so, will make claims based on the out-of-the-ordinary weight loss results achieved by just one subject out of perhaps 50 in the study, according to Levy. He says that to avoid being deceptive, companies should only tout results seen in at least 30% of study participants, and these specific figures should be revealed by the company.

Levy also cautions against products that include high amounts of central nervous system stimulants, as these tend to result in side effects. He says that formulations should not exceed 100 mg of caffeine per serving, but many contain double that, which can lead to high blood pressure, anxiety and jitters.

Levy also cautions against products that include high amounts of central nervous system stimulants, as these tend to result in side effects. He says that formulations should not exceed 100 mg of caffeine per serving, but many contain double that, which can lead to high blood pressure, anxiety and jitters.

Neil E. Levin, CCN, DANLA, nutrition education manager for NOW Foods, Bloomingdale, IL, voices the frustration felt by responsible companies forced to observe infomercials and Web sites that make blatantly illegal and fake claims. From this perspective, he says, it is gratifying to see that the current regulatory structure is adequate for keeping the industry honest. But another frustration occurs when responsible companies are lumped in with the bad actors by industry critics trying to make a case for more regulation, he says. Common sense dictates that there are bound to be lawbreakers in every industry, Levin argues, and the best way to stop them is through proper enforcement of existing laws.

Some question, however, if it is really healthy for FTC to always be taking the lead. Skop says while FTC’s efforts to clamp down are appreciated, the industry should really be cleaning its own house from time to time. There are good, well-researched weight management ingredients available, he says, but deceptive marketers can leave consumers with an overarching suspicion of dietary supplements for weight loss. “Instead of offering supplements that are proven to be safe and effective, these companies choose to peddle fad weight loss products in very deceptive marketing campaigns that prey on those who are desperate and uninformed,” Skop says.

For Dallas Clouatre, Ph.D., consultant for R&D to Jarrow Formulas, Inc., Los Angeles, CA, there is a concerning element to FTC’s efforts. “We need to distinguish between the regulatory action, on the one hand, and its use to attempt to rewrite one or more rules governing evidence, on the other hand,” he says.

This most recent initiative is not a surprise, according to Clouatre, as the companies involved were flagrantly violating existing FTC and FDA rules, not to mention normal business ethics (making up data, doctoring clinical trial results and marketing products without performing even small animal studies). But in his view, FTC appears to be creating de facto standards on the scientific evidence required to make product claims, without going through the proper regulatory channels.

“These standards would include requirements for more studies than ever have been accepted as essential in the past, meaning two clinical trials rather than one, and the application of unclear yardsticks for evaluating the quality and hence the acceptability of the studies,” says Clouatre. These areas of uncertainty leave manufacturers venturing into the weight loss arena vulnerable with regard to new ingredients, he explains.

for more studies than ever have been accepted as essential in the past, meaning two clinical trials rather than one, and the application of unclear yardsticks for evaluating the quality and hence the acceptability of the studies,” says Clouatre. These areas of uncertainty leave manufacturers venturing into the weight loss arena vulnerable with regard to new ingredients, he explains.

Priya Khan, Ph.D., president and CEO of NutriGold, Orem, UT, raises an issue related to the electronic marketplaces that have become fixtures in this category. There is a worry, she says, “that the FTC, like the FDA, will simply go after ‘soft’ targets and turn a blind eye to the egregious activities of hundreds of companies that abuse the online platforms that Google and Amazon provide to peddle unproven or, worse, unsafe products to unsuspecting consumers with zero oversight and even less accountability.”

“It has become all too common,” Khan says, “for scam companies to purchase private label products and slap on a label without verifying whether the product contains what it claims to contain, and promote it using unethical and unlawful business practices to consumers who are trusting enough to buy into all the hype.”

To complicate things further, Tony Moore, director of R&D at RightWay Nutrition, Bluffdale, UT, explains that many times, companies that get in trouble with regulators did not have the “intent” to mislead. They observe market trends, he says, and move ahead without understanding the marketplace. Nevertheless, he says, “This intense regulation does not generate good feelings or consumer confidence in the industry.”

What can responsible companies and even retailers do about it? They can start by measuring the playing field laid out by FTC for weight management and playing accordingly. Retailers, by the way, are stakeholders because their customers most certainly are. Anurag Pande, Ph.D., vice president of scientific affairs at Sabinsa Corporation, East Windsor, NJ, paraphrases former FTC chairman Deborah Platt Majoras in saying that claims based on fad science can help consumers to lose cash, not pounds.

“Companies like ours work to maintain consumer trust and respect by not only following the law, but also taking it further to encompass industry self-regulation, including professional codes of conduct and third-party certifications,” says Levin. Responsible companies should establish internal review panels to examine marketing claims for regulatory compliance, he says, explaining that regulations require, in most cases, that claims only refer to supporting healthy body structures and functions. When utilizing the few qualified health claims that FDA allows, applicable rules must be followed, he adds. Studies and charts in marketing must be positioned cautiously, Levin says, and messages must include an emphasis on diet and lifestyle.

“Companies like ours work to maintain consumer trust and respect by not only following the law, but also taking it further to encompass industry self-regulation, including professional codes of conduct and third-party certifications,” says Levin. Responsible companies should establish internal review panels to examine marketing claims for regulatory compliance, he says, explaining that regulations require, in most cases, that claims only refer to supporting healthy body structures and functions. When utilizing the few qualified health claims that FDA allows, applicable rules must be followed, he adds. Studies and charts in marketing must be positioned cautiously, Levin says, and messages must include an emphasis on diet and lifestyle.

But trying to draw definitive conclusions about what regulators want may prove difficult, according to Clouatre. FTC does not have the right to introduce new standards through cases and settlements, he says, and if two randomized placebo-controlled double-blinded trials are to be the minimal standard for the weight loss market, the rules should go through a formal proposal period. If this were to happen, the new rules need be made clear far enough in advance for manufacturers to comply, he says.

Industry, meanwhile, should accept the message FTC is trying to convey. “The writing is on the wall that the regulators will continue to push for increasing the validation requirements and that two good-quality clinical studies probably will eventually be needed,” says Clouatre.

Skop says the industry should be proactive in adopting principles to fortify FTC’s efforts. These include:

1. Utilize double-blind, placebo-controlled studies to demonstrate products are effective and safe.

2. Urge media outlets not to accept ads for weight loss products that make dubious claims.

3. Report cases of companies that are making outrageous, unsubstantiated claims.

The challenge, says Steil, is to remove the products making up this last category, and eliminate others that are nothing but a trendy marketing story. The key to doing so is to look at the published human clinical trials, he believes.

Bob Green, president of Nutratech, Inc., West Caldwell, NJ, points  out that his company’s bitter orange extract (Advantra Z) has its safety and efficacy supported by over 30 research studies from more than a 15-year period. “Branded ingredients usually offer a body of ongoing research over a period of time to validate structure/function claims,” Green says.

out that his company’s bitter orange extract (Advantra Z) has its safety and efficacy supported by over 30 research studies from more than a 15-year period. “Branded ingredients usually offer a body of ongoing research over a period of time to validate structure/function claims,” Green says.

Companies not doing the background work end up eroding consumer trust not just in the weight category, but also in all dietary supplements, says Kathy McKnight, vice president of sales and marketing for Natural Factors USA, Monroe, WA. She says her company’s satiety ingredient (PGX) has multiple and ongoing safety and efficacy studies behind it, and has also achieved generally recognized as safe (GRAS) status.

Making sure that scientific backing is relevant to the product being marketed is important. Case in point is the trademarked green coffee bean extract (Svetol from Naturex, South Hackensack, NJ) promoted on The Dr. Oz Show. According to Antoine Bily, R&D director and Thomas Ughetto, deputy director of the nutrition and health business unit at Naturex, there has been an explosion of generic green coffee bean entries into the market since this exposure. Svetol is made with an extraction process that incorporates a high concentration of specific chlorogenic acids. Bily and Ughetto say that some marketers have used the results of studies on this specific ingredient to support claims for finished products that contain it, and have not seen any regulatory issues.

They say it is still advisable to match the marketing to the actual ingredients studied. “Each result linked to our product is based on scientific evidence and backed by several studies. This guarantees a high efficacy of our products and our clients can base their marketing and claims on our data. This saves time for our customers and ensures a full compliance with their regulatory environment,” they say.

Dijkstra agrees that at the end of the day, ingredients that have been scientifically tested will come out ahead. “Weight loss structure/function claims are permissible claims under the Dietary Supplement Health and Education Act (DSHEA). These claims should be backed by well-designed clinical studies so as to not mislead consumers,” he says.

Retailers, for their part, need to make sure that the products they sell and the ingredients in them are approved under and compliant with DSHEA, according to Green. “That’s especially important in the weight management category when you consider the outrageous claims made by companies involved in the FTC Operation Failed Resolution,” he says.

Retailers, for their part, need to make sure that the products they sell and the ingredients in them are approved under and compliant with DSHEA, according to Green. “That’s especially important in the weight management category when you consider the outrageous claims made by companies involved in the FTC Operation Failed Resolution,” he says.

Uncertainty exists regarding product testimonials in weight management marketing, as FTC has attempted to guide the industry on their use and misuse in the past. “Testimonials are all well and good, but do not in any way serve as the basis for making claims about any given product. There is simply no substitute for well-designed clinical studies to establish efficacy and to support claims,” says Georges Bergen, senior manager of regulatory affairs for DSM Nutritional Products, Parsippany, NJ. The FTC has served notice, he says, and those who use deceptive strategies should expect to be penalized.

Though testimonials are a primary strategy for some companies, Levin says that his tries to focus on science. It does, however, have “ambassadors” who provide their full names and history, and explain how diet along with supplementation helped them to achieve weight goals. “They aren’t necessarily endorsing a single product; they’re describing how a regimen of natural products has supported and helped them overcome health or athletic obstacles,” Levin says.

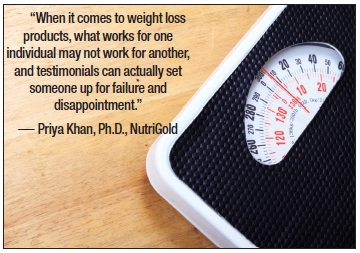

Though they can be useful in other contexts, there are two reasons that testimonials can be problematic in weight management marketing, according to Khan. “When it comes to weight loss products, what works for one individual may not work for another, and testimonials can actually set someone up for failure and disappointment,” she says. The other factor is that marketers are tempted to either concoct fake testimonials or pay for them, thus defeating the purpose.

LoMacchio says his company won’t use testimonials customers send in because of how much results vary. Skop’s take is that while companies should want to publish and promote success stories from those that have taken their products responsibly, there is no  “magic pill” and testimonials should not imply there is. Moore believes that testimonials can be an important factor in getting consumers to pick up a product, so long as they are honest. “There is a place for them, but each company needs to do their best to be as direct and open about them as possible,” says Moore.

“magic pill” and testimonials should not imply there is. Moore believes that testimonials can be an important factor in getting consumers to pick up a product, so long as they are honest. “There is a place for them, but each company needs to do their best to be as direct and open about them as possible,” says Moore.

As for the regulatory environment, Clouatre says to expect testimonials and other “unquantifiable” types of advertising to eventually be either not allowed or heavily restricted. He also says to watch for attempts by FTC to expand the pool of accountability for deceptive claims beyond manufacturers and marketers to potentially include media outlets. Legal wrangling would then ensue, he predicts, as issues of censorship and prior restraint would come before the courts.

But beyond these misgivings and the uncertain atmosphere, Pande notes that weight management has always been a top segment in the dietary supplement industry and is likely to remain so. He hopes that from FTC’s latest actions, the industry will emerge stronger and with a more level playing field.

Mass media always seem to pounce on news regarding products sold under the DSHEA regulatory pathway, says Dan Lifton, CEO of Quality of Life Labs, Purchase, NY. “There is, of course, a danger that the combination of unremittingly negative media coverage and well-publicized regulatory actions could permanently damage consumer confidence in dietary supplements,” he says. But Lifton feels a greater danger is letting irresponsible marketers continue to ply their trade unabated.

Singled Out

People’s willingness to believe in simple solutions, combined with the media hype machine, have created a weight management market predominated by a few hot ingredients. These buzzed about extracts, like green coffee bean and Garcinia cambogia, are often featured solo as the main active substance in a supplement. How much of this is attributable to companies giving consumers what they think they want, and how much is solid science?

“Generally speaking, consumers tend to have difficulty grasping onto multi-nutrient formulations, and the bulk of weight loss dietary supplement sales have been going to a few key nutrients as standalone products.” explains Levy.

“Generally speaking, consumers tend to have difficulty grasping onto multi-nutrient formulations, and the bulk of weight loss dietary supplement sales have been going to a few key nutrients as standalone products.” explains Levy.

This makes sense, says Charles Heying, president of Clinical Study Applications, dba Bricker Labs, Chandler, AZ, since simplicity is a key tenet of consumer marketing. “A simple message will always bring more success than a complex, multi-angle approach. This is why so many commercially successful products tend to rely on a single ingredient,” he says. He feels that although there are very effective single ingredients available, all have weaknesses on their own.

One or two ingredients in the weight management category sometimes need to be taken on their own, according to Clouatre. This is due to the “food effect,” which causes substances like Garcinia cambogia extract to be poorly absorbed when taken with food. Clouatre says that unless garcinia extracts have been specially processed, their bioavailability can be reduced 60% if followed by a small meal. By processing HCA (the key active in garcinia) as a potassium-magnesium HCA salt, he says his company reduced this effect.

Apart from cases like these, “emphasizing single ingredients generally has a lot more to do with the media and advertising than it does with human physiology,” Clouatre says. The body depends on elaborate checks and balances to regulate its metabolism, beyond the cues it sends to eat less or alter food choices, he says. These include the thermic effect of food (which can eliminate 10% of calories consumed), effects on thyroid function, cues to engage in or reduce physical activity, alteration of food efficiency and more. Clouatre says that in those who are overweight or obese, often more than one metabolic pathway is dysregulated.

In addition to the desire to capitalize on media attention, Khan says the ease and speed with which single-ingredient products can be brought to market is another factor in their dominance. Then, there is the simple fact that some ingredients are thought to work for a particular aspect of weight loss, like garcinia for satiety.

The type of research being conducted is  influencing the high number of single-ingredient product launches. “One of the reasons is that the clinical studies, or claim substantiation, may be available on a single ingredient, but not in combination with any other ingredients,” Pande says. LoMacchio agrees, saying the general emphasis at universities and from independent companies on conducting clinical trials of single weight management ingredients sets the table for single-ingredient products.

influencing the high number of single-ingredient product launches. “One of the reasons is that the clinical studies, or claim substantiation, may be available on a single ingredient, but not in combination with any other ingredients,” Pande says. LoMacchio agrees, saying the general emphasis at universities and from independent companies on conducting clinical trials of single weight management ingredients sets the table for single-ingredient products.

One positive associated with single-ingredient formulas is that when they work, customers keep coming back, and may even trade up to more complex multi-ingredient options, says Trisha Sugarek MacDonald, B.S., M.S., director of R&D/national educator for Bluebonnet Nutrition Corporation, Sugar Land, TX.

Single ingredients have performed especially well over the past two years as more marketing efforts have focused in on them, says Steil. He says his company’s weight management ingredient (7-Keto) has seen strong interest recently as a standalone ingredient in finished products.

The consumer demand and rush to fill it for some of these ingredients somewhat resembles a feeding frenzy, and much of it is fueled by media personalities like Dr. Oz. “I don’t blame Dr. Oz for this; he is a tremendous advocate for this industry and if the consumer really pays attention, he usually recommends a specific type or potency of an ingredient, generally one that has been clinically tested and has proven results,” says LoMacchio.

Weight Supplement Approaches

It wouldn’t be advisable or safe for consumers to try every class of weight management supplements at once, and it can be costly and time consuming to cycle through them one at a time until something works. So, some helpful advice on what might work best for most people seems welcome.

Clouatre takes a first stab at identifying a major cause of obesity, especially in our culture. He says the more fats have been replaced by carbohydrates in American diets, the more prevalent weight issues  have become. Insulin is the factor that explains this, he says, and insulin metabolism must be improved if weight loss is to be lasting or significant. To succeed, dieters usually need to reduce meal size, reduce snacking and reawaken the body’s natural responses to food, Clouatre says. This means weight ingredients designed to improve satiety and support insulin metabolism can help a wide range of people.

have become. Insulin is the factor that explains this, he says, and insulin metabolism must be improved if weight loss is to be lasting or significant. To succeed, dieters usually need to reduce meal size, reduce snacking and reawaken the body’s natural responses to food, Clouatre says. This means weight ingredients designed to improve satiety and support insulin metabolism can help a wide range of people.

In agreement that weight gain is being driven by the overconsumption of sugar and carbohydrates is Lifton, and he believes supplements that help to block carbohydrate absorption and reduce cravings for them can be effective long-term aids.

Relatedly, McKnight tells us about a proprietary fiber ingredient (PGX from Natural Factors) that can positively impact blood sugar. “Regulating blood sugar is a key factor in many health conditions, including weight gain,” she says. Human clinical research has shown it to help reduce appetite, promote healthy blood sugar levels already within the normal range and reduce the glycemic index of foods, according to McKnight.

A clinically studied extract of the white kidney bean, according to Skop, has been shown to reduce starch digestion. The extract, therefore, has the potential to induce weight loss and reduce blood sugar spikes. It achieves this through its inhibition of alpha-amylase, the enzyme responsible for breaking down carbohydrates.

Eric Ciappio, Ph.D., R.D., manager of scientific affairs for DSM Nutritional Products, explains that fats induce satiety more efficiently than carbohydrates or protein. He says that using this knowledge, his company developed an oat/palm oil emulsion (Fabuless) that helps induce satiety and manage appetite. This is an important benefit for those who’ve concluded diets, because maintaining a healthy weight is a big challenge for many, Ciappio says.

|

Weight Management Products and Ingredients

Bio Nutrition, Inc./Only Natural, Inc.: Pure Green Coffee with GCA, Garcinia Cambogia extract veggie caps and liquid), African mango extract IGOB131. |

|

Increasing fiber content in the diet is one way of creating more feelings of fullness, according to Marlena Hidlay, associate marketing manager for DSM. A soluble oat fiber ingredient (OatWell) containg oat beta-glucan fits this mold, she says. “Consumption of high molecular weight oat beta-glucan results in the formation of a viscous layer at the surface of the small intestine. This increased viscosity reduces the re-absorption of bile acids and the subsequent uptake of cholesterol by the intestine,” says Deshanie Rai, Ph.D., FACN, senior scientific leader for DSM. This increased viscosity also lengthens the intestinal transit time of food and delays food digestion. This provides the double benefit of reducing the release of glucose into the blood and creating satiety.

Another intriguing ingredient that may help positively regulate insulin is yacon syrup. It is a source of beneficial fructooligosaccharides, and in one human clinical trial, it was found to increase satiety, decrease body weight and benefit the overall health of obese pre-menopausal women (2).

Steil delves further into the available weight management supplements, saying, “Each sector offers unique advantages to address the needs of each individual user.” Besides satiety supplements (like fiber, saffron and carraluma) and blood sugar control (chromium, green coffee bean), he cites thermogenics as key.

While she says product choices always need to be tailored to the individual, Sugarek MacDonald argues that the most promising category in weight management is thermogenics. “Thermogenesis products are felt immediately, they support energy levels and the science is there to back it up when combined with exercise and a well-planned diet,” she says. Thermogenesis is the natural process in which fat is burned to create body heat, she explains, and fat that isn’t burned for energy is stored as adipose tissue.

Supplements like bitter orange, guarana, caffeine, green tea and yerba mate enable the body to maintain a higher metabolic rate, thus burning fat faster. Sugarek MacDonald cautions, however, that many thermogenic supplements are also central nervous system stimulants, which can mean unwanted side effects.

Moore says that this stimulatory effect is not as pronounced as some might think with most thermogenics. Instead, they get the metabolism moving and fat continually burning. He feels that as a group, they hold the most promise in the market, and while an effect may not be felt immediately as with some stimulants, they do work long term. Green says the thermogenic properties in his company’s ingredient can safely jump-start metabolism for almost anyone when combined with diet and exercise. “You really shouldn’t be in the weight management business these days without a tried-and-true thermogenic component,” says Green.

Lifton adds that chemical and hormonal imbalances (like neurotransmitters and thyroid hormones) are also major causes of the obesity problem, and consumers may significantly benefit from supplements that correct these imbalances.

Superfoods constitute their own weight management category, Khan argues. She singles out chia seeds as an inexpensive, nutrient-rich addition to a weight loss effort. “While the soluble fiber in chia helps with satiety and calorie control, the insoluble fiber helps support digestive and colon health,” Khan says.

Weight management united. Despite the prevalence of all-star ingredients, there is a large and growing market for complex weight formulas that leverage several ways to support healthy weight.

Levin says that while there are plenty of clinical trials on single ingredients, his company often finds that adding a natural base of one or more other ingredients can enhance a product. For example, he says the company has used green tea extract as a base for other active ingredients, like African mango. CLA has also been used as a base for 7-Keto softgels, Levin says.

Trademarked ingredients are often found working in tandem in today’s weight management supplements. Dijkstra says past clinical research has shown a Garcinia cambogia extract (Super CitriMax from InterHealth) when combined with a chromium ingredient (ChromeMate from InterHealth) has a greater impact on weight than just the garcinia extract alone. Garcinia helps to suppress appetite and inhibit fat production, according to Dijkstra, and chromium supports blood sugar control and lean body mass.

Sometimes, multiple ingredients are harnessed for a more focused approach. “We combine ingredients in specific formulas to maximize their synergistic effect around a specific functional benefit, such as the reduction of carb absorption and of carb cravings,” says Lifton. He mentions one product (Carboquel) that does just that by featuring both the white kidney bean extract and chromium ingredients discussed previously.

For those having issues controlling hunger, LoMacchio lays out a potential combination of bulking fiber like glucomannan from konjac root or psyllium husk, with an extract of Garcinia cambogia or saffron. The former can physically expand, taking up space and making the user feel full, while the latter can impact neurotransmitters that control the feeling of fullness. For those not necessarily dealing with hunger issues but instead interested in burning more fat, he suggests a combination of green tea extract (for its thermogenic properties) with raspberry ketones, which LoMacchio says have been shown to shrink fat cells in animal studies.

Heying says that his company has always found natural products retailers to be exceptional at educating customers on more advanced, multi-part formulas. The example he sets forth is a combination of a brown seaweed extract (InSea2 from innoVactiv) with L-carnitine (Carnipure from Lonza). It is designed to minimize the storage of energy as fat, and facilitate the conversion of stored fat into energy. The seaweed extract, he explains, can help slow the rate of carbohydrate digestion, leading to healthier insulin and glucose responses. “We know that high insulin reduces lipolysis and increases lipogenesis, so keeping it as low as possible in the critical post-meal period should help weight maintenance,” he says.

The L-carnitine tartrate is a cofactor in the transport of fatty acids inside mitochondria, which is necessary to produce energy. Without L-carnitine, Heying says, the body is crippled in its efforts to burn fat. “An optimal intake of L-carnitine tartrate can thus ensure that fatty acids will be burned effectively during exercise or fasting,” he says.

An even more complicated combo comes courtesy of Pande. Extracts of Coleus forskohlii (ForsLean), hydroxycitric acid plus 5% garcinol (GarCitrin) and piperine (BioPerine), each from Sabinsa, combine to form an ingredient (LeanGard) that has been linked to decreases in body mass index, body weight and body fat, along with an increase in lean body mass. Pande says researchers found synergy between these extracts for increasing fat metabolism. The active diterpenoid forskohlin helps break down fat; the HCA/garcinol extract helps burn fat, block its formation and reduce appetite; and the piperine helps inhibit the maturation of fat storage cells called adipocytes. Pande says this adds up to a “Break-Block-Burn” activity from one ingredient.

More complex still is a combination that tackles what Levy calls the five “physiological obesity factors”: thyroid health, blood sugar control, calorie burning, appetite control and fatty acid oxidation. “If your thyroid gland is malnourished and underactive, you simply cannot lose weight,” he says. The ingredients enlisted to help in these areas are raspberry ketones, green coffee bean extract, capsicum extract and seven additional nutrients.

These complex formulas, as well as some weight management programs that involve more than one product, have their place in the market. “Consumers respond well to a more holistic, dedicated approach for weight management,” says Caroline Brons, director of marketing for DSM. She believes well-thought out diet offerings that consist of multiple ingredients or formulas and address several aspects of weight management are viewed positively by consumers. She says programs that offer choices, where consumers feel they can take some measure of control, are also valued.

Bily and Ughetto feel that more complex supplement programs can help consumers avoid the yoyo effect commonly associated with weight loss diets. They say their company is working on a program to combine green coffee bean extract with other actives from botanicals. WF

References

1. “Sensa and Three Other Marketers of Fad Weight-Loss Products Settle FTC Charges in Crackdown on Deceptive Advertising,” Federal Trade Commission, Jan. 7, 2014, http://www.ftc.gov/news-events/press-releases/2014/01/sensa-three-other-marketers-fad-weight-loss-products-settle-ftc, accessed Jan. 28, 2014.

2. S. Genta, et al., “Yacon Syrup: Beneficial Effects on Obesity and Insulin Resistance in Humans,” Clin Nutr. 28(2), 182-7 (2009).

Published in WholeFoods Magazine, March 2014