Looking great entails stripping down to build back up. Hygiene and cleanliness is the stripping down of a layer of yesterday’s scented products and the invisible dirt that naturally accumulates, while building back up is the post-cleaning application of skin-softening and hydrating products and makeup. The process repeats every day.

As retailers, you are well aware of the power of providing effective and pampering health and beauty care (HBC) products for everything from natural hair gloss to natural toenail polish. More than ever, specialty healthy-lifestyle product stores have grown way beyond the old “health food” mindset. Consumers get it and they want it. This demand is the driving force for many longstanding HBC brands to continue to launch new lines, as well as for many boutique upstarts that cater to natural consumers at all demographic and psychographic levels.

Today’s HBC Market

According to market research data firm Mintel, the natural/organic personal care (NOPC) market tallied $462 million in 2009, experiencing a growth of 10% from 2007 to 2009. The year 2009 was rough for nearly all industries due to the throes of the recession, and this category experienced a 2% decline; yet Mintel’s research shows a solid rebound is  expected this year. In 2009, the natural/organic facial skincare and soap/bath products declined 5% (sales of $120 million) and 0.9% (sales of $81 million), respectively, while the natural/organic oral care segment increased 1.9% with sales of 60 million. One company taking part in this growth was Nature’s Gate, which recently relaunched its toothpaste collection with sulfate-free formulations that contain the company’s exclusive blend of seven oral health botanicals.

expected this year. In 2009, the natural/organic facial skincare and soap/bath products declined 5% (sales of $120 million) and 0.9% (sales of $81 million), respectively, while the natural/organic oral care segment increased 1.9% with sales of 60 million. One company taking part in this growth was Nature’s Gate, which recently relaunched its toothpaste collection with sulfate-free formulations that contain the company’s exclusive blend of seven oral health botanicals.

Mintel’s report also asserts that there are very strong opportunities in this market for manufacturers and their retail partners. Specifically, ethnic hair and skin care, and natural/organic HBC products aimed at men.

Meanwhile, Mintel expresses another growing challenge that has blurred what should be distinctive in the specialty marketplace: it attests that through its research, it found personal care companies that are exploiting the natural/organic market (dubbed “greenwashers” or “fauxganic”). Such firms purport to have the natural and organic ideals through packaging, advertising and other marketing techniques, yet their products themselves do not live up to the content. Because of the confusion engendered by these manufacturers, those that are truly organic are undertaking aggressive educational tactics by aligning themselves with organizations offering a “seal of approval” that signifies true organic certification. These organizations include the Natural Products Association (Natural Certification for Personal Care Products and Ingredients), Compact for Safe Cosmetics and the effort by Whole Foods Market with its new Premium Body Care Standards to designate products meeting stringent requirements.

This, then, brings forth questions about what exactly constitutes organic and, of course, natural; and just what does certification mean when there appears to be disparity among requirements. Certifications vary as to the allowable percentage of organic ingredients. European organization Ecocert, for instance, requires that 10% of total ingredients be from organic farming for its Natural and Organic Cosmetic label.

Ecocert points out, however, that 10% is a high percentage, "in the extent that ECOCERT Standard is the only one to take into account ALL the ingredients of the formula in its calculation, including water." Water cannot be certified as organic, but it is a main ingredient in most cosmetic formulas, says the firm.When certifying firms exclude water and salt, Ecocert feels the final organic percentage is inflated; this figure often appears on label for consumers to read. The firm adds that though 10% organic ingredients is the minimum percentage, brands certified by the group have products displaying organic percentages up to 100%.

Such roiling discourse has continued, spurring the Organic Consumers Association (OCA) to file a complaint with the U.S. Department of Agriculture (USDA)’s National Organic Program (NOP) in 2010, requesting action on what it called the widespread and blatantly deceptive labeling practices of leading “organic” personal care brands. OCA noted that while the USDA enforces strict standards for the labeling of organic food, there is no such clear rigidity for the personal care category.

Mintel’s research has thus unveiled that presently, many consumers feel that “faux natural” products are perhaps good enough—no doubt in part because they believe simply that if the active ingredients are botanically derived, well, then, the product must be healthier and safer than its conventional counterparts!

Whole Foods Markets took a stand when it stated that after June 2011, it will no longer sell organic HBC products that are not third-party certified organic. Many in the industry support this action, and notably, what it represents. They seem optimistic that Whole Foods may have started a domino effect that will result in clear and standardized distinctions between what may be truly organic and what may simply only contain a smattering of organic ingredients.

Robyn Milewski, CEO, Pure SKN, Detroit, MI, a manufacturer of upscale natural color cosmetics and skin care products that are vegan and gluten free, thinks “it’s excellent that Whole Foods is setting this standard. It will help tighten the processes and increase compliance among manufacturers. I am excited for consumers to gain further education and inquire of the reasons. I do not see a negative impact at all.”

“Fantastic idea!” enthuses saponifier Larry Plesent, founder of Vermont Soap, Middlebury, VT, whose handmade soap bars are uSDA-certified organic to food standards. “I applaud Whole Foods for taking a leadership role. No doubt, corporate organic will drag this out (enacting real topical organic rules) as long as they can. Dragging out the implementation of organic personal care standards has diluted the Organic Brand. And I believe this is, in fact, the mission many corporate companies are on: to obfuscate what a natural product actually looks like. There is no [standard] definition of ‘natural’ [personal care]… Only by having a clear definition of what natural and/or organic means can we separate real claims from green-washed claims.”

Plesent adds that the abundance of “natural looking seals” reflects consumers’ yearning for safe, effective, non-toxic and affordable personal care products.

Badger Balm, Gilsum, NH, decided to certify its products to ensure transparency and trust among consumers according to Rebecca Hamilton, head of product development for the company. Nearly all products bear the uSDA organic seal. When viewing the overall organic HBC product landscape, she, too, sees many companies boldly making organic claims, but without a standardized definition of what exactly that means for personal care products, many consumers remain confused and often misled.

The primary challenge with certifying organic, she states, is the lack of diversity in commercially available certified organic ingredients for personal care products. Therefore, “many personal care companies will struggle to reformulate their products so that they can become USDA certified organic, or they will simply have to stop making organic claims on their packages or even in their companies’ names. Despite this challenge, our hope is that many manufacturers will take this opportunity to certify any products that they can and in doing so, help to alleviate customer confusion at the store level. We may begin to see a more limited offering of organic personal care available on the shelves, but people can be assured that what is available will be truly organic. This may by challenging for many companies, but this Whole Foods requirement is just one more important step toward standardizing the meaning of organic for personal care products,” says Hamilton.

The primary challenge with certifying organic, she states, is the lack of diversity in commercially available certified organic ingredients for personal care products. Therefore, “many personal care companies will struggle to reformulate their products so that they can become USDA certified organic, or they will simply have to stop making organic claims on their packages or even in their companies’ names. Despite this challenge, our hope is that many manufacturers will take this opportunity to certify any products that they can and in doing so, help to alleviate customer confusion at the store level. We may begin to see a more limited offering of organic personal care available on the shelves, but people can be assured that what is available will be truly organic. This may by challenging for many companies, but this Whole Foods requirement is just one more important step toward standardizing the meaning of organic for personal care products,” says Hamilton.

The Whole Foods mandate, according to Brigitte Rau, founder, Brigit True Organics, Charlottesville, VA, is an “excellent idea in theory, but imposes prohibitive increases in costs of entry into organic products by small companies; many of the finest organic products are produced in relatively small batches by small companies in the united States.”

Similarly, Linda Miles L. Ac., D.O.M., vice president of derma e Natural Bodycare, Simi Valley, CA, believes that while the Whole Foods decision “will not make a large impact on the manufacturing side, there will be fewer offerings at the retail level. All of the wonderful niche companies that make the natural industry what it is will likely be driven away by high costs.”

Santosh Krinsky, president of Lotus Brands, Inc., Twin Lakes, WI, agrees, noting that there are numerous different ways to certify organic. “If it is all ‘product level,’ this will probably ensure that the biggest manufacturers own the industry and the smaller ones are shut out, as the costs are very high. If it is ‘ingredient level,’ getting organic certifications on specific content is not overly burdensome and is a reasonable approach. Of course, all manufacturers should be in compliance with the USDA/NOP organic front panel label requirements if they intend to use front panel organic labeling, and in that case, they should have the certifications needed, so it should not be a real issue.”

Assuming the retailer’s mandate is indeed strictly implemented, says Tim Schaeffer, Mineral Fusion, Denver, CO, it will primarily affect the manufacturers’ management of labels and components. “I do not anticipate it will affect the retailer or the consumer as much as some would believe. Nevertheless, it is ultimately a good thing to bring everyone into the same standards.”

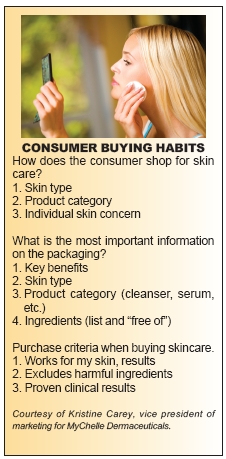

MyChelle Dermaceuticals, Louisville, CO, has all its organic ingredients certified through NOP and Ecocert, therefore,  says Kristine Carey, vice president of marketing, the company won’t have any issue with this change. “That said,” she asserts, “it is smart for our ingredients to be challenged with all the products and brands that are entering. We must watch out for our consumers and provide them the detailed info they need. There will be companies that this causes a problem for if they are not currently being certified.”

says Kristine Carey, vice president of marketing, the company won’t have any issue with this change. “That said,” she asserts, “it is smart for our ingredients to be challenged with all the products and brands that are entering. We must watch out for our consumers and provide them the detailed info they need. There will be companies that this causes a problem for if they are not currently being certified.”

The Certification Situation

Certification, as touched upon, will shake things up, no doubt, and impose a myriad of challenges and potential hardships for niche-oriented HBC manufacturers. Investments, in both finance and time, may make the difference between market success and failure. This mandate raises other issues as well, notably, the potential for many other naturals retailers to follow suit and implement a similar restriction.

Certification, declares Hamilton, is an important piece of maintaining transparency and consistency within organic personal care, and she reminds us that the organic food sector underwent a similar process when the USDA organic standard was first introduced. “Although many companies struggled to meet the rigorous requirements, the end result was a trustworthy and consistent offering of organic food products. The personal care industry is just now undergoing the same growing pains, but the end result will be worth the challenges,” she underscores.

Carey concedes that organic certification will be quite challenging for smaller businesses, but states that “the goal is not to bring barriers to entry, but instead to be sure that we are telling consumers the appropriate information and that you have proof that your ingredients are organic.”

Schaeffer, whose company offers mineral color cosmetics, believes that depending on the product, the ultimate performance and attributes for the consumer should be the primary goal. For example, he says, while a USDA-certified organic beauty product may be the ultimate in purity, it may tend to impart a characteristic feel, scent or look that may be off-putting, driving consumers more to the natural but- not-organic counterpart. He explains, “Going certified-USDA organic in personal care is different than food; an organic apple still tastes like an apple, maybe even better. But, this is often just not the case in personal care. Sure, certification is a good thing and the expenditure can be reasonable. But if a company can’t afford it, it cannot make the organic claim—but, it can still make its product to its own high quality standards.”

In essence, Schaeffer’s statement offers optimism: does it really matter if the company whose products you sell offer certified organic HBC products if those products are still effective, and even luxurious in their natural (chemical-free) content?

Speaking of natural, for nearly a decade now, mainstream brands in Food, Drug and Mass channels have touted the wholesome appeal of “Natural” and “Organic” in their various beauty and skincare products—in the coordinated effort to appeal to the majority desire of using much less harsh product in hair and on skin. This will only continue and there are several diametrically opposed thoughts to the influence upon the specialty naturals retail environment.

Mass Market: Thunder Stealing?

Mainstream brands, Krinsky says, generally have built-out R&D departments as well as huge marketing budgets and the ability to project products into the marketplace. “To the extent they launch natural and organic products, they have the muscle to succeed with them if done right. If they are merely greenwashing, there will eventually be a backlash,” he predicts. “This is clearly a significant trend that will affect particularly smaller niche manufacturers in our industry that simply cannot compete and do not have buying power or research budgets to match.”

It is probably an accurate assessment to say, according to our responses, that the natural/organic industry may be

|

Power of Personal Care Packaging

|

divided about this issue: one side sees the glass half empty, another views the vessel as half full. And for some, the liquid in the glass is in the middle because it comes straight down to constitutional authenticity behind the claims.

As an example of the latter, “We are always happy to see a large company that creates truly natural and organic products,” comments Hamilton. “These companies certainly raise awareness for natural and organic and drive the innovation of novel natural and organic ingredients. However, many mainstream brands are merely trying to capitalize on a trend, and they do not create truly natural and organic products. Rather, they release conventional synthetic products that have a few natural or organic ingredients and the words ‘natural’ or ‘organic’ on their labels. This is misleading to consumers and takes market share away from more authentic companies.”

Rau echoes the sentiment: “On the one hand, bringing attention to the product category is helpful, but these large companies simply do not have the ability to create high-quality products at their price points. So, they cut corners and therefore hurt the efficacy of their products, which may turn off the consumer to the whole organic category.”

Plesent is unapologetic when he declares that the infiltration by mass “just dilutes the mission. The trouble is, the proliferation of fake natural/fake organic products doesn’t help anyone but the get-rich-quick set. Emotionally, I sometimes feel frustration, but getting mad just shortens my lifespan. This is a stage in the cycle. We all have to be grassroots activists to keep the organic brand meaningful in the face of Corporate America-influenced politics.”

Miles sees a positive influence by the awareness generated and willingness of trial for crossover. She explains that when mainstream personal care brands market and publicize natural ingredients and their benefits, it helps the naturals market by creating mass appeal to increase crossover. “Because natural consumers educate themselves on scientifically proven natural ingredients, and the amount of ingredients required to make the product effective, we are confident that they will see past mainstream marketing claims and know which products are truly natural and effective,” she remarks.

According to Jack Brown, vice president of sales and marketing at Lily of the Desert, Denton, TX, the dividing line remains the typical mass appeal of shortterm gratification versus the longer-term supportive action. He explains that the basic marketing strategy of the mainstream personal care industry—the belief that all products should relay an immediate sense of fulfillment to the consumer— can be seen as a root cause of this failure. He points to claims such as softness, touch, fragrance, aromatherapy, smoothness, healthy, fresh, silky and radiant— which expressly supply a short-term promise to the end-user.

“Although the mainstream personal care companies have continued to improve their ability to fulfill-long term promises—anti-aging, wrinkle-reduction, evening of skin tone—their expertise still lies in immediate gratification via topical application,” he says. “The burgeoning concept of ‘beauty from within’ is a claim that demands a long-term promise for success— a three-to-six-month period for regeneration followed by a maintenance program. And, the expertise of supplement companies lies in their ability to educate the consumer in the long-term promise.” And this is where naturals retailers truly distinguish themselves from any other retail environment because interested consumers will purchase both.

In the end, however, the choice of success or failure in retailing natural and organic HBC products is solely that of the individual naturals retailer. Careful selection of brands and product types as well as aggressive and savvy marketing, merchandising and promotions will make the big difference in seeing an increase of loyal HBC shoppers. And remember, women can be your best brand ambassadors: when they have excellent experiences and results with a brand or product, they translate this message and encourage new customers to trial. Why not help them do so and reward them? Permission-based email marketing can galvanize such a campaign and also launch a platform of interactive discussion that can be mined for continual research into brand/product selection, as well as appropriate and fun marketing and merchandising ideas for this category.

Category Trends

Being able to lead in addressing emerging trends before the mainstream is also an attribute of a specialty retailer. The natural/ organic personal care industry has much to offer, which should, by all accounts, lead to an invigorating sales landscape in 2011.

Although anti-aging itself is spiritedly mainstream, Carey observes that the definition of anti-aging and how it is being addressed in the industry is evolving. “For instance, with our recent introduction of Plant Stem Cell technology, and as one of the first natural skin care companies to do so, we are even more effectively able to address the process and onset of aging. By addressing the body’s stem cells, which are responsible for the infinite rejuvenation of your skin and the turnover of skin cells, we can help speed up cellular turnover, which slows down with age.”

Carey adds pointedly that this leads to another budding trend she sees emerging in our industry in 2011: addressing the degrading effects of photo aging (incurred by accumulated sun exposure). Overexposure to the sun can cause dark spots, droopy skin and leathery texture, and may contribute to wrinkles, sun spots, hyperpigmentation and dryness.

“These trends look to be on the path to continue into 2011, with significant strides in the industry to provide effective skin care options, while also helping to educate the consumer about the various nontoxic options out there,” she observes. “As the anti-aging and innovative technologies that support this develop further in the year 2011, we believe more consumers will be seeking out effective skin care options that are nontoxic and natural; so in short, we expect to see a rise in the demand for effective, natural skin care products and “natural beauty” will be a trending keyword throughout the year.”

Miles also sees diversification in the anti-aging category because of such strong demand and continued research into the efficacy and benefits of anti-aging ingredients such as antioxidants. Because the media frequently reports about natural anti-aging ingredients and products, the market is rapidly growing amongst consumers of all ages. younger consumers are paying more attention to their skin and are becoming more educated about the effects of sun, pollution and free radical damage; in tandem, anti-aging products are moving in an upward trend because we have a large population over 40 years of age.

Specifically, she points to new exotic ingredients, such as tamanu oil, which received incredible positive exposure on the Dr. Oz Show in March. derma e just launched its Tropical Solutions line blending tamanu oil with green tea, pomegranate, papaya and vitamins A, C and E; and Miles believes that anti-aging consumers are ready and willing to try such newer, more exotic natural anti-aging topicals.

In Hamilton’s view, the most significant trend in organic personal care is an increase in the availability of certified organic ingredients including more complicated ingredients such as emulsifiers, preservatives and surfactants. “Innovative ingredient suppliers have been working hard to supply the organic personal care industry with the tools we need to make more elegant complex products. This, in turn, will lead to a wider range of certified organic personal care products such as lotions and facial care in the upcoming year,” she predicts.

Glenn Gillis, Ph.D., senior science officer/director of research for Lily of the Desert (maker of Aloe80 Organics personal care products), holds a different view: “The most interesting development in the certified organic segment of the personal care industry has been that which has not been developed,” he declares. “The inability of scientific research to create qualified functional ingredients in order to develop better products restricts further market growth. Some improvement has occurred in the past few years, particularly in Europe. But, a certified organic personal care item is sure to fail in the market when it cannot be compared to other (non-certified) products that emphasize function.”

Meanwhile, a huge trend that will grow in 2011 involves category niche/sub-segments that continue to gain appeal and volume as they address niche lifestyle concerns as well as how people want to care for their outer health.

For instance, Brigit True Organics offers skin care for specific consumer needs; these include vegan products and all body care products that are gluten free as well as free of peanut and tree nut oils. “We put priority emphasis on educating and supporting our retail network’s sales staff to help them understand the ingredients and processes of our products so they can better convey these features and benefits to their customers. It is important to fulfill the consumers who have super-sensitive skin care needs,” Rau says.

Krinsky observes that today’s younger generation is more clearly concerned about things like “cruelty-free,” “vegan,” “gluten-free” and “sustainable” in relation to personal care products they want to use and this will only see increases in 2011 and beyond. Lotus Brands is primarily involved with satisfying these concerns; its Beauty Without Cruelty brand, for example, is entirely vegan and cruelty free and most products are also gluten free. Similarly, its imported Logona brand has developed extensive lists of personal care products that are also gluten free, vegan etc. to meet this increasing demand.

Gluten-free definitely gained momentum this year, agrees Kim Wells, personal care manager at NOW Foods, Bloomingdale, IL. In tandem, she sees anti-aging topical products and supplements as a segment that will also draw interest in naturals stores. She states, “In 2011, I think you will see beauty regimens that provide products to help your skin from the inside out.”

Another trend seen in infomercials and online is mineral-infused color cosmetics—and this bodes well for perhaps the most underperforming of all natural HBC sub-segments: natural makeup. Schaeffer remains highly excited about the growth in use of natural mineral makeup as more women of all ages enjoy its look and feel. “The launch of skin-nourishing minerals was most significant for us,” he relates. “It’s easy for naturals retailers to convey to women. Just like our internal health responds positively to mineral supplements, so too does the skin to topical application of minerals. Looking into 2011, we’re looking to innovation in sun protection,” he adds.

Also, hair products that go beyond cleansing and moisturizing and into the realm of upscale styling products are growing in the naturals specialty arena. For example, Aubrey Organics’ NuStyle Organic Styling, both USDA and NOP certified, include two new hairsprays, a detangler and shine booster, and smoothing serum.

Furthermore, a handful of highly popular supplement brands with powerfully positive retail and consumer reputations have entered the topical nourishment arena. This “beauty-from-within” market subset, Brown believes, shows great promise in growth for the simplest of reasons. “Historically, supplement claims are health claims and these claims are directed toward consumers who hold a particular interest in that claim due to personal health issues. Regardless of a consumer’s status with respect to health, ethnicity, age or finance: the term ‘beauty’ is attractive to all,” he explains.

One example is NOW Foods, which is considered primarily a supplement company and, according to Wells, the response to the relaunch of its personal care items in new packaging has been “absolutely great.”

Other recent entries of supplement makers in the personal care category include the Organique skin and hair care line from Himalaya Herbal Products USA; and the Glimpse skincare line and Juni personal care line from XanGo.

A natural barrier may be the mindset that a company specializing in pills may not be that adept in offering topicals that stand the test of efficacy. Wells asserts that retailers can help those consumers by stating the fact that if you want to keep the outside healthy you must keep the inside healthy. It’s a two-part, wholly integrated system. She says, “As a supplement company that has been in the industry a long time, I think we have a great advantage to offer a beauty regimen that benefits the consumer from the inside out. Retailers should remember that consumers are open to new products, especially if they believe in the company and the products it provides. Plus, the personal care category has always been a growing area in sales; women make up the majority of buyers and they are always looking for new, exciting products or alternatives to current products.”

Overall, the prevailing feeling is that the personal care product category for the specialty naturals stores will be a “clean” sweep of customer satisfaction and fulfillment—as mainstream continues to emphasize the very concepts of natural and organic, inadvertently driving a continual influx of newly introduced consumers into the naturals retail environment. Further, the Whole Foods mandate will spur more companies big and small to attain organic certification and potentially influence a more rigid and wholesale set of personal care organic standards. The exciting growth of niche segments such as gluten-/nut-free, vegan, cruelty-free, etc., will also draw the niche consumer with special skincare needs that can also easily translate into supplements and foods. WF

Lisa Schofield is a freelance writer based in Freehold, NJ.

Published in WholeFoods Magazine, December 2010