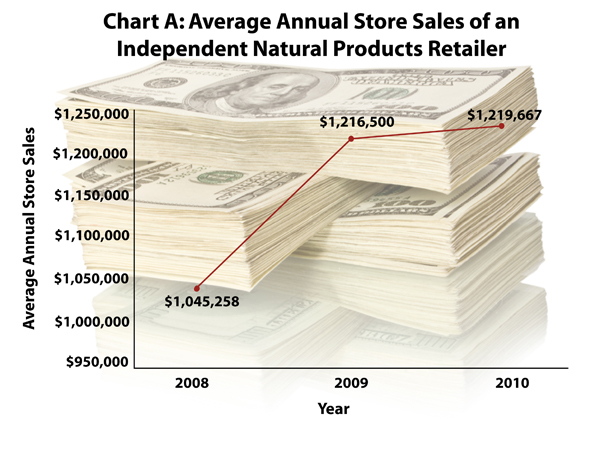

Chances are, you've heard "times are tough" a lot this year. But, just how tough has it been on natural products businesses? Well, according to the 2010 WholeFoods Retailer Survey, many stores are pulling out of the recession in stride as they report strong, even thriving sales. Other retailers are taking some time to bounce back. But, the overall trend is good news: among all stores, there has been a small bump in sales over the past year. Sales grew from $1,216,500 in 2009 to $1,219,667 in 2010, proving the natural products industry is strong and healthy (see Chart A).

Perhaps these figures are even more striking because of the study period. Data from this year’s survey reflect the period of September 1, 2009 through August 31, 2010. Our fresh numbers represent, in part, a period of time in which sales among nearly all retail segments were in a downward trend. And, the end of the range accounts for the time when many businesses were seeing far better days as they began climbing out of the recession.

Perhaps these figures are even more striking because of the study period. Data from this year’s survey reflect the period of September 1, 2009 through August 31, 2010. Our fresh numbers represent, in part, a period of time in which sales among nearly all retail segments were in a downward trend. And, the end of the range accounts for the time when many businesses were seeing far better days as they began climbing out of the recession.

Thus, the figures presented here will give you a good idea of how independent natural products stores weathered the economic storm this year and, importantly, how things are looking now that the worst is behind us (hopefully). It also will offer information about which strategic approaches helped businesses be successful.

A special thank you to Jay Jacobowitz, president and founder of Retail Insights and WholeFoods Magazine merchandising editor, who played an integral part in the data computation.

Let’s Focus!

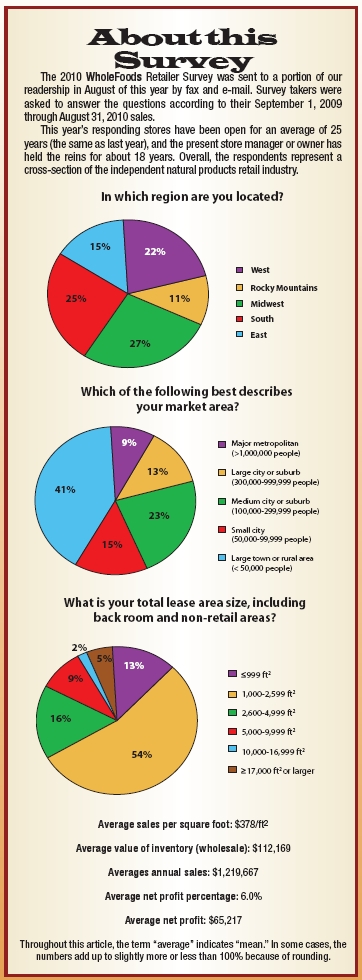

Before giving you some numbers to chew on, it’s important to understand the study group, especially the store type (see sidebar, “About this Survey”).

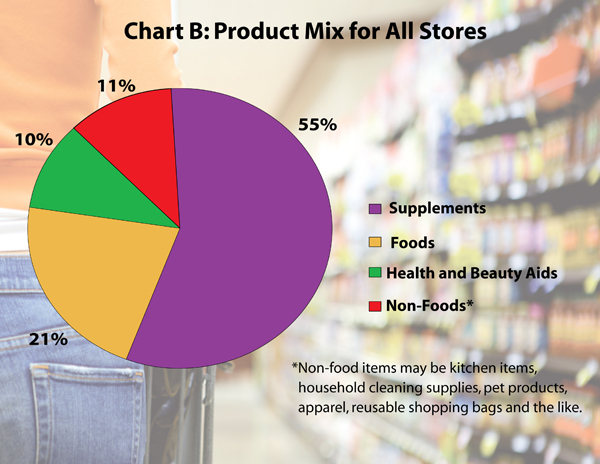

This year’s survey seems to have attracted a high proportion of smaller, supplements-focused retailers. In 2009, the respondents represented less heavily vitamin stores, with about 51% of all sales coming from supplements. This year, however, stores reported a larger percentage of sales from supplements (55%) and slightly more from foods (21% in 2010 versus 16% in 2009). This year’s stores also sold fewer non-food products (e.g., pet products, household cleaners, gift items, books and appliances) than they did last year (11% in 2010 versus 24% in 2009). Sales from health and beauty care (HBC) items remained the same, accounting for 9–11% of all sales both years (see Chart B).

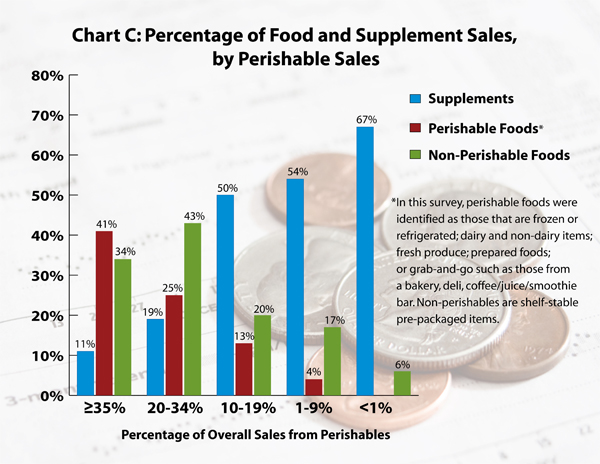

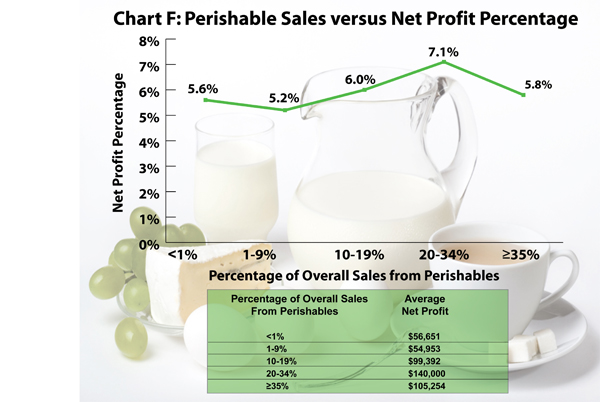

Perishable sales percentage. When data are broken down by percentage of overall perishable sales, we see how diverse our respondents are. In this survey, perishable foods were identified as those that are frozen or refrigerated; d airy and non-dairy items; fresh produce; prepared foods; or grab-and-go such as those from a bakery, deli, coffee/juice/smoothie bar. The amount of perishable sales ranged from 0% to 46%, with an average of 8% and a median of 4%. Throughout this survey, the term “average” is used to describe the mean; the median is the midpoint of the dataset, with half of all responses higher and the other half lower.

airy and non-dairy items; fresh produce; prepared foods; or grab-and-go such as those from a bakery, deli, coffee/juice/smoothie bar. The amount of perishable sales ranged from 0% to 46%, with an average of 8% and a median of 4%. Throughout this survey, the term “average” is used to describe the mean; the median is the midpoint of the dataset, with half of all responses higher and the other half lower.

In the most perishable-heavy stores (≥35% of all sales from such foods), shops reported that just 11% of their revenue came from supplements. Conversely, businesses with the least perishable sales (<1%) said supplements were their top-sellers (representing 67% of all sales) (see Chart C). The correlation is linear; as the percentage of supplement sales rises, the percentage of perishables declines.

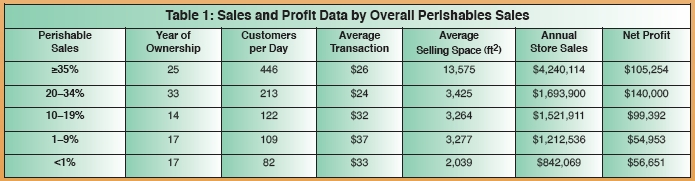

How perishable sales may affect your store. So who was selling the most perishable items? As with last year’s survey, the bigger the perishable sales, the larger the store, in general (see Chart D). But, do perishable sales translate into a successful store?

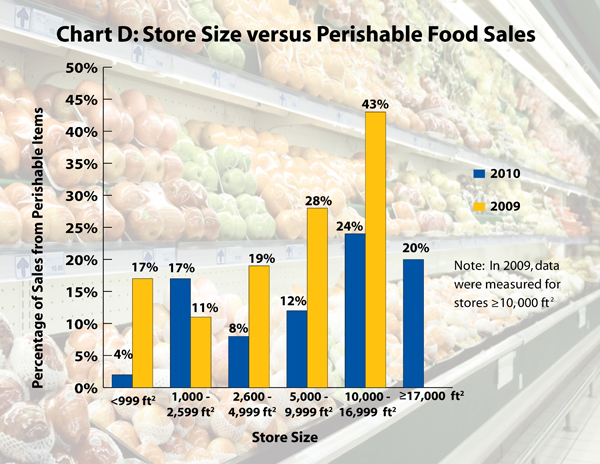

Though this year’s survey data do not represent a direct correlation of “large perishable sales create large profits,” we can say more shoppers sought out stores with large perishable offerings. In fact, shops with the most perishable sales (≥35%) had 446 transactions daily, while stores on the opposite end of the spectrum (<1% perishables sales) had 82 shoppers per day (see Chart E).

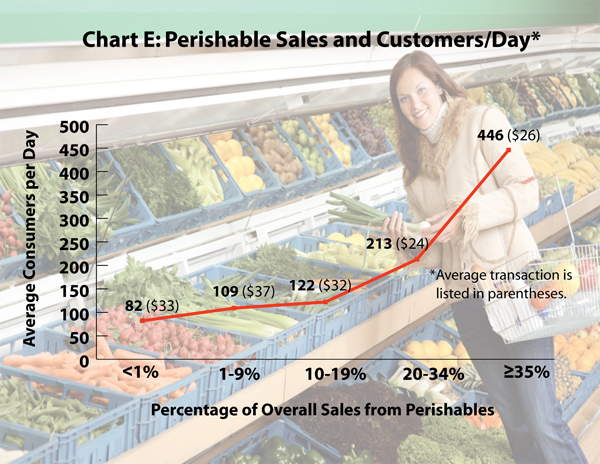

Up through 20-34% perishables, the relationship was linear: the more perishables, the more net profit (see Chart F and Table 1). The trend stopped with the 35% or more perishables group. Their net profits did not increase possibly because they offered more labor-intense (and expensive) departments (e.g., café, deli), which require top-notch locations with high population density and heavy foot traffic.

And, one must consider the net profit percentage. This is affected by various factors like store size, supplement sales and perishable sales, which are usually lower-mark up, higher-volume items. Perishables drive traffic, but they don’t necessarily create large profit margins on their own. In this year's survey, respondents in the 20-34% perishables group may have found a “sweet spot.” They earned the most net profit ($140,000)and had the best net profit percentage (7.1%) of all the groups. They also were the most experienced owners (see Table 1). This makes sense,  since it’s not easy to do perishables well. One must have sufficient customers per day to keep foods fresh, a good location, an attractive and relevant product mix and the experience to do it all well. The 20-34% perishables group seems to have this winning combination, as evidenced by their high net profits/total sales ratio.

since it’s not easy to do perishables well. One must have sufficient customers per day to keep foods fresh, a good location, an attractive and relevant product mix and the experience to do it all well. The 20-34% perishables group seems to have this winning combination, as evidenced by their high net profits/total sales ratio.

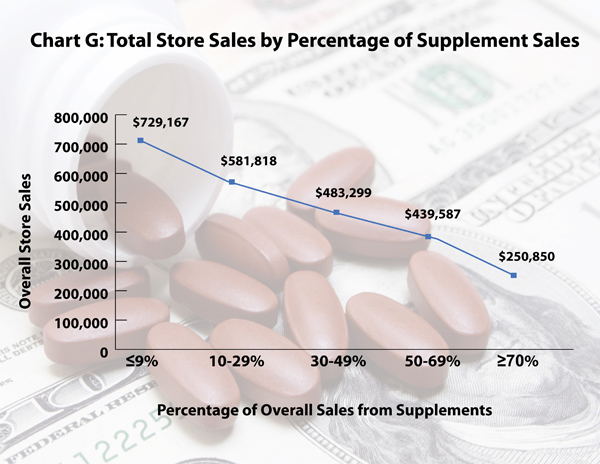

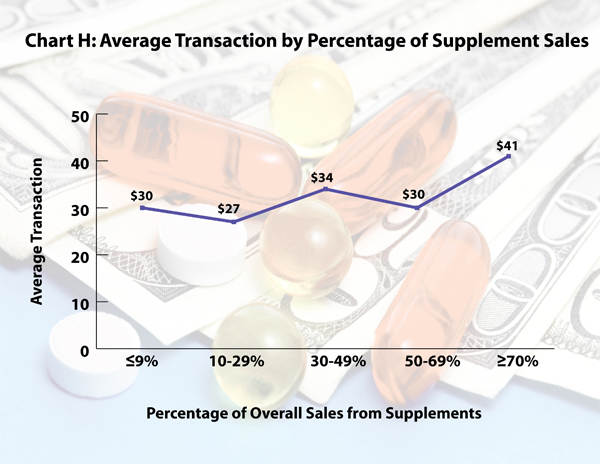

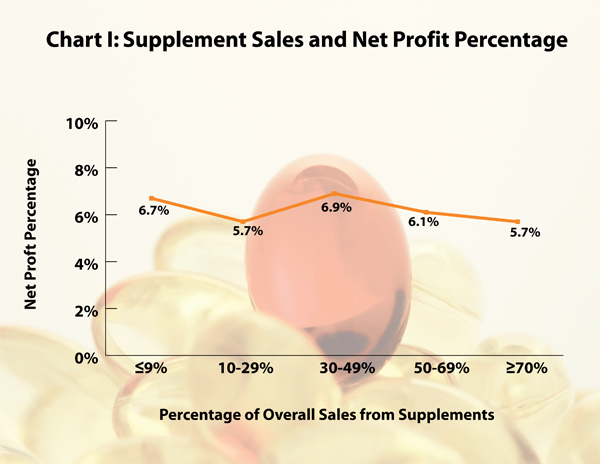

Supplements sales. Thus, one shouldn’t assume that focusing on supplements cannot be profitable. Data were regrouped by percentage of supplements sales. We found that although those with the most supplements sales had the lowest overall sales and foot traffic, shoppers tended to spend more per transaction in these stores than other types of shops (see Charts G and H). In fact, they reported decent net profit percentages. Consider Chart I. Stores with 10–29% of their overall sales from supplements had about the same net profit percentage as those with more than 70% of sales from supplements (5.7%).

So given that the mark-up for supplements is more than perishables, 300+ shoppers don’t need to come through the doors of a supplement store per day (though it would be nice…). If smaller supplement stores maintain ample gross profit margins, manage their expenditures well and focus on great customer service, they, too, can generate good profits.

Changing Sales and Foot Traffic

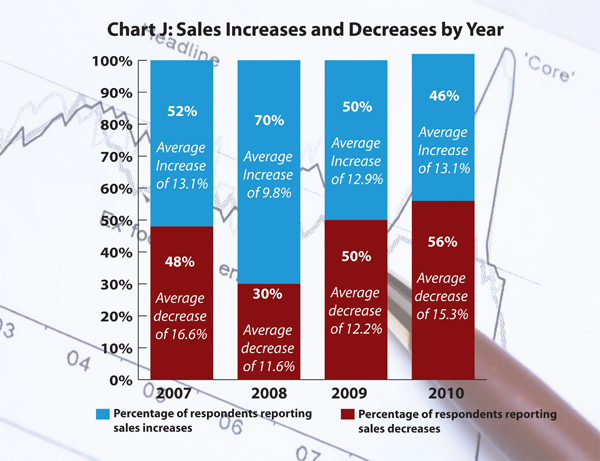

Unfortunately, more than half of all stores reported sales decreases over the past year (56% of all businesses had declines). Those that reported a sales increase averaged annual sales of $1,825,017 (net profit percentage of 7.4%) and those with decreased sales averaged $932,135 (net profit percentage of 5.1%).

On a very positive note, the amount by which survey takers said their store sales grew in 2010 was slightly more than last year (by 13.1% in 2010 versus 12.9% in 2009) (see Chart J). Food retailers outside the naturals channel experienced a fraction of this growth in the 2009–2010 economic environment. A two-year compound average annual growth of 12–13% is strong evidence of the resilience of independent natural products stores.

On a very positive note, the amount by which survey takers said their store sales grew in 2010 was slightly more than last year (by 13.1% in 2010 versus 12.9% in 2009) (see Chart J). Food retailers outside the naturals channel experienced a fraction of this growth in the 2009–2010 economic environment. A two-year compound average annual growth of 12–13% is strong evidence of the resilience of independent natural products stores.

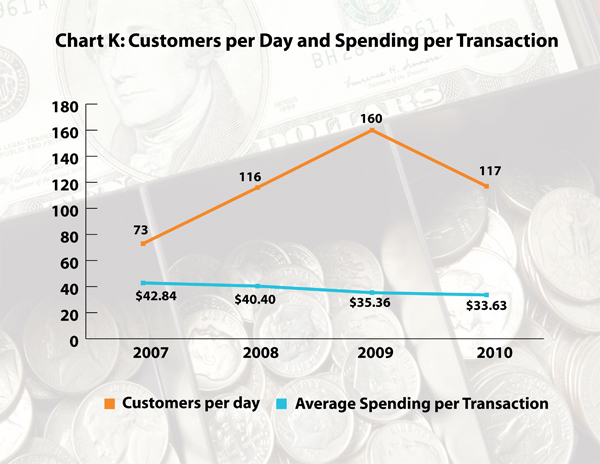

There’s more good news: shoppers spent nearly as much per transaction in 2010 as they did in 2009 ($34–35) (see Chart K). This is significant because it exemplifies the strong dedication of core natural products buyers to their health and wellness. A good portion of your clientele likely experienced tough times in 2010. Clearly, if they were forced to cut back their retail spending in 2010, they prioritized your store and saved the scrimping for another venue. Again, core buyers are here to stay. Those that float in and out as they try a carton of organic eggs here and some flaxseed  there will most likely return in full force when the economy improves and they have the leeway to spend a little more.

there will most likely return in full force when the economy improves and they have the leeway to spend a little more.

Stores did report 27% fewer customers in their stores than they did last year (117 people versus 160). One might chalk this up to the store type; this year’s survey takers mostly represented supplements-focused businesses, which typically have fewer customers per day.

No Marketing Money? No Problem…Maybe

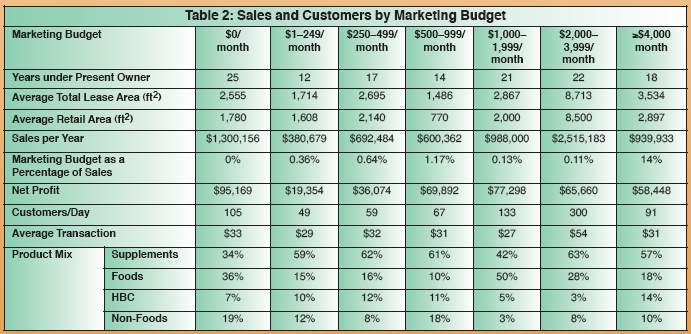

Veteran owners. A new analysis for this year’s survey broke down respondents by how much they spent on advertising their stores each month. The stores that fared best this year (with great year-long sales, highest net profit, decent foot traffic and more) were the ones that budgeted no money at all to advertising.

But (and this is a very big BUT), these stores tended to be owned by the same owner for far longer than other stores. To put it into perspective, the average length of time all stores were owned by the current owner was 18 years; those that spent $0 on marketing in 2010 averaged 25 years of continuous ownership to date. These shops were mostly run by the original owners, to boot.

But (and this is a very big BUT), these stores tended to be owned by the same owner for far longer than other stores. To put it into perspective, the average length of time all stores were owned by the current owner was 18 years; those that spent $0 on marketing in 2010 averaged 25 years of continuous ownership to date. These shops were mostly run by the original owners, to boot.

So clearly, these businesses’ excellent reputations in their respective communities—and a positive word-of-mouth customer referrals—went a long way to keeping customers coming back, despite tough times.

Another contributing factor may have been the favorite promotional strategy among this group: everyday low pricing. Everyday low pricing was favored by 23% of stores that didn’t spend money on advertising. Rather than offer periodic sales, this method entails keeping prices low all the time, probably passing along volume discounts from distributors and manufacturers.

One must keep in mind the potential serious consequences of this risky method. While tagging products with deeply cut prices may help stores generate a steady stream of shoppers, it certainly won’t do much for a store’s gross profit margin. Sales and promotions may hurt profits even more, too. Everyday low pricing also builds a clientele that expects discounts, and may be resistant to price hikes—even if it’s just to a standard retail price!

Discounting retailers may only be able to stay in business by negotiating with vendors for 10–20% off supplements and 5–15% off foods as volume discounts. This may help fund your discounts. The group in this survey may be adept negotiators; their net profit was $95,169 and the net profit percentage was 8.3%. Overall sales were $1,300,156. But again, think long and hard about the potential negative outcome to your bank account before attempting deep, regular discounts.

Stores in the 0% marketing group also have the right product mix to serve their unique clientele. It’s interesting to note that businesses with no marketing budget were not “pill stores.” In fact, they logged more sales in the food category (36%, with half of that coming from perishables) than in the supplement category (34%).

Table 2 shows data from all stores, according to their marketing budget.

Advertising gurus. Though stores with no marketing budget fared well over the past year, it’s often a good idea to invest in ways to get the word out about your store. But, be smart about your budget. Stores that spent the most (≥$4,000 per month) only had 91 customers per day; they were only earning $7 of sales for every $1 spent on marketing (which is 14% of their overall sales) (see Table 2). Compare this to stores that spent $2,000–3,999 monthly. They drew 300 customers daily and earned $75 per $1 of the marketing budget (just 0.11% of their overall sales).

Advertising gurus. Though stores with no marketing budget fared well over the past year, it’s often a good idea to invest in ways to get the word out about your store. But, be smart about your budget. Stores that spent the most (≥$4,000 per month) only had 91 customers per day; they were only earning $7 of sales for every $1 spent on marketing (which is 14% of their overall sales) (see Table 2). Compare this to stores that spent $2,000–3,999 monthly. They drew 300 customers daily and earned $75 per $1 of the marketing budget (just 0.11% of their overall sales).

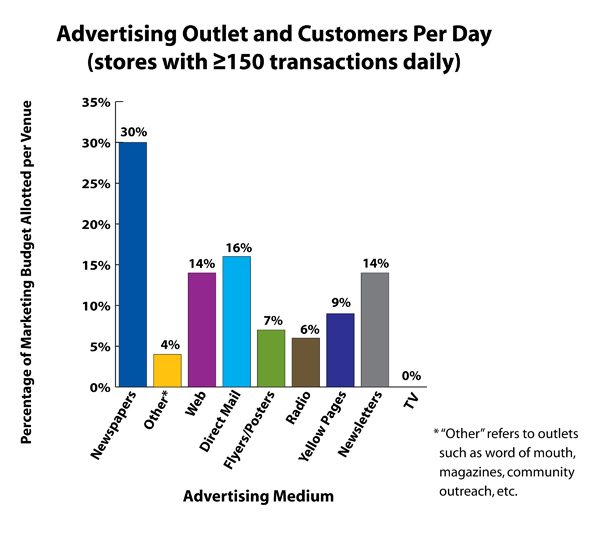

If we look at data by daily transactions, those with the most customers per day (more than 150 daily) had the highest marketing budgets (about $5,211 monthly). But, they also generated annual sales of $4,278,293, meaning that they spent $1 for every $68 earned (or 1.46% of their overall sales). Their net profit percentage averaged 6.3%, also above the overall average of 6.0%.

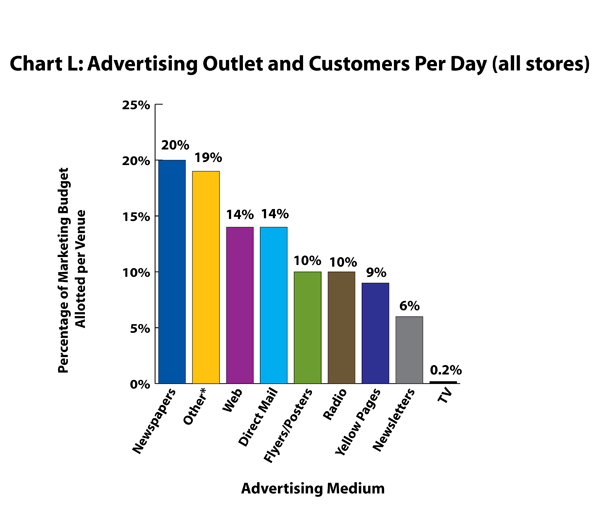

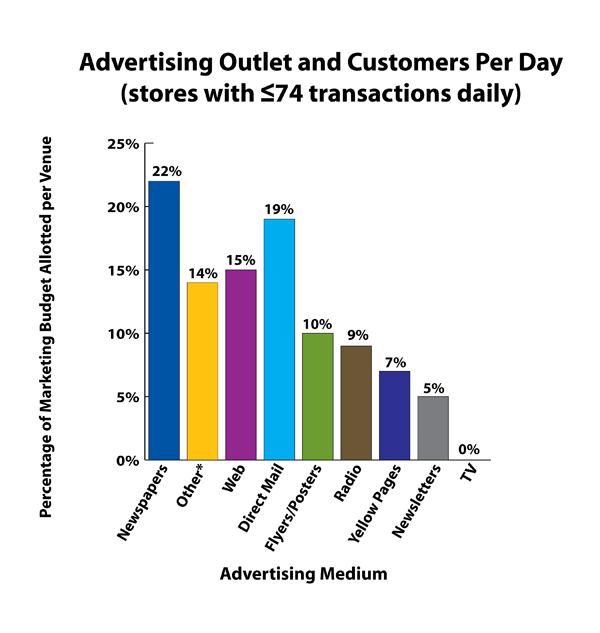

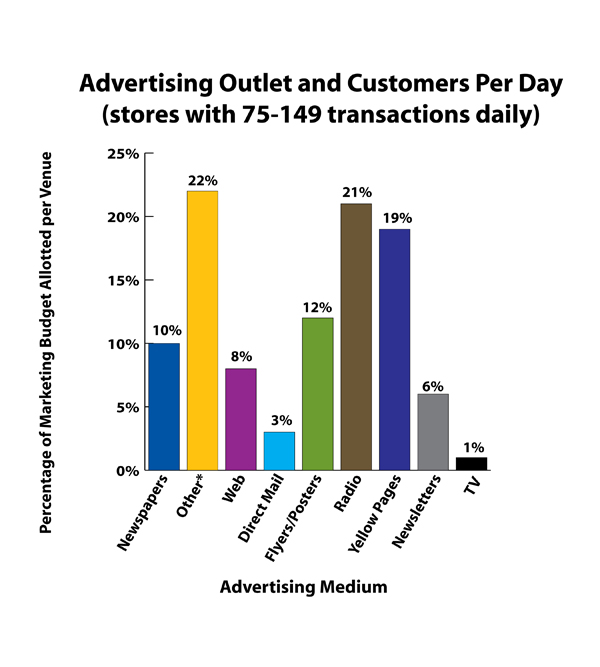

So, how did these stores get customers inside? Stores with the most foot traffic primarily relied on newspapers (30% of budget), direct mail (16% of budget), Web advertising (14% of budget) and newsletters (14% of budget). But, the success of these advertising media is highly variable, as they fluctuate by region, market, audience, the marketing message and more. Want proof? Stores with the least foot traffic (0–74 people per day) also favored these forms of advertising, directing the largest portion of the marketing dollars to newspapers (22% of budget), direct mail (19% of budget) and Web sites (15% of budget) (see Chart L).

The bottom line is a lot can be done with little to no marketing budget. But if you are spending money on getting your name out there, be sure you’re spending it in the right places. Some marketing specialists recommend putting your eggs all in one basket. Choose your preferred advertising medium (say, your local newspaper), and spend all your marketing dollars there. This is called

“owning the market.”

“owning the market.”

It worked! Store owners, want to hear about some tactical marketing strategies that worked well for your fellow natural products retailers? Here are some ideas that stores said were their most successful marketing strategies over the past year.

Before trying these techniques, remember that marketing and promotions must be considered carefully. What works for one store, may not work for another. This is especially important to remember before trying anything that involves sales and discounts (see the previous statement about negotiating discounts with vendors to help you keep your gross profit margins at a healthy level).

- Take your “word of mouth” referrals to a new level by using them to everyone’s advantage with a referral program. For instance, if a shopper gets five friends to sign up for your mailing list, give them a coupon for 20% off one item.

- Make your top clients feel special by inviting them to a 30-minute product preview presentation. Have a knowledgeable staff member show off your newest SKUs and let shoppers ask questions. If you can, let the audience try samples. Offer a coupon for discounted purchases of new items made that day only.

- Hold an open house for the community to see all the great products your store has to offer. Combine it with store-wide discounts for extra sales.

- Here’s an interesting idea from one survey participant: “Set up a projector and screen in your window at night advertising products using PowerPoint. I had the computer, bought a projector for $500, and made a pull-down screen out of a shower curtain. I always have people calling about what they saw when they were walking or driving by.” This example shows that out-of-the-norm techniques can really make for a standout

ad.

ad. - Stress your unique customer service skills by filling special orders. Also carry hard-to-find or locally made items that your competitors don’t stock.

- Hold a discount day or customer appreciation day to lure in extra buyers.

- Offer package deals. For instance, purchase Cold and Flu Homeopathic Remedy XX and get Lozenges X free. Or, band together two products and price out with a small discount (e.g., Shampoo with SRP of $15 and Conditioner with SRP of $18 packaged together for SRP of $30).

- Find innovative ways to reach shoppers you normally don’t consider “your clientele.” Some ideas from this year’s survey takers include buying an ad on the placemat of your local diner; join networking groups with your local Chamber of Commerce; or have your staff nutritionist hold a seminar for local physicians to learn about your offerings.

On the Fence about Private Labeling? Time to Hop Off

On the Fence about Private Labeling? Time to Hop Off

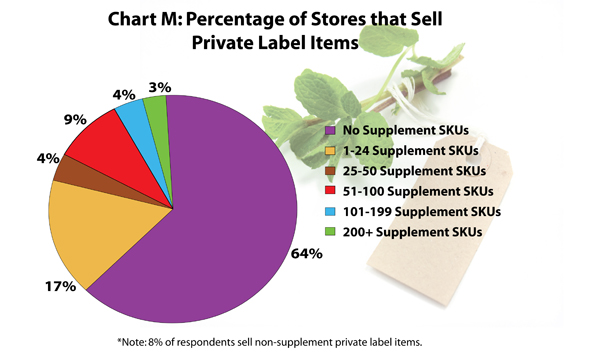

This year, about 37% of retailers said they sold at least one private label supplement (see Chart M), and 8% carried non-supplement items like personal care products and grocery items.

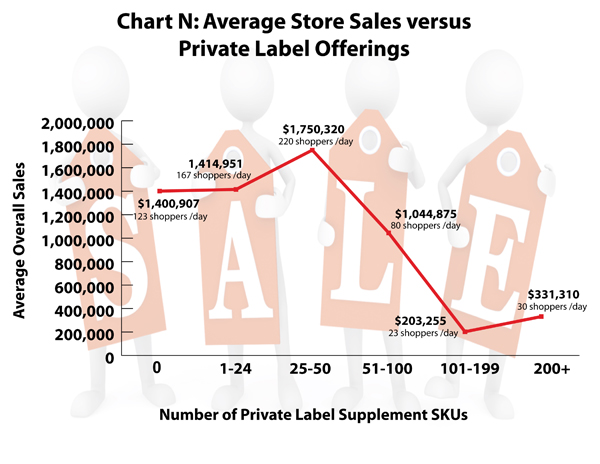

In this year’s survey, stores that had 1–24 private label supplement SKUs and 25–50 private label supplement SKus seemed to do the best in terms of overall sales and transactions per day. In fact, sales grew even with a fairly limited private labeling offering of one to 24 supplements versus no supplements at all ($1,400,907 for no private labels to $1,414,951 for 1–24 private label supplement SKUs to $1,750,320 for 25–50 private label supplement SKus). Sales for stores selling 25–50 private label supplements grew 25% over the 1–24 group (see Chart N).

While no one can guarantee a huge return, the lesson may be that if your store can confidently and knowledgably add private label items, it may be the deciding factor between why your customers buy products from you and not that guy down the street. It shows you believe in your store and the quality of the products it offers. Plus, it shows you’re an authority in the area of health and wellness.

But take care when planning a new line. According to the data presented in Chart N, having very large private label supplement lines didn’t automatically make sales and foot traffic multiply exponentially. Perhaps the large lines with smaller sales could indicate stores are over-merchandised for their unique customer base. One way to consider this is by inventory turns per year. Stores with 101–199 private label supplements SKus averaged 2.96 turns per year, but the average for all stores was about 6.42 turns per year, which, remember, is for a largely supplements-focused study group. This figure actually increased with more perishable offerings, as it should; those with more than 35% of perishable sales had 14.83 turns per year.

The overall average may be on the low side compared with industry standards. Thus, it may signal that some stores are carrying too much inventory for their clientele.

Who Grew?

Who Grew?

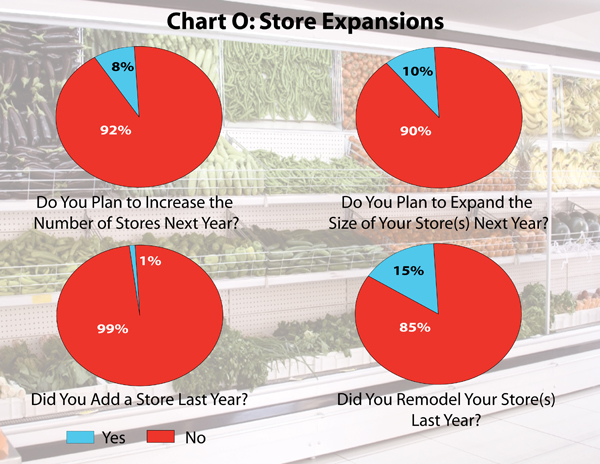

It probably won’t come as a surprise to you that most stores dug in this year, rather than spread their wings with an expansion. In 2009, 12% of stores said they planned to add a store in 2010, but practically no respondents did so. Perhaps these stores are waiting until the economic climate and real estate market bounce back a bit further before taking this step.

Last year, 20% were anticipating a remodel, and this year, some 15% of retailers said they had enough extra cash to remodel their stores (see Chart O). On average, they spent about $25.52/ft2. These renovations ranged from $1,000 to $300,000 jobs, covering everything from a fresh coat of paint to new bathrooms. Here’s more positive news: several of the stores felt their businesses were healthy enough to expand their offerings. Such shop owners reported adding food service areas, therapy rooms, resource areas with Internet and reading material and more.

WholeFoods compared trends among stores that remodeled and those that didn’t. Showing that there are rewards for investing in your business, renovators averaged higher net profits ($86,308 versus $64,693) and store sales ($2,152,282 versus $1,113,581) than nonrenovators.

Next year, we may see additional growth and remodeling among all stores. Most retailers expect 2011 will be a good year; 78% of respondents expect their sales will rise next year by about 12% on average. WF

Published in WholeFoods Magazine, December 2010