Without question, preferences in the dessert category follow the flavor trends and movements taking place in the food industry at large. Savory, for some, is the new sweet, while others look to get creative by cooking up some sweet concoctions for themselves.

It’s also not too much of a stretch to observe that the dessert category follows societal trends. As families continue to diversify the way they feed themselves—at different times of day, with different portion sizes, eating as a group versus eating alone—dessert companies can and do adapt, and new types of products are the result.

Then, there are your customers, in particular.  Catering to them, as they strive to keep things natural when choosing their indulgences, is a challenge in and of itself.

Catering to them, as they strive to keep things natural when choosing their indulgences, is a challenge in and of itself.

What Are They Choosing?

As we all know from experience, dessert choices are guided by a combination of flavor preference and emotion. So, there’s no accounting for them; flavor and texture trends among consumers come and go as they please. Pamela Giusto-Sorrells, president of Pamela’s Products, Ukiah, CA, says that caramel is a hot flavor lately, while no matter what the fad, chocolate is always “in.”

There are, meanwhile, certain things that never change where dessert is concerned. “I have found that ‘dessert’ means ‘treat,’ no matter how you look at it. Some people like to incorporate other concerns into their desserts if they can (e.g., low calorie, sugar-free or fat-free), but the bottom line is that they are looking for a treat that delivers to their taste buds,” says Giusto-Sorrells, whose company specializes in gluten-free.

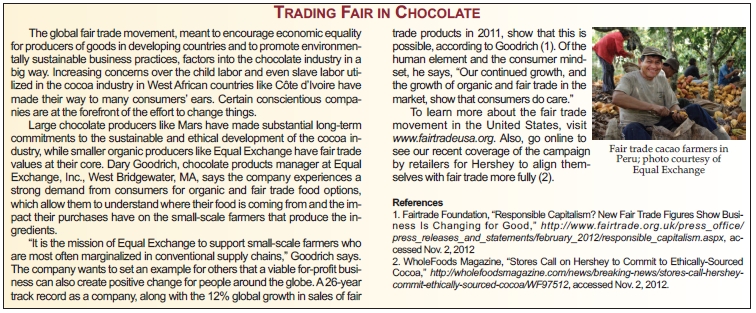

Natural dessert shoppers want to see minimal ingredient lists, with simple, unprocessed ingredients prominently featured. According to Dary Goodrich, chocolate products manager at Equal Exchange, Inc., West Bridgewater, MA, this is part of the trend toward healthier products that has been taking place in the chocolate industry.

As a fair trade chocolate manufacturer with co-op farm partners in South America, Madagascar and elsewhere (see the sidebar on fair trade), Goodrich says customer demand for purity and minimal ingredients inspired the launch of a new line of organic, Fair Trade certified candy bars with only six or seven ingredients. With chocolate in particular, the trend toward healthy also means making products with a higher percentage of cacao, according to Goodrich.

“Another trend we’ve experienced is a desire on the part of our customers for smaller products, as people look for products that come in single-serve options,” Goodrich says. This has translated into 45-g candy bars for Equal Exchange, less than half the size of its original 100-g chocolate bar. Goodrich also points to strong growth for its mini, bite-sized chocolate products, weighing in at 4.5 g.

“Another trend we’ve experienced is a desire on the part of our customers for smaller products, as people look for products that come in single-serve options,” Goodrich says. This has translated into 45-g candy bars for Equal Exchange, less than half the size of its original 100-g chocolate bar. Goodrich also points to strong growth for its mini, bite-sized chocolate products, weighing in at 4.5 g.

“Calories aren’t a main driver for creating our products—real fruit, good-for-you ingredients and satiating protein create a nutritionally sound product,” says Nicki Briggs, M.S., R.D., vice president of corporate communication for Greek yogurt company Chobani, Inc., Norwich, NY. Nevertheless, serving sizes in the dessert aisle are a concern for many. “People are more conscious of portion sizes and often want a small taste of sweets to satisfy the craving,” says Tex Ann Kraft, director of marketing for Bliss Unlimited, LLC, Eugene, OR, makers of Luna & Larry’s Coconut Bliss, a brand of organic ice cream made from coconut milk.

To summarize opinion—even for the health conscious’ desserts don’t need to be super-low calorie affairs, nor do they have to trade away taste to maintain size. Instead, people should indulge in small but satisfying portion sizes, Giusto-Sorrells suggests, that don’t compromise on taste or texture.

Like with all packaged food, the decisions  dessert companies make about serving size and product design are influenced by consumer preferences. Dessert is still most associated with the after-dinner period, “but I do see the use of chocolate more and more as a breakfast food,” Giusto-Sorrells says. Her company felt obliged to add a chocolate flavor when it introduced its Whenever Bars last year. Now, she says, the Chocolate Chip Coconut Whenever Bar is a clear leader over the fruit-flavored bars they offer.

dessert companies make about serving size and product design are influenced by consumer preferences. Dessert is still most associated with the after-dinner period, “but I do see the use of chocolate more and more as a breakfast food,” Giusto-Sorrells says. Her company felt obliged to add a chocolate flavor when it introduced its Whenever Bars last year. Now, she says, the Chocolate Chip Coconut Whenever Bar is a clear leader over the fruit-flavored bars they offer.

Individually wrapped products like these are in demand for breakfast and as on-the-go snacks, and the desire for chocolate goes hand in hand. Placed back in the context of a traditional dessert, individually wrapped says “portion control” to the consumer, she explains.

For other products traditionally enjoyed outside dessert time, like yogurt, consumer flavor preferences are being heard. “Our Vanilla Chocolate Chunk is a fan-driven flavor,” says Briggs. The flavor started life as one of the varieties offered in a kids’ yogurt line, but the company found adults were clamoring for it as well. It is now offered in a 16-oz. container, which the company believes positions it well as a dessert option.

As consumers learn about the health benefits of Greek yogurt, Briggs says cooking and baking with the product has been growing in popularity. She describes both plain and flavored varieties of Greek yogurt as suitable substitutes for ingredients like butter, oil or cream in dessert recipes. Savory flavors have had their introduction into dessert products and recipes, too. Blue Diamond Growers, Sacramento, CA, presents consumers with a recipe called Sweet and Salty Chocolate Almond Cups, which uses Blue Diamond products including Almond Nut-Thins. The recipe can be found at www.wholefoodsmagazine.com/grocery/recipes.

Natural, Organic and Your Dessert Aisle

Isn’t ice cream just ice cream? Why should consumers care whether their dessert choices are natural, organic, et al.? They’re indulging themselves anyway, right? For starters, Kraft believes that with certified organic food, people don’t have to feel “guilty” about eating dessert. In other words, dessert and good nutrition are not mutually exclusive.

In fact, natural and organic dessert makers feel there is much to distinguish their products from their conventional counterparts. It starts with going back to the notion of consumer comfort with the ingredient list. “Basic reading of a label can help consumers decide if they want the ‘natural’ product variety or want to purchase food with ingredients they cannot pronounce,” Giusto-Sorrells says.

In fact, natural and organic dessert makers feel there is much to distinguish their products from their conventional counterparts. It starts with going back to the notion of consumer comfort with the ingredient list. “Basic reading of a label can help consumers decide if they want the ‘natural’ product variety or want to purchase food with ingredients they cannot pronounce,” Giusto-Sorrells says.

Her company’s product line is gluten-free, and she says that many of her customers have multiple food sensitivities. They are looking, she explains, for the healthiest ingredients they can find, sans artificial flavors, colors and preservatives, and including organic, minimally refined ingredients, with plenty of whole grains and fiber. Kraft concurs, saying that consumers of natural products want to skip the additives, artificial ingredients and fillers so often found in conventional products.

These days, they also have more choices in terms of the sweeteners used in dessert products. Natural companies are eschewing processed sugar in favor of alternatives like stevia. And, in the case of Kraft’s company, consumers with lactose intolerance or a wish to avoid dairy have a dessert to call their own. “They can step outside of dairy and still enjoy a delicious frozen dessert that satisfies and tastes delicious,” she says. In general, the ability to avoid dairy, soy, gluten or another ingredient is something that some natural companies provide that conventional manufacturers usually do not.

The peace of mind that certain shoppers get with natural and organic products if of great value to them. “Customers consistently tell us that organic certification favorably distinguishes our products in their minds,” Kraft says. The way organic ingredient suppliers embrace sustainable, pesticide-free farming aligns with their company values, she adds. Organic farmers produce premium ingredients, she believes, and this is reflected in the finished product.

Through a commitment to such values as organic, fair trade, non-GMO and kosher parve, Kraft says her company conveys to the consumer its integrity as a food manufacturer. WF

Published in WholeFoods Magazine, December 2012