Innovation, fresh applications and exciting new products continue to dot the natural sweetener landscape. But before we can engage with what’s new, it’s good to review the basics. We’ll also shed some light on the obstacles facing those that supply these solutions for sweetness. Then, learn how customers can put stand-alone sweetener products to use at home.

Sweetener Sketches: Highlights and Updates

Whether they’ve been widely used for decades or are just now coming into vogue, each of the following natural sweeteners are highly valued as ingredients both in finished products and on their own. A quick look at their resumes will show us why.

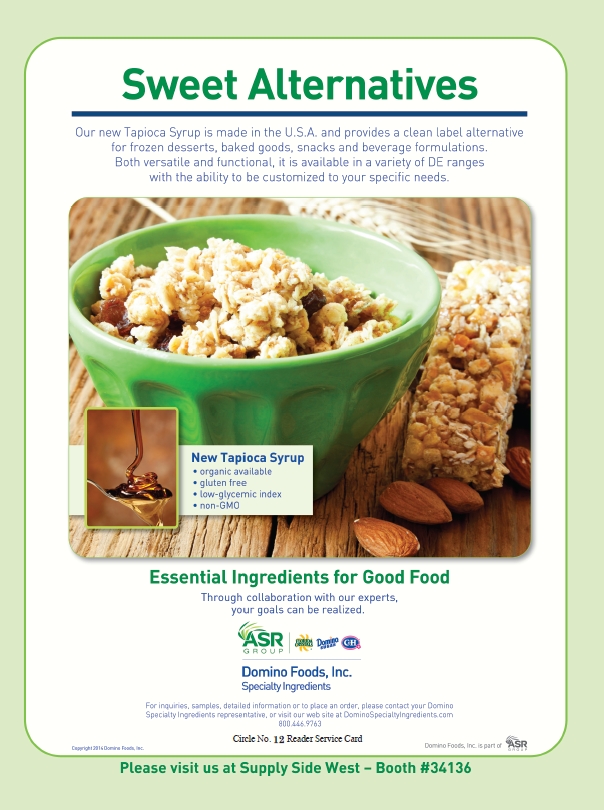

Jim Morano, Ph.D., head of new products and new business development for Suzanne’s Specialties, New Brunswick, NJ, starts us off with an industry standby. “If I was going to highlight one, not just from a health standpoint but for its impact on the industry, I would certainly highlight brown rice syrup,” he says.

Almost all other sweeteners, he explains, consist of purified starch from the raw sweetener crop. Much of the nutritional content is lost when only starch is used. Brown rice syrup is usually made from the whole grain, according to Morano. This leaves the rice bran intact, and the healthful attributes of rice bran are well established, he says.

Brown rice syrup is a cornerstone of the natural sweeteners industry, Morano says, and it is widely used as a replacement for refined corn syrup by natural products companies. The industrial conversions that corn syrup is put through can be approximated with brown rice syrup, but through the use of enzymes rather than acid.

Molasses, particularly the darker grades, is very  nutritious, according to Morano. The nutritional content in cane juice, which is removed by the preparation of sugar, is retained in molasses. He says that while molasses may not be aesthetically pleasing, it is a good option as it contains a lot of vitamins and minerals. He also cites honey for its health benefits, and notes that agave is a great natural alternative to sugar due to its low glycemic index.

nutritious, according to Morano. The nutritional content in cane juice, which is removed by the preparation of sugar, is retained in molasses. He says that while molasses may not be aesthetically pleasing, it is a good option as it contains a lot of vitamins and minerals. He also cites honey for its health benefits, and notes that agave is a great natural alternative to sugar due to its low glycemic index.

Elke Crafts, natural retail sales manager for GloryBee, Eugene, OR, says her company’s traditional agave nectar, called maguey syrup, has been used as a sweetener and as nourishment by indigenous people in Mexico for over 1,000 years. It is made from juice collected from the flowering stem of the Agave salmiana plant and collected in small batches. It is unrefined, Crafts says, making it different from many agaves in the market. “It contains Metlin (from Vivente), a prebiotic dietary fiber from the agave azul plant, which aids in digestion and has a low glycemic index,” says Crafts, adding that this agave has a characteristic robust flavor and is similar in color to molasses.

Because agave is 1.4 times sweeter than sugar, less of it needs to be used and calorie counts can be reduced, according to Debbie Carosella, CEO of Madhava Natural Sweeteners, Longmont, CO. As a sugar substitute, agave nectar is suited to making cookies, cupcakes, popsicles, ice cream, beverages, cocktails or bread, Carosella says. “It can also be used as a sweetener in coffee or tea, and many consumers put it on their oatmeal, cereal or fruit in the morning and at other occasions,” she says.

Organic agave nectar ingredients extracted from blue agave have been gaining in popularity with manufacturers looking to replace high-fructose corn syrup, says Thom King, president of Steviva Ingredients, Portland, OR. He says this ingredient, offered by his company, is extracted at low temperatures and mildly filtered, and that high-intensity steviol glycosides are added to boost its sweetness. Steviol glycosides are compounds extracted from the stevia plant that provide stevia ingredients their sweetness. The ingredient’s consistency, King says, is only slightly thinner than honey, making it an ideal substitute. “It dissolves quickly in hot or cold liquids, so it can easily be incorporated in beverages, sauces and dressings. It serves as a binding agent in cereals and bars,” says King.

Though stevia is well known to most consumers today, there really is no basic “stevia” ingredient. Instead, many preparations and extracts of the basic plant are being used in the market, each with its own merits.

Peter Sokoloski, key accounts manager for NOW Foods, Bloomingdale, IL, describes his company’s stevia extract, which is sold both as a finished product and as an ingredient to manufacturers. “What’s unique about this particular extract is its proprietary preparation: it’s organically grown and goes through an enzyme-treatment process that greatly reduces the aftertaste that’s typically found in stevia,” Sokoloski says. This makes it a viable alternative to sugar as a tabletop sweetener, or as part of a complex formula, he explains. It is used in dietary supplements, foods and beverages, he says, and a variety of food manufacturers have turned to it when Reb A stevia extracts haven’t suited their formulas.

Peter Sokoloski, key accounts manager for NOW Foods, Bloomingdale, IL, describes his company’s stevia extract, which is sold both as a finished product and as an ingredient to manufacturers. “What’s unique about this particular extract is its proprietary preparation: it’s organically grown and goes through an enzyme-treatment process that greatly reduces the aftertaste that’s typically found in stevia,” Sokoloski says. This makes it a viable alternative to sugar as a tabletop sweetener, or as part of a complex formula, he explains. It is used in dietary supplements, foods and beverages, he says, and a variety of food manufacturers have turned to it when Reb A stevia extracts haven’t suited their formulas.

High-purity, high-quality Reb A is still of primary interest in the food and beverage industry, according to Phil Coggins, director of commercial sales for Pyure Brands, Naples, FL. Perhaps the most effective and widespread use of stevia in the food industry today is as a sweetener for beverages, Coggins suggests. “Stevia is highly soluble and is a natural choice for high sugar content beverages. Virtually every major food and beverage manufacturer has a product that contains stevia, or is currently formulating products that do,” he says.

Though using high levels of Reb A is a common route for product formulators, King says his company developed a proprietary blend of steviol glycosides consisting of 60% Reb A and 95% steviosides. He says this combination delivers a flavor profile that is well rounded and less bitter. He adds that water extraction and temperature-induced spray drying are used to produce the powdered ingredient. “Clean processing is especially important because the meaning of the word natural is coming under scrutiny,” he says.

This same stevia blend, King says, has been developed as a liquid solution as well. It is designed for use in beverages, marinades, dressings, soups and other water-based applications. It is heat stable to 200 degrees Celsius and water soluble at any temperature. Trace amounts of grape seed extract are added to the liquid solution to serve as an anti-microbial, and to perhaps add to a product’s shelf life.

The need for stevia is evident, explains James A. May, founder and CEO of Wisdom Natural Brands, Gilbert, AZ, maker of SweetLeaf Stevia Sweetener. “It has been well established that sugar is a major cause of the health problems plaguing the world today, including increasing obesity and diabetes at alarming rates,” he says.

May, founder and CEO of Wisdom Natural Brands, Gilbert, AZ, maker of SweetLeaf Stevia Sweetener. “It has been well established that sugar is a major cause of the health problems plaguing the world today, including increasing obesity and diabetes at alarming rates,” he says.

Stevia’s intensely sweet glycosides can be made into a white powder that is hundreds of times sweeter than sugar, and a better option for human health, May says. There are estimated to be over 1,500 published scientific studies documenting stevia’s safety and health benefits. His company’s stevia has zero calories or carbohydrates, and thus elicits no glycemic response. This makes it ideal for those with diabetes, weight challenges and anyone seeking a healthier alternative, he says.

Currently, May says his company’s ingredient is being used in a slew of food products, such as organic chocolate milk, nutrition bars, salad dressings, tortilla chips and ice cream. It is even being used in cosmetic products. The company’s chocolate-flavored liquid stevia drops are being used to help schools achieve federal goals for providing healthier chocolate milk to children. May says the use of stevia can help schools reduce total levels of sodium, sugars and fats in meal programs. The natural flavors in these flavored liquid drops, May says, are derived from a combination of culinary herbs, fruits and vegetables.

May also shares an innovative addition to the stevia consumer packets his company offers. They contain slightly less than a gram of inulin, a soluble fiber that promotes good intestinal flora, which is needed for proper immune function and digestive health.

Highly soluble inulin, as well as a related natural sweetener called oligofructose, offer several advantages, according to Joseph O’Neil, president and GM of BENEO, Inc., Morris Plains, NJ.

Oligofructose can replace sugar in formulas while providing the benefits of dietary fiber. “It’s beneficial in the following three ways: as a natural sugar reducer, it is more stable in low pH food preparations for foods such a yogurt, and offers superior texture for food preparation. It also can complement stevia because of its profile being closer to sugar,” O’Neil says. At about 30% of the sweetness of sucrose, these ingredients deliver fiber content while adding a mildly sweet taste to foods and beverages, he explains. O’Neil adds that they work well in reduced-sugar and reduced-calorie fruit preparations for yogurt, and in the binding syrup for fiber-enriched ice cream, cereal bars and baked goods.

O’Neil also touts the advantages of a sweetener made from pure beet sugar. It can replace sugar and offers a very low glycemic response, is better for teeth and provides a natural taste and sweetness profile.

O’Neil also touts the advantages of a sweetener made from pure beet sugar. It can replace sugar and offers a very low glycemic response, is better for teeth and provides a natural taste and sweetness profile.

Xylitol is another natural sweetener continuing to make inroads across the food industry. It is a naturally occurring, white crystalline carbohydrate that looks and tastes like table sugar, says Ryan Hogan, communications director at Xlear Inc., American Fork, UT. Xylitol is slowly absorbed, making it ideal for those with blood sugar issues, and it is a lower calorie alternative to sugar (1). It can be sourced from any woody, fibrous plant material, and commercially it is extracted from renewable resources such as corncobs.

Some of the primary benefits associated with xylitol are in the realm of oral health. Research conducted under a variety of conditions has indicated that xylitol use can reduce tooth decay rates, according to Hogan. “Sugar-free chewing gums and candies made with xylitol as the principal sweetener have already received official endorsements from six national dental associations,” he says. Xylitol helps prevent harmful bacteria from adhering to tissue, which also allows it to be used effectively in saline nasal sprays and for fighting infections and allergies.

New and noteworthy. The food industry continues to focus on key sweeteners like stevia, including expanding production and introducing new products. Coggins says to expect hundreds of new products with stevia in the coming years. Just as Splenda slowly took hold of the industry decades ago, Coggins says we are still early in the growth progression of stevia. “It is the most economically viable high-intensity sweetener on earth,” he says.

There is plenty new to discuss, though, including up-and-coming sweeteners and novel uses and combinations. “Sugar alcohols continue to be of interest as ‘bulking agents’ to accompany stevia in beverage applications, so it is important to keep your eyes on those,” Coggins says, adding that his company introduced a non-GMO, certified organic erythritol product recently.

There appears to be a trend toward using  combinations of sweeteners to achieve results in foods and beverages, whether the goal is an acceptable mouth-feel or improved taste profile, according to Sokoloski. He points to his company’s blend of its stevia ingredient with erythritol, inulin and maltodextrin that offers a taste similar to sugar. It browns and bakes like sugar, he says, and produces the needed bulking and texture in baked goods. Sokoloski notes that some are also combining traditional sugar with stevia to form a lower-calorie alternative.

combinations of sweeteners to achieve results in foods and beverages, whether the goal is an acceptable mouth-feel or improved taste profile, according to Sokoloski. He points to his company’s blend of its stevia ingredient with erythritol, inulin and maltodextrin that offers a taste similar to sugar. It browns and bakes like sugar, he says, and produces the needed bulking and texture in baked goods. Sokoloski notes that some are also combining traditional sugar with stevia to form a lower-calorie alternative.

According to O’Neil, sensory testing has shown that a combination of his company’s oligofructose with stevia, in both dairy and non-dairy products, delivers a sugar-like taste, with none of the “off-taste” sometimes present with stevia. “A case in point is sugar-reduced fruit yogurt; when oligofructose and stevia are combined, the end result is similar to the control sample in terms of flavor, acid aftertaste, sweetness and body,” he says.

Another effective combination, according to Hogan, is erythritol and xylitol (both are sugar alcohols). He says his company is in the process of launching this combination ingredient, which contains zero calories and produces no aftertaste, making for a sweetener with good taste and a low glycemic index. It is approximately 85% as sweet as table sugar, he says, making it an ideal replacement in many foods. The combination is also easy on the digestive system, he adds, and may help reduce the risk of dental cavities.

Luo han guo, or monk fruit, is a relative newcomer to keep tabs on, says King. Its sweetness is derived from a group of glycosides known as mogrosides. He says it can be extracted with water from the pulp of the fruit. A monk fruit ingredient first gained generally recognized as safe (GRAS) status in the United States in 2010.

A blend of stevia, monk fruit and erythritol offers several advantages, King says. On its own, stevia can have a slightly bitter taste, but monk fruit can mask this and enhance the overall flavor. Erythritol contributes a mild cooling effect. But he notes that because of their intense sweetness, extremely low amounts of these sweeteners are required to match the sweetness of sucrose. This can leave final formulas without enough solids, which must be built back up to achieve a comparable mouthfeel.

Other blends aimed at enhancing taste include a baking mix from Carosella’s company that combines organic cane sugar with organic coconut sugar. She says they’ve also introduced a reduced calorie, low-glycemic option that blends agave, stevia and monk fruit.

Morano says he is intrigued by the prospect of organic coconut sugar, and that his company has been communicating about it as an industrial ingredient with producers worldwide. However, the price of this ingredient is so high that he says it is beginning to feel like another maple syrup. By this, Morano means that the sweetener must bring some intrinsic value that will get consumers to pay more for products that incorporate it. A few years ago, he says some companies were experimenting with organic coconut sugar, but many have since pulled away. Morano says there may, however, be the potential for growth on the retail side for coconut sugar, where customers may seek it out as an in-home ingredient.

Market Issues

Market Issues

The rise in interest in natural sweeteners has inevitably led to some concerns over supply. Some reasons for these concerns are surprising, says Morano. One sweetener, organic honey, is falling through the cracks between the non-GMO and certified organic products industry, he explains. It is difficult to certify honey as organic due to the requirement for a certain radius of land and agriculture that meets organic standards (such as a lack of pesticides or genetically engineered crops). Bees travel for miles around as they pollinate, and the organic radius is too large to be realistically achieved in the United States.

Meanwhile, the demand for non-GMO products, including honey, continues to rise. Those in search of non-GMO honey are seeking out organic, Morano says, because of the assurance that certified organic products are produced without GMOs. This double demand means there is not quite enough organic honey to go around, raising prices. Even if you do get your hands on honey that is supposed to be organic, it’s not always a sure thing. Morano says his company has analyzed some organic honey and discovered GMO content.

Agave is also a volatile market. Morano says that there is a long gap of around seven years between when an agave crop is planted and when it can be harvested. “Every four or five years, we see a spike in the price of agave because it’s a plant that takes so long to mature, and it’s almost impossible to project how much you’re going to need to plant today,” he says.

As the primary source for the production of tequila, when the tequila market spikes, more agave crop gets bought up and prices rise. Carosella says, tequila growth is strong globally, “and has now been accepted into the China market which has greatly influenced the supply side of agave.”

In 2008, when Coca-Cola pulled out of commitments to Chinese suppliers of stevia, it created a glut in the market and stevia prices dropped, says King. This led to a decline in production, as stevia fields were replaced with other commodity crops. Suppliers have yet to make up enough ground to account for the more recent upswing in demand, so pricing has moved up, he says. “It is our belief that prices will stabilize as there is more steady market adoption of stevia as a sweetener,” King says.

Coggins confirms this dynamic, saying that stevia pricing has already come down as it has become more commoditized. “Hopefully in the future, the pricing will fall even further, but for the time being it has remained pretty stable,” he says. Sokoloski notes that this back and forth is merely a sign of stevia’s popularity, as it mirrors the supply and demand curve for any hot new product that takes off the with public.

There is a separate sourcing conundrum in the sweetener realm,  according to Coggins. He explains that most viable stevia extract, about 90%, comes from China. While several companies claim to grow “U.S. Stevia leaf,” he says the reality is that even if stevia is grown here, it usually needs to be processed at a Reb A extraction facility in China. The final product, therefore, is of Chinese origin. “In the United States, there is considerable backlash over Chinese-produced food products, although stevia has been well received,” Coggins says.

according to Coggins. He explains that most viable stevia extract, about 90%, comes from China. While several companies claim to grow “U.S. Stevia leaf,” he says the reality is that even if stevia is grown here, it usually needs to be processed at a Reb A extraction facility in China. The final product, therefore, is of Chinese origin. “In the United States, there is considerable backlash over Chinese-produced food products, although stevia has been well received,” Coggins says.

Sokoloski says another hurdle facing those in the natural sweetener industry is the task of effectively integrating options like stevia into food and beverage formulas. “Food scientists at times struggle to use high-intensity sweeteners in their recipes; the process isn’t as easy as using sugar or other traditional ingredients,” he says. Often, some trial and error is required before the flavor profile can be tweaked to meet consumer expectations. But Sokoloski says this can pay off in the form of a superior formula with great flavor and the health benefits natural options offer.

A basic roadblock for the stevia market and for sweeteners in general is consumer awareness, May says. While more people are interested in stevia as a tabletop sweetener and as a primary ingredient in their foods and beverages, he feels there may currently be some market confusion. He says it’s important that people know how to differentiate between the various stevia options, based on important distinctions like the amount of added sugars and other ingredients, as well as the amounts of steviol glycosides in a given ingredient. “We recommend that consumers read the ingredient panel on their sweetener box,” May says.

Sweeteners in the Home

As people begin to take a more active role in preparing their own food, and as the popularity of natural sweeteners increases, the market for home sweetener products is set to keep growing. Crafts says her company has noticed an uptick in sales of its retail line, which includes blackstrap molasses, coconut sugar, organic date sugar and honey crystals and more. “More consumers are getting educated on how they can replace their usage of sugar with alternative natural sweeteners in their baking and cooking or for use in their beverages,” Crafts says.

As a longtime purveyor of stevia as a tabletop sweetener, Sokoloski says his company is poised for growth as both a consumer brand and a private label service provider. “As consumers’ tastes change, they see the value in high-intensity alternative sweeteners; the benefits, including low-glycemic index and greatly reduced caloric intake, can have profound and lasting health effects,” he says.

Coggins notes the introduction of stevia brands like his company’s into mainstream retailers as a sign of the exponential market growth currently taking place.

Growth has been significant enough for Hogan’s company to expand its line of sweeteners. He says a focus has been placed over the past two years on educating consumers about the home uses of its xylitol sweetener, and communicating its nutritional and dental benefits.

Honey not only still reigns supreme as the most popular in-home sweetener, but Carosella says it also is seeing some of the strongest year-over-year growth. The sales growth for coconut sugar is even more explosive, she says, an indication of the wider distribution it now enjoys.

Stevia products for home use now come in all shapes and sizes, as May describes. His company’s packets of stevia blended with inulin are sold in boxes, with each packet replacing two teaspoons of sugar. Stevia shaker bottles deliver the same ingredient in an easy home use package, May says. Dissolvable stevia tablets are ideal for on-the-go use. The company’s baking ingredient combines stevia glycosides with cane sugar to form a low-calorie alternative. He also refers us back to his company’s liquid stevia drops, which add flavor without calories or carbohydrates. “Several of the flavors, including cola, root beer, vanilla and grape, when added to sparkling water, mimic the taste and mouth feel of soda, thus providing a delightful bubbly beverage without any harmful ingredients,” May says.

The 95-60 steviol glycoside blend King described earlier is offered in small bottles for home use, he says. His company also blends stevia and erythritol to deliver a mouthfeel similar to sugar, and offers a blend of stevia and fructose that King says is ideal for baked goods and any recipe that requires browning. He adds that his company will soon release a stevia blend in powdered form, as well as a blend of fortified agave nectar and stevia that can replace corn syrup in bottles sized for home and foodservice use. WF

Reference

1. WebMD, “Xylitol,” http://www.webmd.com/vitamins-and-supplements/xylitol-uses-and-risks, accessed Aug. 31, 2014.

Published in WholeFoods Magazine, October 2014