Nature Made Makes Waves With Pickle-Flavored Gummies

April 15, 2024

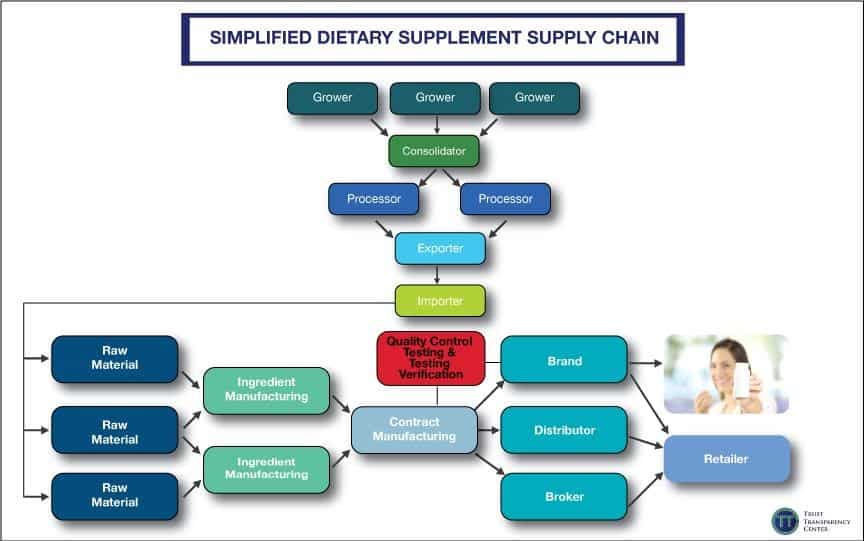

Many of the brands stocked in store or purchased online focus heavily on marketing and product positioning, leaving critical operations such as actual manufacturing and testing to so-called “expert” outsourced companies. Emerging brands especially will make use of these services, exploiting low minimum commitments rather than investing heavily in their own capabilities. While this is easily understood at operational and business levels, it opens the door to corner- and cost-cutting and other unsavory business practices. In fact, all too often it becomes a race to the bottom as margins erode, driving additional cost-cutting in a vicious cycle.

Many of the brands stocked in store or purchased online focus heavily on marketing and product positioning, leaving critical operations such as actual manufacturing and testing to so-called “expert” outsourced companies. Emerging brands especially will make use of these services, exploiting low minimum commitments rather than investing heavily in their own capabilities. While this is easily understood at operational and business levels, it opens the door to corner- and cost-cutting and other unsavory business practices. In fact, all too often it becomes a race to the bottom as margins erode, driving additional cost-cutting in a vicious cycle.

NOTE: WholeFoods Magazine is a business-to-business publication. Information on this site should not be considered medical advice or a way to diagnose or treat any disease or illness. Always seek the advice of a medical professional before making lifestyle changes, including taking a dietary supplement. The opinions expressed by contributors and experts quoted in articles are not necessarily those of the publisher or editors of WholeFoods.