Currently, there are over 14,000 dietary supplement brands listed as vitamins and supplements through an Amazon search, and at least five of the brands listed are Amazon owned: the Elements line, Solimo line, Revly, Own PWR and Mama Bear.

An overview of the offerings:

- Elements was launched by Amazon in February 2016 with just four products; it now has 30 SKUs, and targets the general population. It does not provide structure function claims for any products or ingredients, thus eliminating an area of regulatory concern experienced by most brands.

- Solimo, an Amazon line launched in March 2018, already has 91 dietary supplement SKUs. It also targets the general population, and does not provide structure function claims.

- Revly is clearly geared toward women.

- Own PWR targets men and the power-lifting community.

- Mama Bear is Amazon’s kids-focused line.

- Nature’s Wonder. Amazon is expanding its reach through its “Our Brands” program, which includes Nature’s Wonder. It was launched as an Amazon exclusive in September 2017 and now has 72 SKUs. Unlike the other Amazon brands, Nature’s Wonder provides specific claims and targeted branding.

The Amazon Element line expresses its main product differentiator as transparency. The offering page details historically opaque items of product detail such as contract manufacturer and country of origin of ingredients as well as many other aspects of the product. Through a QR code the consumer can find lot specific analytical test data for the product purchased.

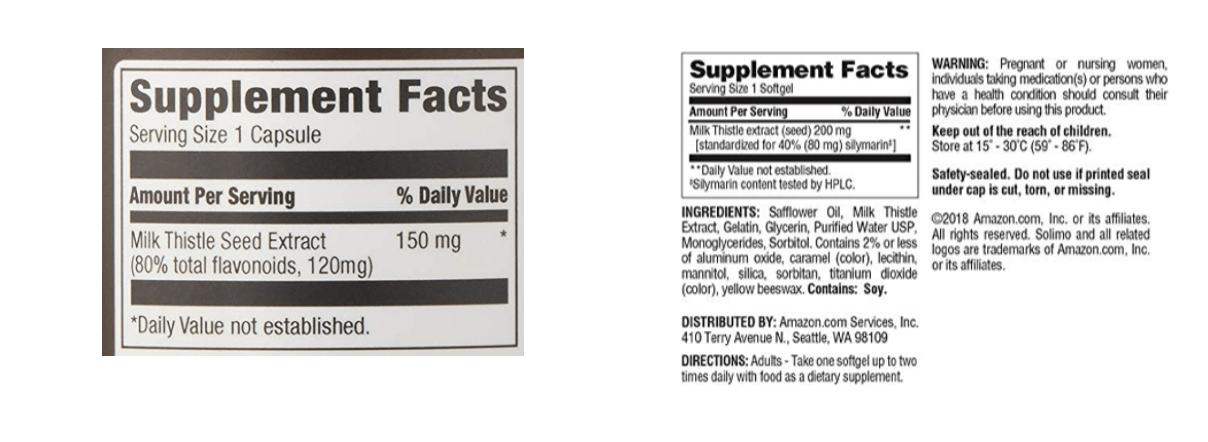

Based upon sales ranking data, the Elements line is performing respectably for Amazon. The Solimo line is a more price aggressive line with no transparency. The Solimo products routinely have less benefit than the Elements line and border on deception in some items. For example, Amazon Elements Milk Thistle states the product provides 150mg per serving. The Amazon Solimo Milk Thistle offers 200mg on front label:

The Solimo label would seem to indicate a 30% increase of Milk Thistle over the Elements brand. In reality, each Solimo softgel contains 67% (80mg vs. 120mg) of Milk Thistle found in each Elements capsule:

This type of discrepancy routinely occurs between the three brands and is perhaps most apparent when reviewing the multivitamin products with similar label names (i.e. One Daily Men’s, Women’s One Daily Vitamin and Men’s One Multivitamin).

Another element of interest as it relates to transparency is the label phrasing “Contains 2% or less of…”. On some labels this phrasing includes magnesium stearate, polysorbate 80, polyethylene glycol and other sometimes-controversial items.

While the Elements and Solimo brands are more similar than different, Nature’s Wonder brand is “Targeted Health” and condition specific. This brand takes on the leaders in their category including Centrum, Move-Free and Flintstones brands and names them in comparison on the front of the label:

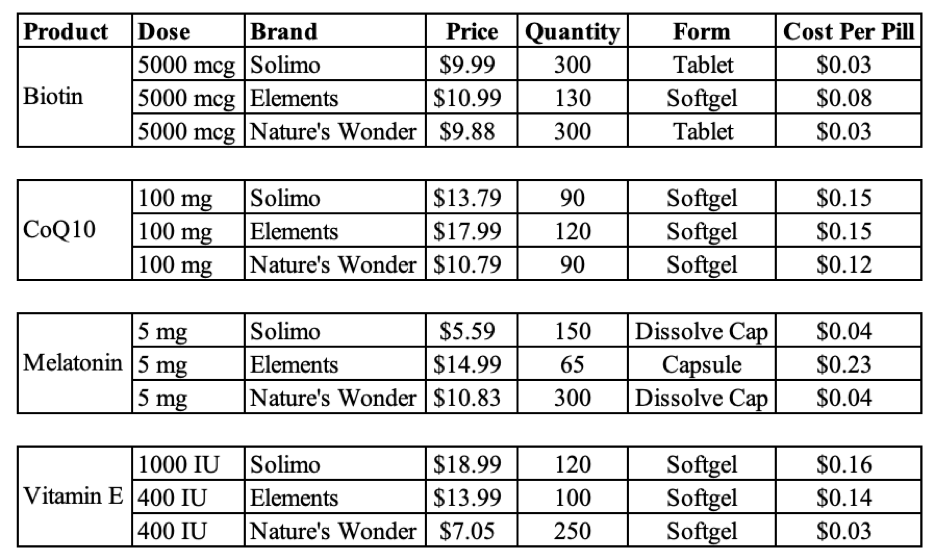

The pricing between the three brands is inconsistent but trends toward offering the Nature’s Wonder product at a discounted price from the Elements and Solimo brands. Some examples:

An interesting note here is the least “generic” looking Amazon-exclusive brand, Nature’s Wonder, is the least expensive. If the synthetic Vitamin E is an indication of ingredient quality, as evidenced by the natural Vitamin E in the other Amazon brands, the ingredient quality is likely low.

What is clear is that Amazon is continuing to create a formidable line of private label dietary supplements. Benefit claims are not going to be part of the majority of Amazon marketing and they are leaving that to others to provide or the consumer to discover on their own. What is not clear is how the “bare bones” marketing of Solimo will fare against the transparency initiative of the Elements brand. Trust Transparency Center will continue to analyze and track the emergence of the Amazon impact on our industry from a variety of angles.

Nature’s Wonder and Solimo appear designed to

get market share at the low/economy end of the spectrum. Solimo and Elements

are offering a minimalist approach to information and benefits of their

products. This opens the door for competing brands and retailers to improve

upon the Solimo approach and create meaningful and valuable content for the

consumer.

So, what does all of this internet knowledge and

Amazon Brand exploration mean to you, the WholeFoods

Magazine reader? The reality is this information is affecting the way you sell

or buy products. The Amazon brands discussed are clearly focused primarily on

price and so opportunities exist everywhere but

price when competing. Every aspect of the Amazon strategy should be analyzed

for opportunity and/or improvement. On a monthly basis in 2019, Trust

Transparency Center will provide insight on this topic. Let us know how Amazon

is impacting your business and questions you have by emailing editor@wfcinc.com.