What’s so important about that?

Many ingredients such as vitamins and minerals are essentially commodities. Although there may be many suppliers of a particular ingredient, there is little to no difference between them. There is almost always no ‘proprietary’ science done on them, and for a brand, no benefit in using supplier provided information to educate about them, beyond general category information and science, like for vitamin D.

Branded ingredients, on the other hand, frequently offer good information provided by the actual suppliers. These suppliers often invest heavily in both science as well as marketing to differentiate their products, even though they might be somewhat similar. There might be specific intellectual property to support the brand including patents, trademarks, and the all-important proprietary research that the supplier has developed to create an opportunity to feature an ‘Intel Inside’ proposition. Now, to be clear, just because that label doesn’t state a brand name for the ingredient, that doesn’t mean they’re not using it, it just means they’ve decided not to use it on the label. In theory, whenever a brand makes a structure function claim on the label, that claim must be supported by research. If they make a unique claim based on proprietary research conducted by their supplier, again, in theory, they must use the ingredient and supplier that did that research.

What about in practice?

In practice, it’s sometimes different. Companies (and non-branded ingredient companies)‘borrow’ the science done by the original supplier. This is not only unethical—it is actually a regulatory violation. Some unethical brands like to keep options open and have redundancy of possible suppliers of an ingredient rather than be locked into a single source of supply. This has actually been under more pressure in recent months with supply chain challenges around the world disrupting inventories, and in many cases, building redundancy does make sense. However, this again is a violation of the regulations. If a brand makes a claim based on proprietary science, the brand must be able to substantiate this should the authorities ask. When the branded ingredient is in fact stated on the label, you, as a retailer should ask your brand for this research too. If you see an exceptional claim, that’s the time to verify that the brand is in fact using validated science.

It does get even more complicated. There are some known cases where unscrupulous brands (and contract manufacturers) use a small amount of the branded ingredient so they have that supply documentation, but then for the bulk of their ingredient supply, they use commodity material. This lowers their raw material cost (branded ingredients typically cost more) and gives them supply options. Suppliers in a few cases have ‘done the math’ and taken up proceedings against a few of these actors, but the practice does occur. This is why it’s so important to understand your brand’s supplier practices, audits and other relationships, and gives the brick and mortar retailer another opportunity to differentiate and really connect with customers.

But does it matter to consumers?

In 2019, a Trust Transparency Center (TTC) consumer survey indicated that science was the most important factor when choosing a supplement to purchase.

To specifically study the impact of branded ingredients on the purchase decision, and how they contribute to the development of trust in dietary supplements, in 2020, TTC commissioned a 2,000+ person survey of regular supplement users from the U.S. (1,000 consumers), the UK (500 consumers) and Germany (also 500 consumers). The survey asked about supplements in general, with a deep dive into specific categories and with branded ingredients, including a look at Probiotics, Prebiotics, Vitamin K2, Collagen and Turmeric.

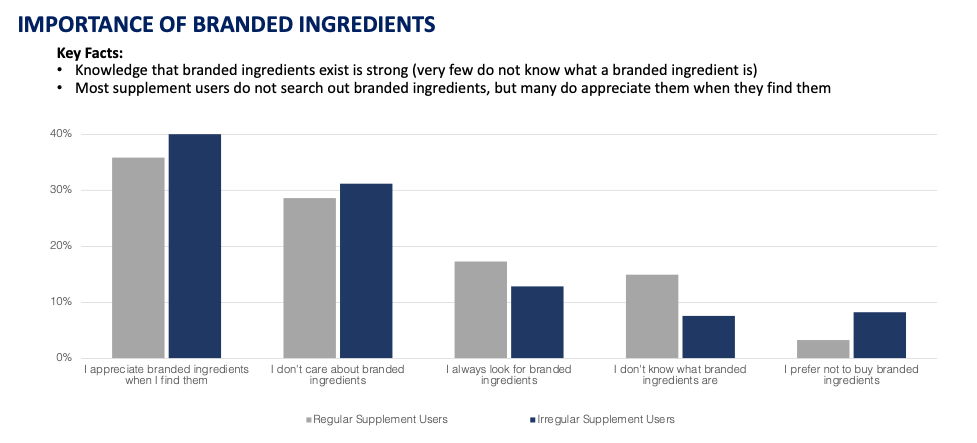

The survey overall demonstrated that the majority of dietary supplement users know what a branded ingredient is and many appreciate the differentiation when they find one or more included in the formulation. It was clear many users do not seek out branded ingredients as the sole criteria for their purchase decision. Figure 1 below shows that many regular and sporadic users (as high as 40% of sporadic appreciate branded ingredients) appreciate and always look for branded ingredients. And while many don’t really care, some consumers always look for branded ingredients and others (interestingly more regular than sporadic) don’t know what they are, suggesting an education gap – or opportunity.

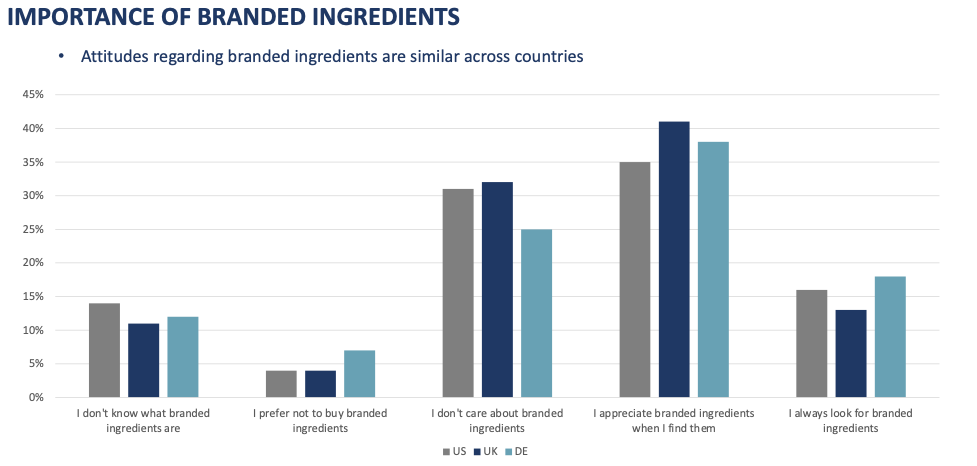

Figure 2 below shows a cross country comparison amongst all supplement users, regardless of frequency of use. The three countries are quite similar, with over half of the respondents surveyed indicated they either look for or appreciate finding branded ingredients.

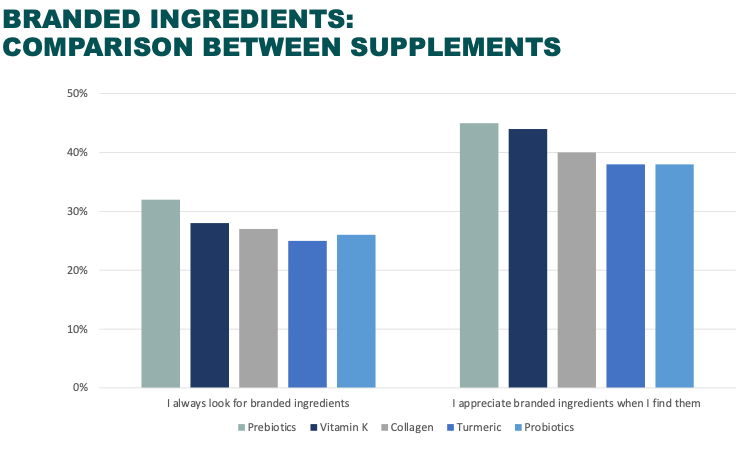

Figure 3 below illustrates an important, but not surprising fact when we look at the purchasing motivation for specific ingredient categories. Regular dietary supplement consumers of Prebiotics, Probiotics, Vitamin K, Collagen, and Turmeric, were asked “When deciding which supplements to purchase, how important is the inclusion of branded or proprietary ingredients?” The percentage of these consumers that state they were influenced by branded ingredients was near or above 70% across all of these five ingredient categories.

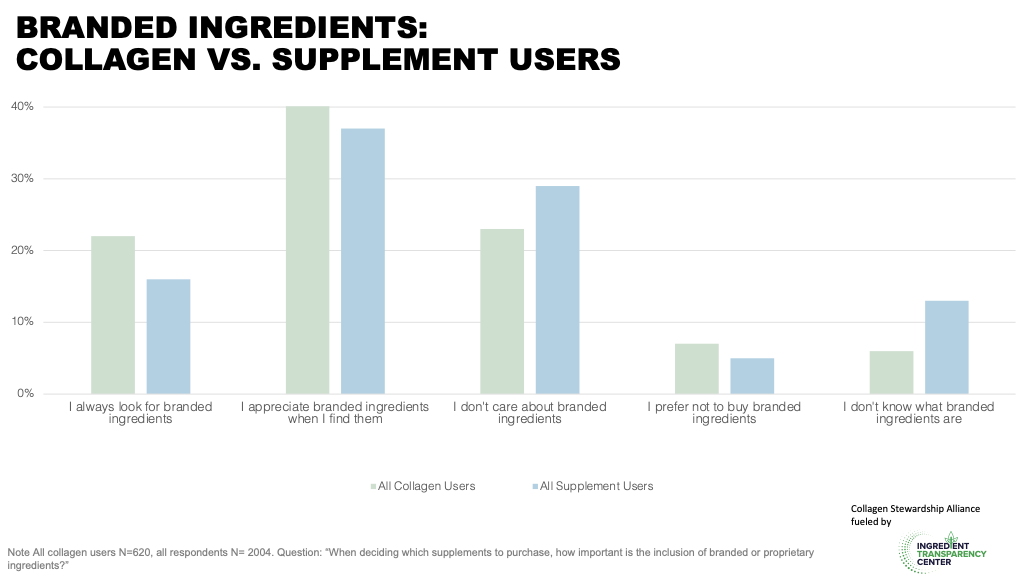

Figure 4 dives specifically into one of the survey’s feature categories, collagen, a really ‘hot’ ingredient category and compares the importance of branded ingredients in this category versus the rest. Consistently collagen users were even more likely to be positively influenced by the presence of branded ingredients.

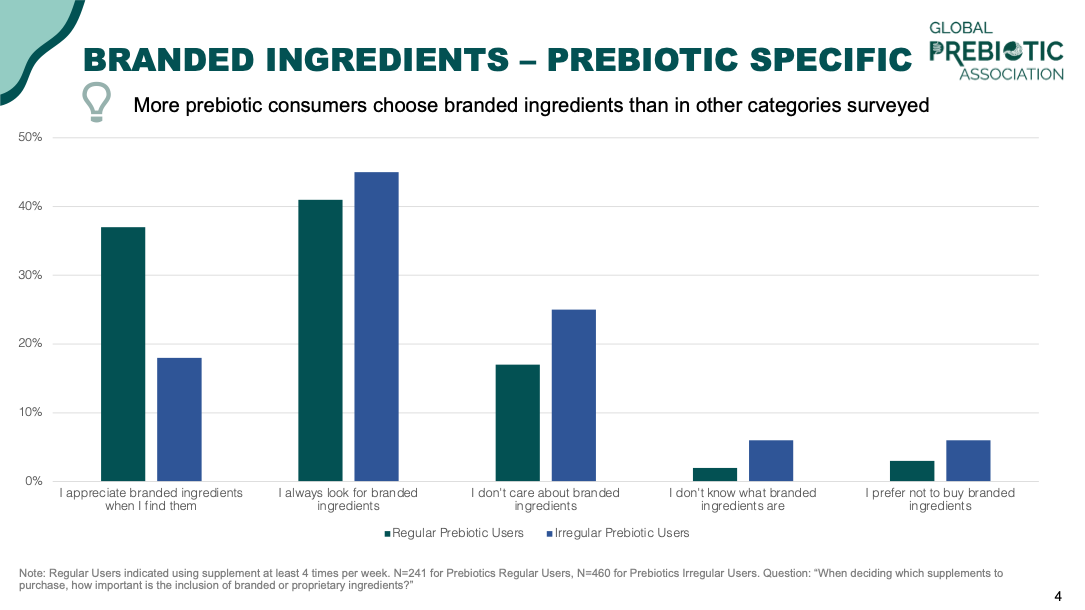

Similarly, Figure 5 shows the importance of branded ingredients, with another emerging category where science is building almost daily, this time with prebiotics. Here, the results index higher than the general supplement users, and regular prebiotic users especially appreciate or always look for these ingredients (almost 80%), and even less frequent users are strongly impacted (over 60%). Clearly prebiotic consumers care.

Trust is the cornerstone of dietary supplements. Trust is the glue that binds this industry to its consumers. One of the strongest ingredients in proving and improving trust in dietary supplement is the branded ingredient. Consumers recognize the importance of branded ingredients and this needs to be a critical aspect of brand and retail communication with an increasingly curious and informed consumer base.