Amazon and supplements….

Amazon’s power over the supplement industry has become even more impactful as the rate at which the market giant is gobbling share is unprecedented and seems without constraint. The most recent report from Slice Intelligence indicates the vitamin and supplement category is outpacing other e-commerce categories. This same Slice report indicates U.S. vitamin and supplement ecommerce sales grew 40% in 2016 and at a 12% faster rate than the general ecommerce market.

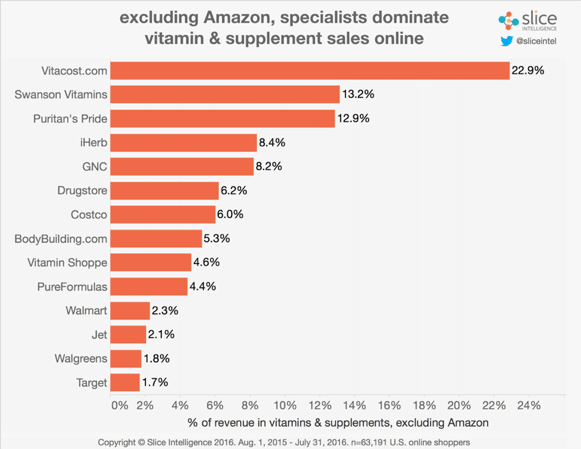

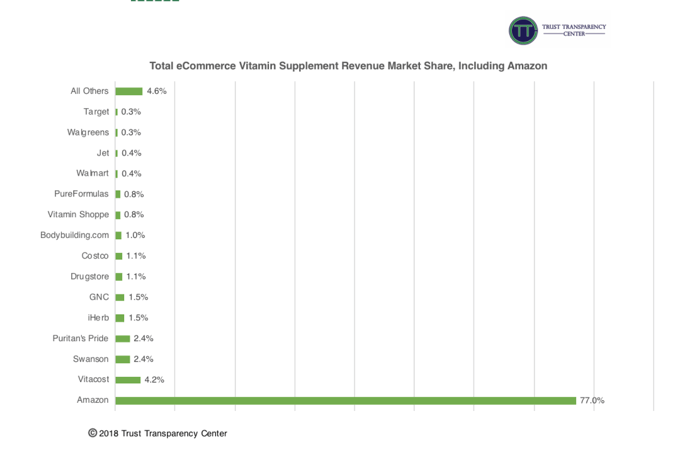

According to a 2017 Slice Intelligence survey of U.S. shoppers, Amazon accounts for 77% of all U.S. vitamin and supplement sales made online. The remainder of the vitamin and supplement ecommerce sales are almost entirely divided by vitamin and supplement specialized sellers such as VitaCost, Swanson, Puritan’s Pride and iHerb.

The two largest brick and mortar vitamin and supplement retailers, GNC and Vitamin Shoppe, combined receive approximately 2.3% of the total ecommerce market in their category, further underscoring the emergence and impact of the Amazon effect.

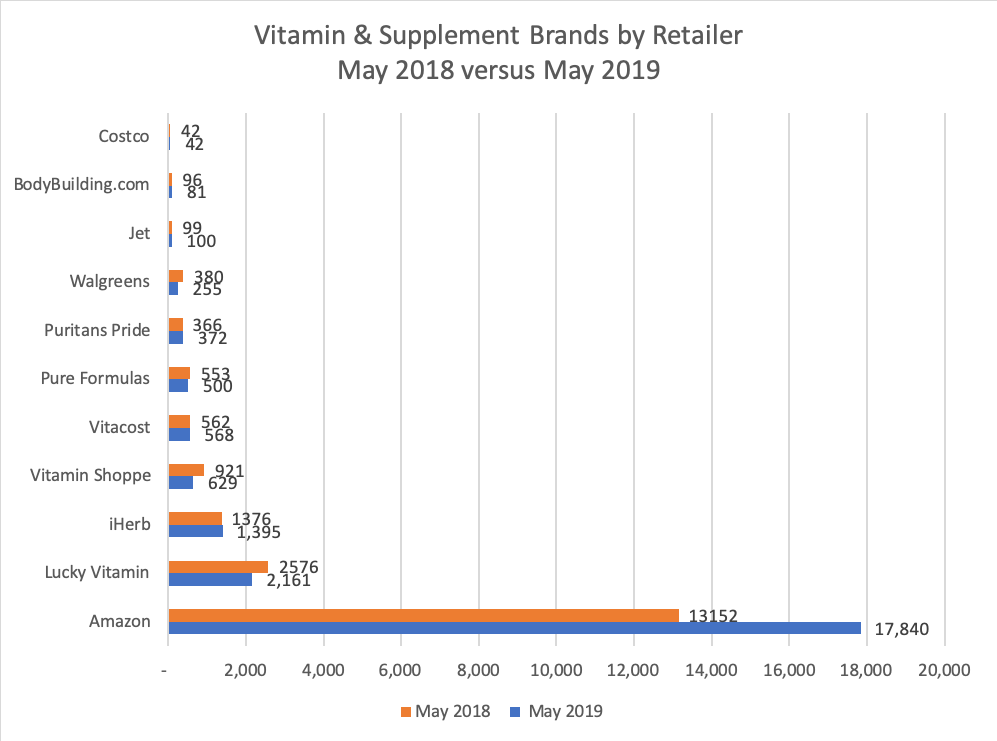

Another aspect of the Amazon effect is the product offering the providers carry. The more involved the platform vetting process, logically, the fewer brands are offered. Amazon is the demonstrated leader in the market offerings with over 17,500. The range of brands being carried among other retail e-commerce platforms that promote multiple vitamin/supplement brands is 42 to 2,161.

Most ecommerce retailers either are continuing to offer relatively the same number of brands (between 2018 and 2019) or have deleted some brands. The reason for the deletions of brands by both retailers and brand holders would presumably be due to low volume of sales and insufficient profit. But it may be that they’re scrutinizing their product offerings more closely during the vetting process.

Trust Transparency Center contacted Amazon to find out what it takes to sell a dietary supplement product on the site. Amazon directed us to a terms and conditions page specifying the five requirements to sell dietary supplements on Amazon: Amazon Seller Central Dietary Supplements

These are:

- Name of the dietary supplement

- The net quantity or amount of the dietary supplement

- Nutrition labeling

- The ingredient list

- The name and place of business of the manufacturer, packer, or distributor

“According to our Terms & Conditions, which are valid for all third-party sellers selling on Amazon, it is not allowed to offer products that are violating legal provisions. If we get notified about specific products, we will immediately review and, if confirmed, remove items as well as approach our sellers to secure compliance with our T&Cs.”

Included on the Terms and Conditions included on the Seller Central Page is a listing of 23 prohibited listing categories and a list of banned products and ingredients numbering 1,391. Product names on the list include a ‘hall of shame’ of FDA blocked ingredients and products including Ephedra, steroids and Sibutramine. One curious note on the “prohibited” products listing was the inclusion of a handful of Walmart Spring Valley and Walgreens products including Echinacea, St. John’s Wort, Garlic, Gingko Biloba and Saw Palmetto. All of the Walmart Spring Valley and Walgreens banned ingredients are sold by other brands including Nature’s Bounty, the manufacturer of Walmart Spring Valley products.

It is clear Amazon has some vetting criteria, but it is inconsistent and completely reactive to some undefined impetus from the marketplace. A responsible vetting process would be both proactive and well defined as was written about inthis columnon April 11.

The Amazon dietary supplement space has many freewheelers that may put the industry at risk and there’s a strong need for FDA and FTC to step up their regulation efforts on that front. In the meantime, natural retailers can rise above and protect the industry by incorporating the Four Cs:

- Convenience – What Amazon has provided first and foremost is convenience. Learn from Amazon. Implement a call ahead or online purchase opportunity. If affordable, offer same or next day delivery of an item.

- Community – It has become apparent that the Achilles heel of Amazon is the lack of community. Seek to engage the customer both pre and post-sale in events at your store. Amazon can only make the buying experience easy. Natural retailers have the opportunity to make the buying experience easy plus enjoyable, meaningful and eventful. Include a handwritten thank you, support local events, befriend your store visitors.

- Curation – the sheer number of products on Amazon can be daunting to many. Amazon is primarily a search engine for products the customer knows. Highlight the fact that you offer new ideas and products by vetted suppliers and that your team can educate the consumer and answer their questions.

- Customer Service – You have people that can look at a customer and say, “How can I help you?” and “Thank you!” Amazon never stops trying to please the customer and you can’t either. The sale doesn’t stop after the purchase is made when customer service is in full implementation.

Note: The views and opinions expressed here are those of the author(s) and contributor(s) and do not necessarily reflect those of the publisher and editors of WholeFoods Magazine.