As sales increase, especially with new consumers entering the market, values-based shopping takes on a whole new importance. It’s been evident for some time that legacy brands benefit from consumer trust; their story is generally well-known and many have a reputation for high, consistent quality. Increasingly, the value of transparency is a key decision factor. It is an opportunity for brands to differentiate themselves, and provides an opportunity for in-store education and customer engagement—if done well.

In a recent survey among supplement consumers conducted by Trust Transparency Center’s ITC Insights, 67% of respondents said transparency influences their purchase decision. And, an FMI-The Food Industry Association and Label Insights survey found that when grocery shopping in-store or online, 81% of consumers consider transparency important or extremely important. In addition, Pure Branding reported in it’s The ROI of Transparency: A Consumer Market Research Study that one in five of U.S. consumers make a transparent vitamin and supplement brand their first choice.

But what does transparency really mean?

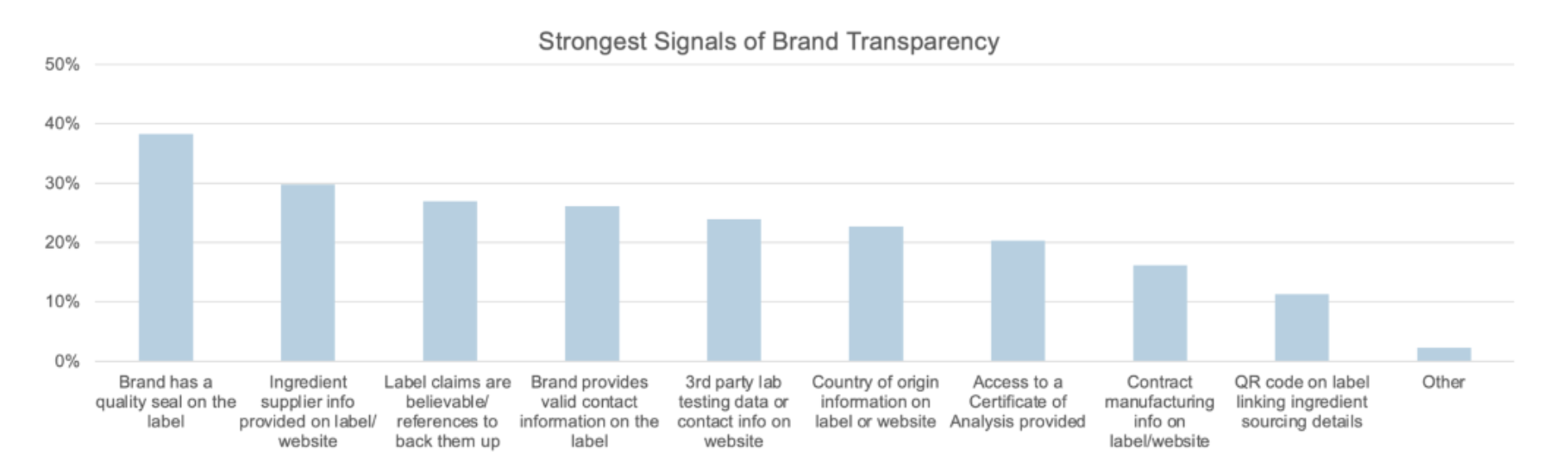

The standard definition fully defines what transparency looks like, especially as it relates to a supplement consumer. It’s one of those ambiguous, often "green-washed" terms that everyone yammers about, but no one can really pin down. With that in mind, Trust Transparency Center looked very specifically at nine transparency signals in its ITC Insights 2020 Supplement Consumer Report. These areas, focusing on "brand" signals of transparency, involved label information, quality seals, contact information, supplier information, 3rd-party testing information, country of origin, and the use of and information contained in QR codes.

The top 5 transparency signals TTC discovered were:

- The brand has a quality seal on the label—38%

- Ingredient supplier information was provided on label/website—30%

- Label claims were believable/references to back them up—27%

- The brand provides valid contact information on the label—26%

- 3rd-party lab testing data or lab contact information on its website—24%

Natural product retailers are natural gatekeepers because they’re in a key position to vet the brands they carry. All of the transparency signals in this survey are areas retailers can demand information on from the brands they carry.

- Quality Check: When evaluating product offerings, look at labels to see if there’s a quality seal and if there is one that’s meaningful. Quality seals can be difficult for some brands because there’s often a fee involved, so if there’s no seal, check if there’s information about the brand’s quality process available.

- Contact Information: What contact information is on the label? Is it valid? When evaluating a new brand to bring in store, take time to try the contact info on the label to make sure it works. Ask your brands for the contact information for their suppliers if it’s not readily available, as consumers want to know where and how their products are made.

- Believability: Dietary supplements are regulated by FDA under the Dietary Supplement Health & Education Act and label claim guidelines are clear. If the label claims sound too good to be true, they probably are.

- Testing: Ask about the brand’s testing methods. Does it use third-party and/or validated testing methods? This will become even more important with Amazon’s new requirements that a certificate of analysis and validated testing methods be provided to list a product on the site.