It would be wrong to classify all people into the same generational mindset based on just their age. For instance, some boomers think and behave more like millennials, while fewer Gen Zs behave like Gen X. We don’t intend to stereotype, but there are some matters involving health, habits and life goals that are worth remembering as you prepare marketing and merchandising plans.

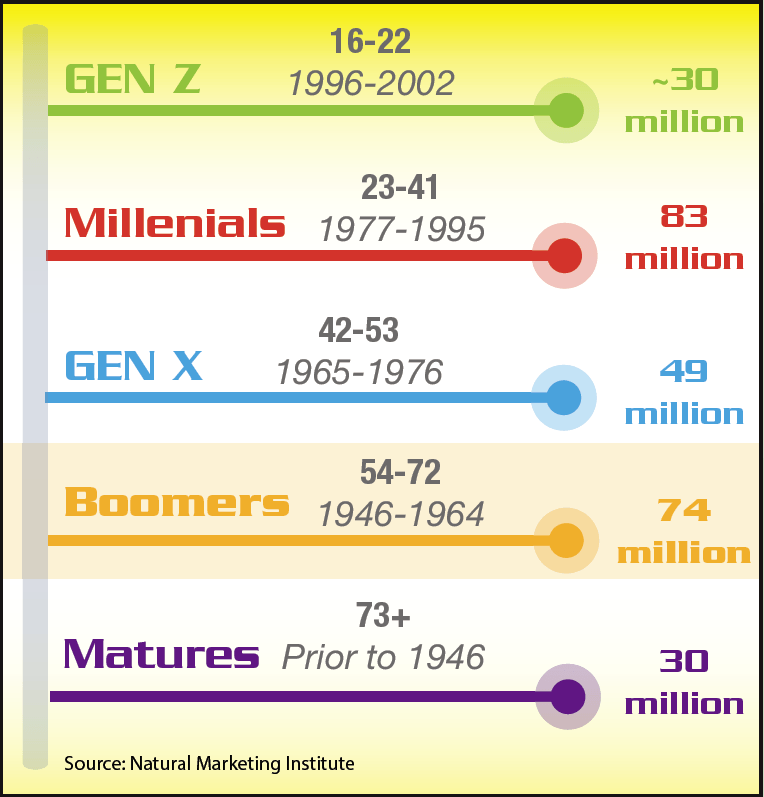

Several different definitions exist of boomers, Gen X, millennials and Gen Z. For our purposes, we chose the birthdate ranges used by the Natural Marketing Institute (NMI). (See figure 1.)

This month we kick things off with the boomers and a sidebar on their elders, which we’ll call the matures. In July we’ll address Gen X. In August, it’s the millennials and September brings us into Gen Z.

While most of the recent focus — some would say obsession — has been on the millennials because of their size and proclivity toward healthy eating and organics, Baby Boomers are the ones with the spending power. Having watched their parents (the segment we’re calling the matures) go down the rabbit hole of prescription medicines and the aftereffects, boomers are eager to avoid the same fate by heading off diseases like diabetes and hypertension while on a quest for a long life.

Boomers are also starting businesses at an unprecedented rate and view retirement in a very different way than the previous generation.

Americans age 55 and older account for 47% — or nearly half of consumer spending — and that’s up 2% year-over-year, says boomer Robert Passikoff, president of Brand Keys, a research firm based in New York. Meanwhile, millennials account for 11% of spending, which is actually down 3% year-over-year.

“Boomers are more self-centered and optimistic,” adds Passikoff. “They are the first generation to live a life-after-children lifestyle, so they are looking to increase their longevity.”

“Companies need to recognize that not all boomers are alike, just as not all millennials are alike, despite marketers continually putting categories into buckets,” says Chuck Martin, boomer, futurist and author of the just-released “Digital Transformation 3.0.”

“Many boomers also are accomplished and now have more disposable income,” Martin says. “This means marketing can involve new things for boomers to try out. Nothing ventured, nothing gained. A product launch or a product test could originate with boomers, which is counter to many market approaches.”

“There are so many supplement brands in particular that are addressing the health concerns of boomers. The challenge, I believe, is to walk that fine line between addressing health needs as we age and the reluctance of many to believe we are getting older,” says Diane Ray, VP, Strategic Innovation, NMI.

NMI uses five segments to define the universe of consumers. Here’s where boomers fall into the designations: • 27% Magic Bullets (Looking for quick, easy solutions and more likely to take supplements) • 20% Eat, Drink and Be Merrys (Least health active and have little motivation) • 19% Well Beings (Most health pro-active, and healthy eating is a priority) • 18% Food Actives (Mainstream healthy, and dedicated to self-directed balance) • 15% Fence Sitters (Healthy ‘wannabes’ and health strivers)

DaRon Gillian, CSO of LifeSeasons, based in Lewisville, TX, is a Gen X manager of a sales team that ranges in age from 25 to 57. He is 48 and his parents are 20 years older. “I see my parents every Sunday and we talk about this stuff. I have parents who are like young 60-year-old people — out hiking and on the boat. They have friends who are not in very good health at all who are approaching the time where they’re thinking about moving into an assisted living facility.”

This gap extends to digital literacy as well. “My parents understand the digital world and we’re finding because of social media, they’re getting marketed to as if they’re Generation X, my age. Then they have other friends who don’t even know what a smartphone is.” When speaking to retailers, he advises his salesteam to become “chameleon” and customize a pitch — speaking one way to a 62-year-old retired woman who now runs a health food store and another way to a 22-year-old with sleeve tattoos.

Meet the Boomers

Kevin Richardson is a 60-year-old artist, educator, communication designer and strategist currently working with the Himalayan Institute in Honesdale, PA, and the Green Party of Pennsylvania.

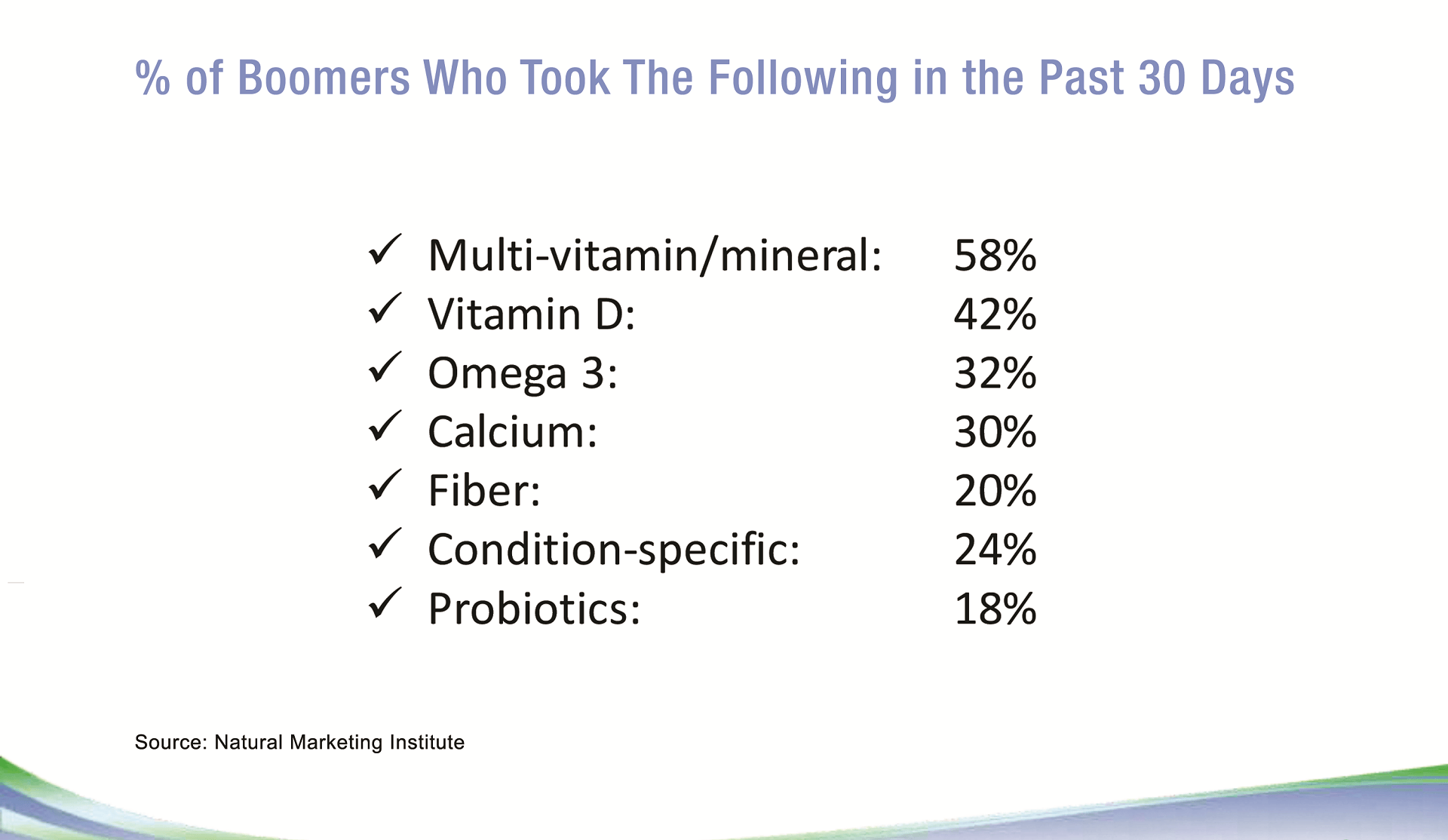

A vegetarian, he tries to eat organic produce and products as much as is possible and affordable. He takes saw palmetto for his prostate and magnesium for stress-relief and regularity. He shops at the neighborhood health food store Nature’s Grace and at P&R Discount in a neighboring town for all the food and supplements beyond the basic daily needs. Recently recovering in record time from a knee surgery, Richardson credits his diet, daily wellness routine of yoga, meditation and the support of a like-minded spouse who studies, teaches and writes on health and wellness.

Chuck Martin won’t give his age but is shy of 70. This futurist is a prolific author and digital

pioneer. His latest book is “Digital Transformation 3.0.” There he is trying out virtual reality at the Consumer Electronics Show.

His prescription for vitality is one vitamin pill in the morning and one+ hour on the treadmill every Monday, Wednesday and Friday. Martin wears a Fitbit to monitor his activity and alternates between standup and sitdown at his home office desk.

Retired art teacher Valerie Dearing turns 66 in July. She’s an avid yoga instructor, kayaker, and practicing artist, still offering classes for children. She runs retreats in Costa Rica that feature zip-lining and hiking and lives in a multigenerational co-housing community in Bristol, VT., where she helps tend the community garden.

Dearing’s also an informed supplement buyer and takes fish oil, coQ10, magnesium, vitamin D, herbs for bone health, herbs for immune support. “I have not been sick all winter!” she says. She orders high quality coQ10 and magnesium online from heart specialist Dr. Sinatra. The herbs are mostly locally grown and custom made by her herbalist in Vermont – a blend of astralagus, ashwagandha, reishi, St. John’s Wort, hawthorn, kudzu, tulsi, drynaria and licorice.

She drinks a daily tea brewed from oatstraw, shavegrass, nettle leaf and alfalfa leaf for bone health. She buys her fish oil and vitamin D at the Middlebury Natural Foods Co-Op for their quality. She also gets her digestive bitters there, which are made in Burlington.

Sound designer and voiceover coach Roy “Uncle Roy” Yokelson is 64. He likes to cook and eat. He’s ditched the sweets in the house in favor of fruit, but it’s hard to abandon the bagels he loves.

“Besides my meds for type 2 diabetes, hypothyroidism, prostate health, and 1/2 Ambien at night for sleep, I take high potency B, B-12, D3, fish oil, and magnesium/calcium/potassium. I buy mostly from CVS, Shoprite, and Amazon for the convenience and prices. Every once in a while I’ll wander into a healthier store. I do like Whole Foods’ variety and quality.”

If they’re available, he occasionally uses Co-Q10, biotin, CuraMed or turmeric, glucosamine chondroitin MSM and Epicor. He’s tried CBD on a subscription plan, but said it didn’t do much for him.Weight management, cardiovascular health and digestive health are of particular importance to boomers, says Jeff Hilton, co-founder and partner of Brand Hive, adding they tend to think of themselves as being 10 years younger than they actually are. Yes, he is also a boomer. “Boomers actually are pretty open,” says Gillian, who operated a health food store before joining the supplement industry 14 years ago. “The generation (of customers) that’s older than the boomers are more reserved. You have to build a relationship with them first. It takes the second or third time they come in. Then they open up. Then you’ve sold them for life.”

Personal Touch In an Impersonal World “Small retailers should be aware that their advantage is that they are small and can be more intimate with their customers. Rather than marketing sales or deals, they should look at targeting shoppers with specific products they know their customers would be interested in, not by statistics, but because of personal knowledge,” says Martin. “Small retailers should leverage the personal touch. As more tech explodes around them, consumers will be even more welcoming of a personal touch, not because of big data analytics but because of person-to-person contact.” (For more on this, see Jay Jacobowitz’ Tip of the Month on page 12.)

In terms of merchandising your store by age, Gillian thinks it can be helpful, but only if it’s done inside a condition set allowing customers to zero in on their needs.

“Masculini-T is our #1 selling product,” he says. “It’s a testosterone product. If you look on the shelf, there’s a lot of them. The majority use red labeling and words like ‘maximum sexual performance.’ We take a more conservative approach and call out the herbs that are the top five ingredients. We’ve done very well in that sector with the more conservative gentleman who doesn’t want to talk about it or pick up a red light bottle flashing sex.”

Gender neutral big sellers among boomers include Choles-T, B/P Stabili-T, and Glucose Stabili-T, Gillian says. “They’ve been to their doctor. They’ve been told, ‘It’s time for you to get on a statin drug, your points are high, let’s get this under control.’ A lot of these boomers are looking at their parents, the matures, and say, ‘I don’t want to be like that.’

“They’ve seen the cycle happen with their parents. They got on a prescription. Once that starts happening it’s a downward spiral,” he adds.

Matures Are Your Customers, Too

Matures share many of the same concerns of the boomers that follow them. But they are the generation brought up to believe everything a doctor says is sacrosanct and to follow instructions to the letter, which means they are most likely on medication.

Still, 88% of matures, in research conducted by NMI, said they take supplements and heavy users grew 9 percentage points from 30% in 2006 to 39% in 2015. Their motivation is a better quality of life.

Matures share many of the same concerns of the boomers that follow them. But they are the generation brought up to believe everything a doctor says is sacrosanct and to follow instructions to the letter, which means they are most likely on medication.

Still, 88% of matures, in research conducted by NMI, said they take supplements and heavy users grew 9 percentage points from 30% in 2006 to 39% in 2015. Their motivation is a better quality of life.At age 75, Bob Woodward is taking a statin. The legendary Washington Post reporter delivered a keynote address at the Council for Responsible Nutrition’s Ascend conference last fall in Tucson, AZ. In a sidebar conversation, Woodward told WholeFoods Magazine he complements that with CoQ10, fish oil, a joint supplement and probiotic. He follows the word of his pharmacist and also exercises with a personal trainer.

A greater percentage of Matures fall into the NMI-defined categories of well-beings, food actives and magic bullets. Some 10% are fence sitters vs. 15% of boomers and 14% are eat, drink and be merrys, compared to 20% of boomers.

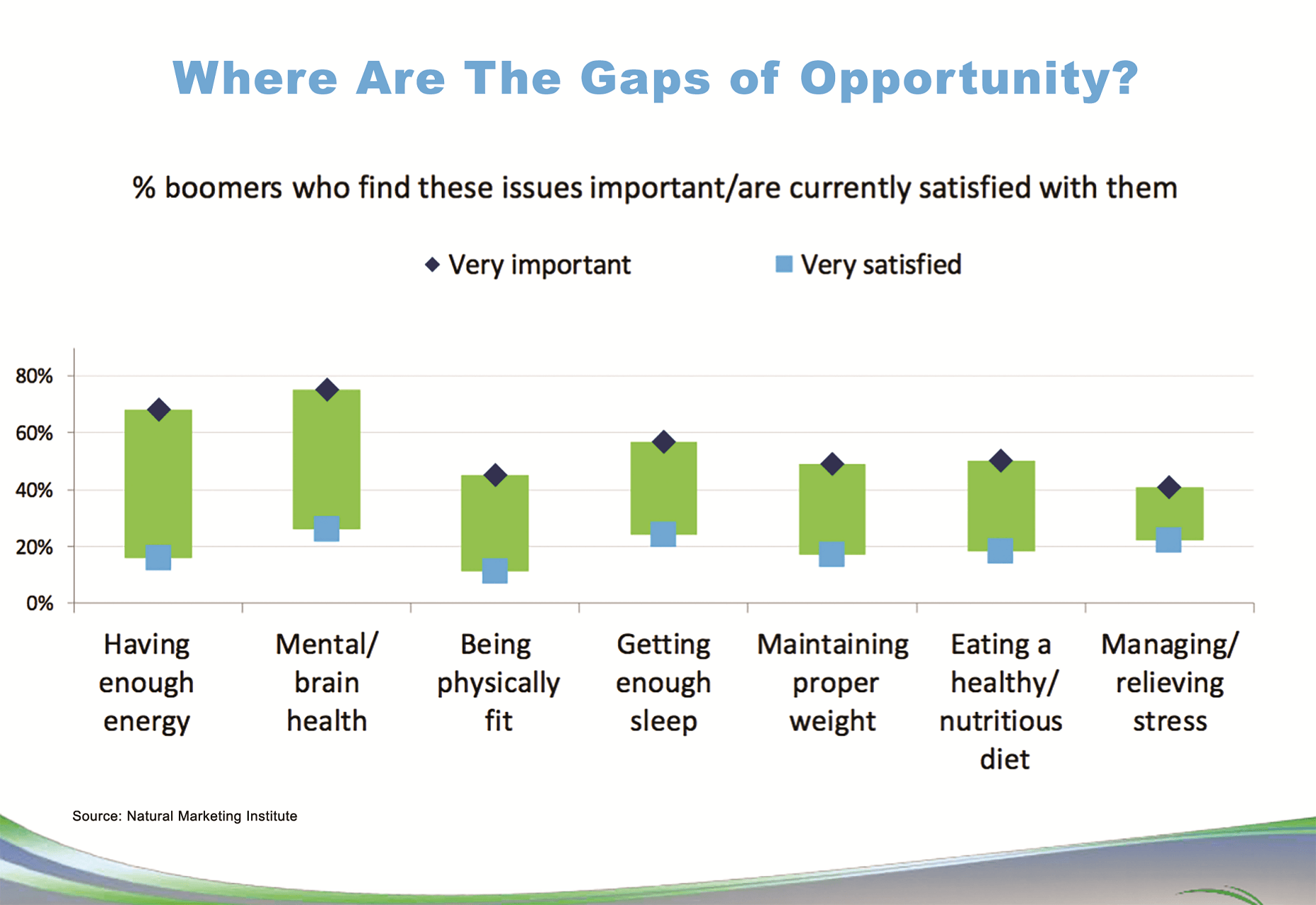

Arthritis/joint health enters in as a bigger concern for this age group. Boomers are more likely to purchase supplements for their mature parents than for their adult children.The older they get, the further in the distance boomers see old age beginning, according to NMI research, but they do still have fears of aging, and plenty of gaps of opportunity exist between what they consider important and how satisfied they are with their current status. (See figure 2).

Boomers ranked their biggest fears of aging as: • Losing mental/brain capacity • Being a burden on family/loved ones • Restricted mobility • Heart attack/stroke • Death of spouse • Cancer • Lack of energy/fatigue

Boomers are often the caretakers for other members of their family and have the wherewithal to buy for others and influence other generations.

“Boomers are buying for themselves,” Gillian says, “and they’re being much more pro-active than their parents were. They are buying for their parents as well.”

“One of my grandmothers would say to me, ‘OK. I’ll take this for you.’ Another one wouldn’t take anything, she’d run and tell the doctor. I don’t see boomers buying for their adult children. They might send them an article and say, ‘You’ve got to pick this up.’ ”

Still Experimenting After All These Years In many respects, this generation that came of age in the ‘60s and ’70s remains the most experimental, and that includes in their use of technology.

“With the wave of new technologies over the last decade or so, including the internet, mobile and now The Internet of Things, a large portion of the population has become more adept at using tech,” says Martin.

“At the beginning of the Net, some older people had some challenges in adapting, but more recent technologies have basically made it easier, he continues. For example, studies have shown that U.S. consumers over 50 are frequent users of voice assistants. The technology of devices like Amazon Echo and google Home are easy to install and easy to use by anyone at any age. The TV marketing for Amazon may have targeted millennials, but it reached and resonated with boomers. Saying something is easier than typing it.”But ecommerce may still be for the outliers.

“At the end of the day,” says Gillian, “boomers read it, they see it and then they want to go and have an interaction with a person. A human being. The older the generation, the more I see them wanting to have a connection and go to that retailer — talk to someone they’ve established a relationship with.”

Still, not everyone is comfortable initiating a conversation when they feel like they don’t know what they’re talking about. Kevin Richardson, a natural food store shopper in Honesdale, PA, suggests bountiful use of shelf-talkers and educational material to guide customers who aren’t yet ready to ask a direct question of a salesperson. WF

Sponsored by:

Published in WholeFoods Magazine June 2018