With that as a backdrop, we utilized data fromWholeFoods Magazine 2022 Annual Retailer Surveyto examine how natural products retailers evaluated trust on the part of their brand partners, and to compare these findings with insights gleaned from the ITC (Ingredient Transparency Center) 2021 Supplement Consumer research program. It turns out that what trust truly means differs significantly, and these two views need to be reconciled if we are to understand how trust impacts our markets and our future.

We know that natural products consumers are discerning and rely on their retailers to provide them with products they believe in—both a burden and an opportunity. This trust that consumers place should ideally be at least mostly aligned with characteristics that retailers themselves look for in the brands they support. Presumably too, consumers and retailers should mostly align on what constitutes quality. Just how well are we doing in this alignment?

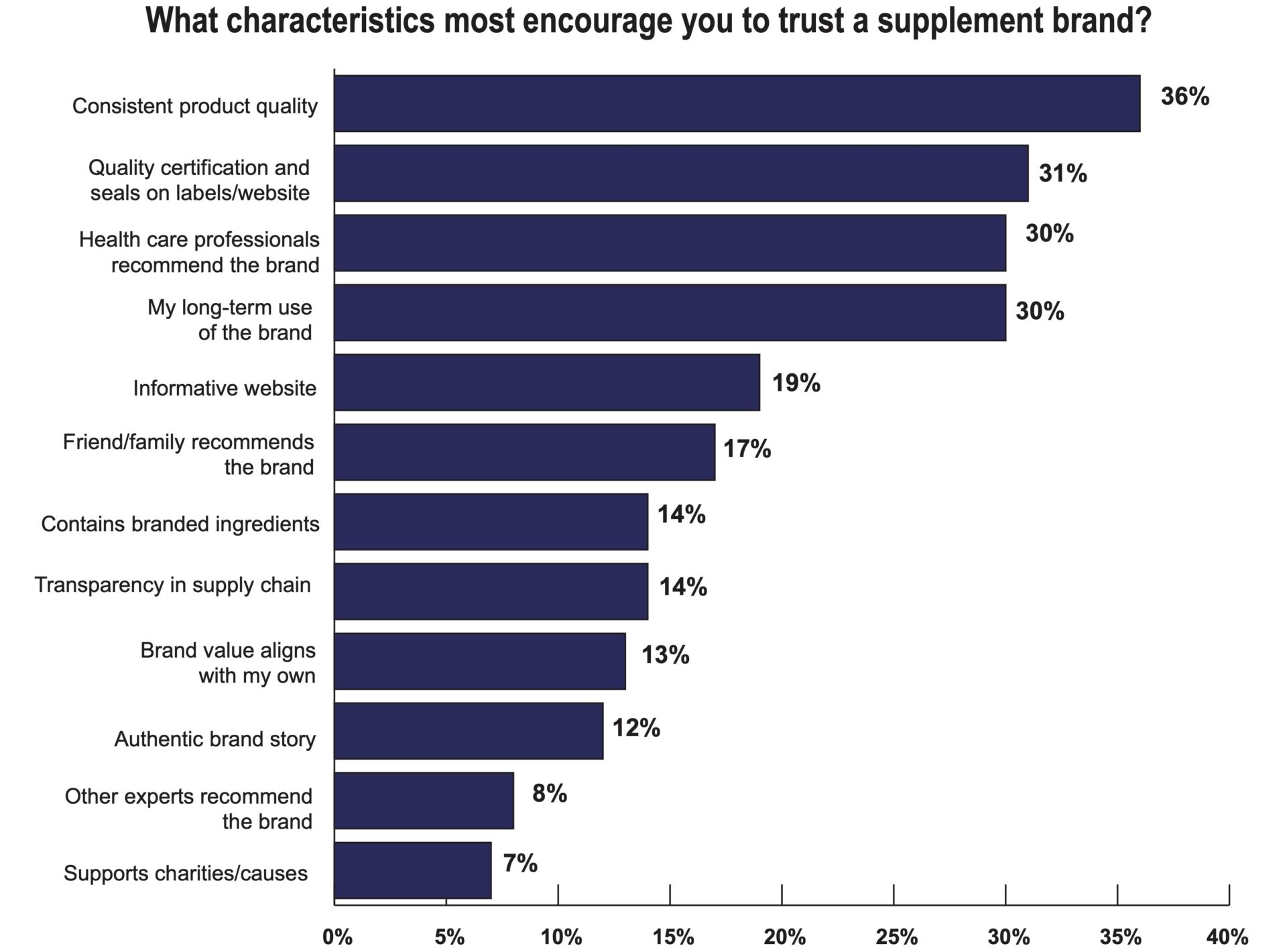

The ITC Insights 2021 Consumer Supplement User Survey found that consistent product quality (36%) ranked top for building trust, and that these consumers are also influenced by 3rdparty validation, whether it be through quality certifications and seals (31%) or through a health care professional’s recommendation (30%). Personal long-term use of the brand (30%) also ranks high with consumers. (See Figure 1.)

Comparing these results to retail trust characteristics is informative.

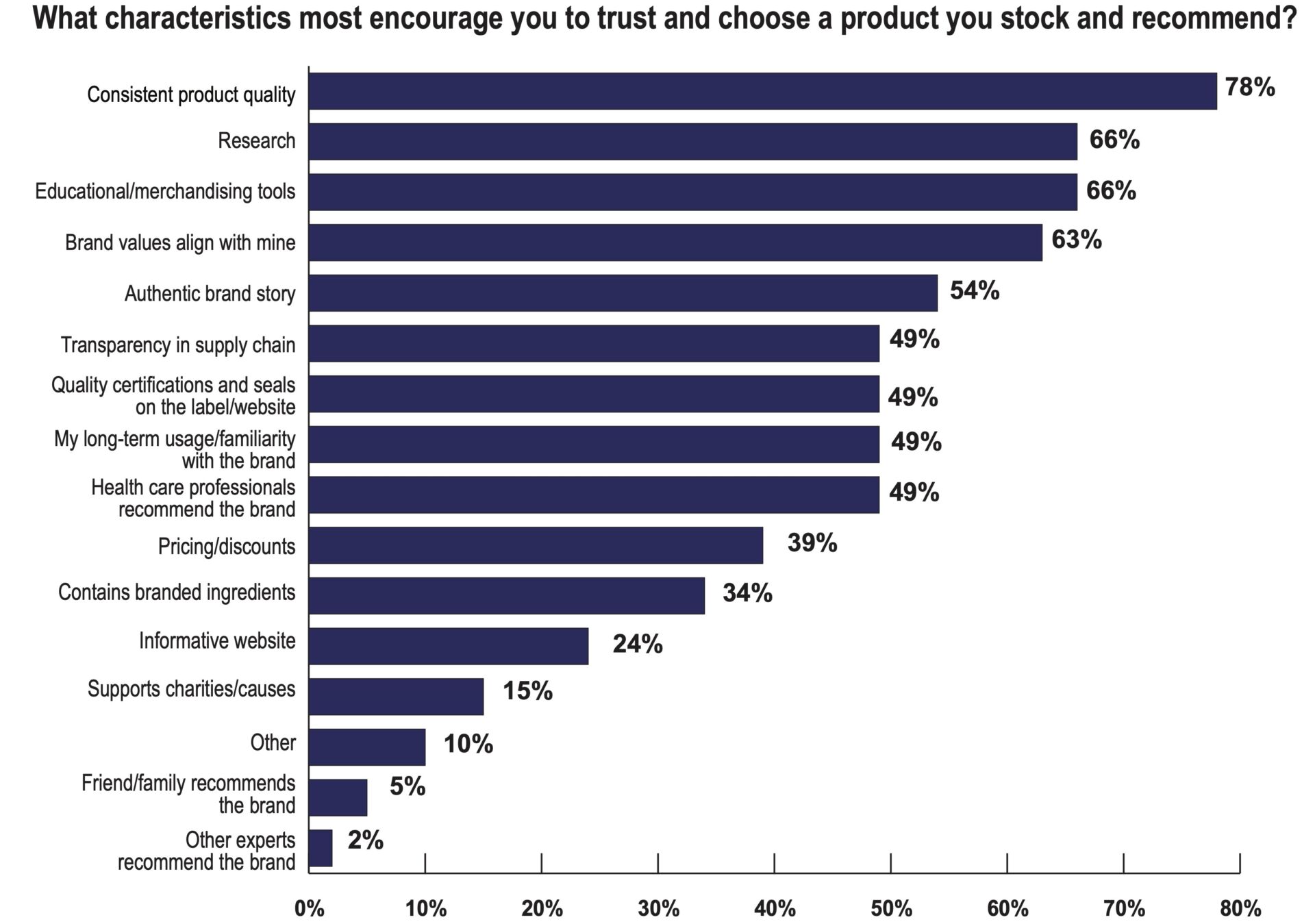

InWholeFoodsMagazine’s retailer survey, independents were asked “What characteristics most encourage you to trust and choose a product you stock and recommend?” Consistent product quality came in at 78%, followed by research (66%), and education/merchandising tools (66%). Retailers showed their independence as qualified influencers by ranking outside recommendations at the bottom of the list. (See Figure 2.)

We can see similarities and that overall, there is general alignment. While quality should be a given, often it is not, and so it’s gratifying to see it at the top of both lists. Consumers look to certifications and seals; retailers put less stock, relatively, in those. Brand values and story, on the other hand, rank consistently higher for retailers than they appear to do for consumers—again relatively.

The presence of branded ingredients ranked in the middle for both stakeholder groups, but it is important to keep in mind that many of the other characteristics instilling trust are usually core strengths for branded ingredients, a critical point for retailers to keep in mind. And, while the consumer data was specific to consumer supplement users, their responses generally carry over into functional foods and beverages as well.

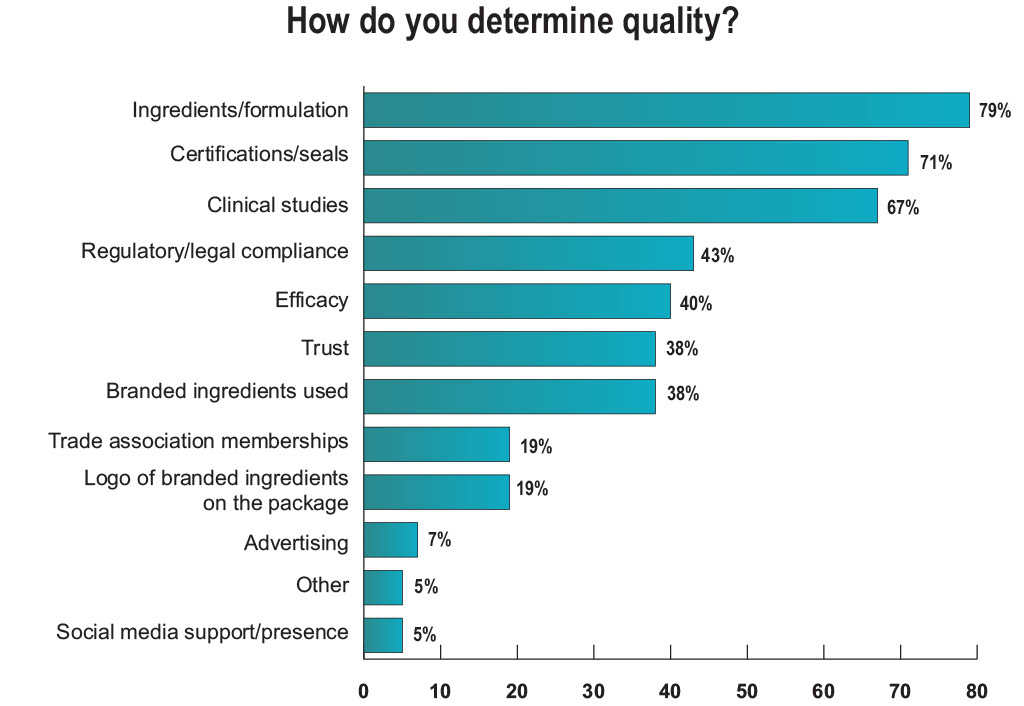

TheWholeFoodsMagazine Retailer Survey also explored retailer feelings about quality and how they determine it. Nearly 80% of retailers responded that ingredients/formulation best represented quality followed by certifications/seals (71%) and clinical studies (67%). Regulatory compliance, efficacy and trust were also important, while advertising and social media play a minimal role when it comes to retailer quality perceptions. (See Figure 3.)

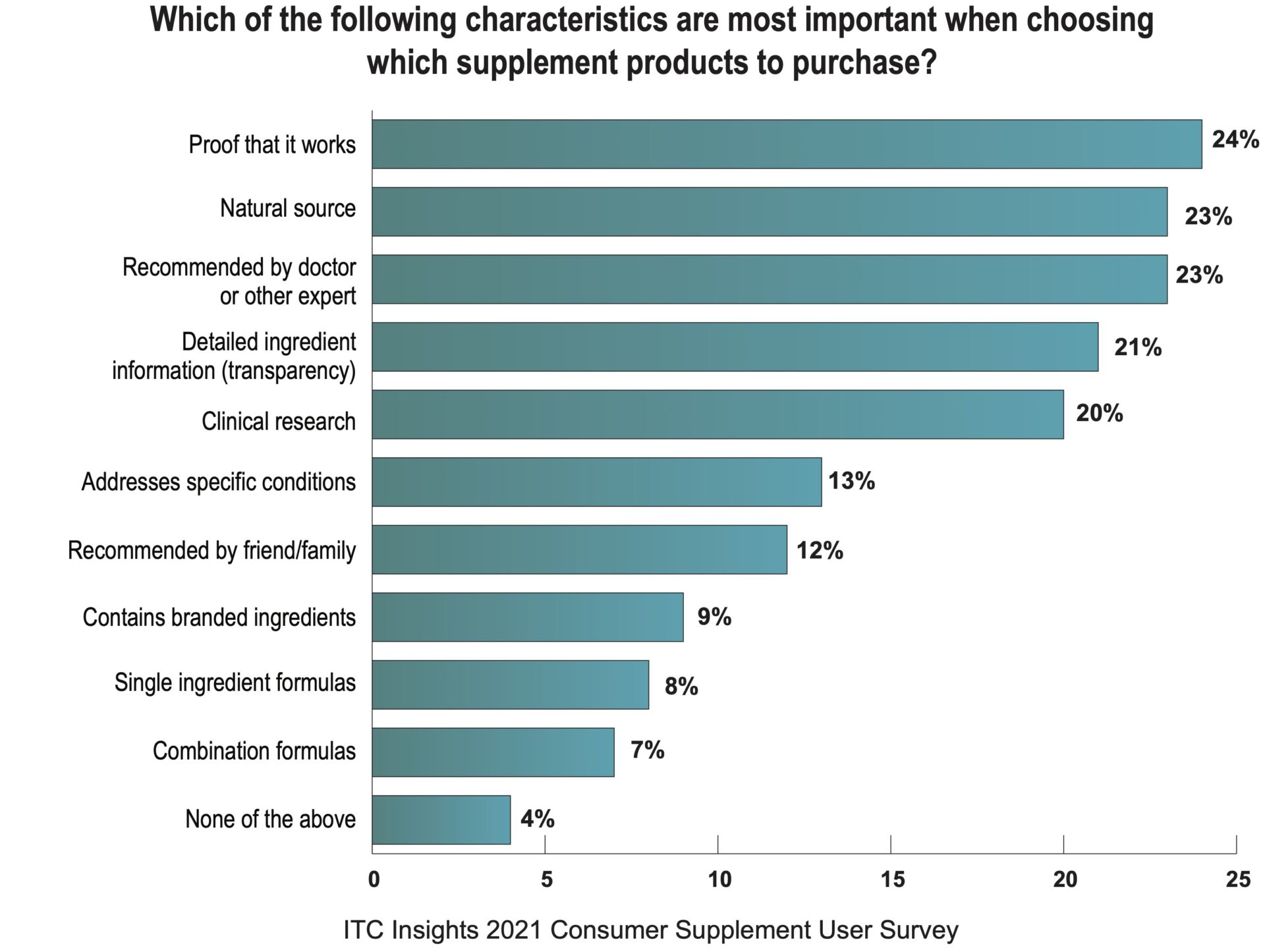

The ITC Supplement Consumer Insights survey did not ask about quality directly. Instead, it asked about characteristics influencing purchase.

For consumers, proof that it works (24%) is most important followed closely by a recommendation from a doctor or other expert and natural source (both at 23% of supplement consumers) while detailed ingredient information (transparency) came in at 21%. (See Figure 4.)

For experiential or measurable supplements (omega-3s, vitamin D) proof that it works can be formal and physical. Expert and authoritative recommendations are the strength of the natural retailer, and many of the other important consumer purchase characteristics are ones that natural retailers can highlight on shelf and with the products they offer there. Consumers are also looking for clinical research (20%) just like retailers so that is something retailers should insist upon for the brands they carry. (See Figure 4.)

The Transparency Imperative

One retailer noted in response to theWholeFoods Magazine 2022 Annual Retailer Survey:“Authenticity and transparency are imperative when maintaining a client/patient relationship. Knowing the products on my shelves and spending time with individuals to determine what is best for them creates a relationship of trust.” While this retailer referred to client/patient, this applies to any customer relationship as well, and it’s no longer a “nice to have,” but an imperative to have if you want to be a successful long-term player in the industry. Brands should really consider stepping up their education and support, and natural products retailers should demand it.WF