The most immediate negative impact of the pandemic to the supplement industry became the impact at retail. With consumer fear and lockdowns becoming the new normal, the brick and mortar retailers suffered first. Prosper Insights and Analytics surveyed 7,762 U.S. consumers from June 1 through June 9, 2020:

- When asked if they felt the COVID-19 crisis would impact the economy, 77% said yes. This result was an improvement from previous surveys in May and April that indicated a concern of 84% and 86% of respondents, respectively.

- 37% of adults surveyed expressed confidence in the economy in June 2020 versus a 52% confidence rating in June 2019.

- 64% of respondents said they were shopping less in brick and mortar stores.

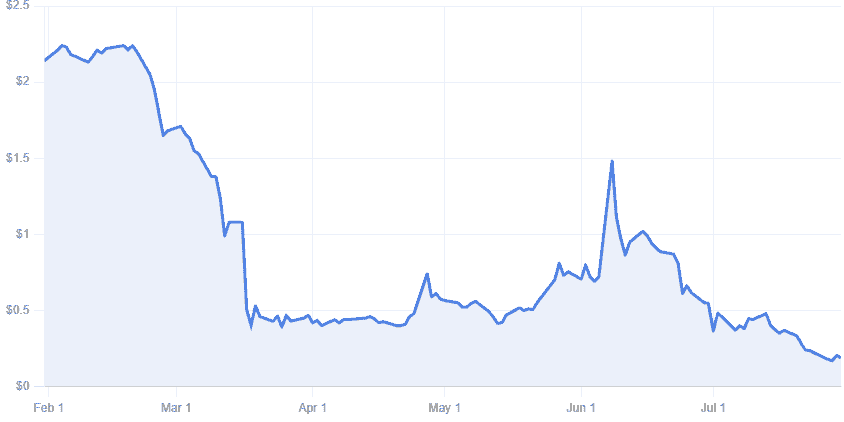

GNC, once the highest grossing brick and mortar natural retailer, has been suffering for years without a pandemic. GNC was hit especially hard by the COVID-19 crisis. On the date of the 2/11 WFM article, GNC was trading at $2.17 per share. GNC subsequently filed bankruptcy and was delisted from the NYSE. It’s current trading is near $.20/share. Earth Fare, another retailer,declared bankruptcyin February and closed its 50 stores early on as the pandemic began. Earth Fare began emerging from bankruptcy andreopening some storesin June.

Bright news has emerged in the natural grocery space, most notably the news from Sprouts Farmers Marketas reportedon its most recent Earning Report Second Quarter Highlights:

- Net sales of $1.6 billion; a 16% increase from the same period in 2019

- Comparable store sales growth of 9.1% and two-year comparable store sales growth of 9.2%

- Net income of $67 million and adjusted net income of $70 million; compared to net income and adjusted net income of $35 million from the same period in 2019

- Diluted earnings per share of $0.57 and adjusted diluted earnings per share of $0.59; compared to $0.30 diluted and adjusted diluted earnings per share from the same period in 2019

Another immediate bright spot for the natural health retailers is the surge of attention to immune health supplements. Legacy brands of supplements are reporting significant increases in sales. NOW Foods reported record March sales primarily amongst immune health products. A “halo” effect has bumped some other categories such as cognitive and heart health categories as well.

Nutrition Business Journal (NBJ) hasreported a significant increase in e-commerce sales. While Amazon has experienced significant growth across most retail sectors, health supplements have experienced significant increases.

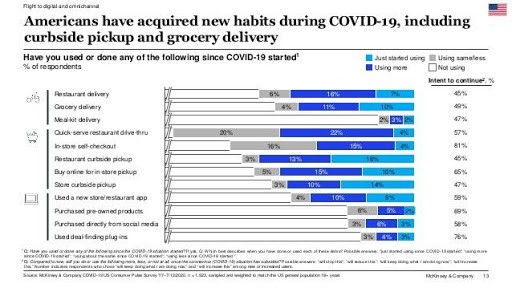

We are now months into the pandemic with no end in sight. We are, though, learning how to deal with this “new normal.” Retailers of all types have had to adapt to the rapidly changed, and changing, consumer environment. All business models are having to adapt and the one clear path emerging as most effective to this adaptation is omnichannel marketing, which can accommodate the consumer shopping experience no matter how they engage with the retailer. Two of the most effective tools to assist with the omnichannel transition are Buy Online/Pick up In Store (BOPIS) and Buy Online/Pick up At Curbside (BOPAC). Both require technology advancements to the website and retail infrastructure, but the reported ROI of the expenses indicate a positive return. A recent Total Retail survey of 2,000 US shoppers indicate:

- 68% of shoppers have tried a BOPIS/BOPAC sales experience with 50% indicating they made purchase decisions based upon where they could utilize BOPIS/BOPAC convenience.

This same survey indicates the expected maintaining of BOPIS/BOPAC shopping habits post COVID-19:

WholeFoods Magazine’s staff could not have imagined how right they were on Feb 11, 2020 when they called the upcoming pandemic’s effect on the Supplement Industry “Very, Very Serious.” While the pandemic is impactful, we will get through it just like we have in the past. The lessons we learn will likely affect us and our future for years to come. The lessons we learn at retail are necessary and important. We are evolving as a society and as a commerce and it is up to all of us to accommodate the necessary changes to benefit us all, together.

References:

- https://seekingalpha.com/pr/17950853-sprouts-farmers-market-inc-reports-second-quarter-2020-results-and-july-update

- https://www.supermarketnews.com/retail-financial/eight-earth-fare-stores-reopen-under-new-ownership

- http://f9e7d91e313f8622e557-24a29c251add4cb0f3d45e39c18c202f.r83.cf1.rackcdn.com/RTP_RT267_SR_BOPIS_June_2020_Final.pdf

- https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/survey-us-consumer-sentiment-during-the-coronavirus-crisis#