Amazon Whole Foods Steams Ahead In December 2018, Amazon closed out its first full year as owner of Whole Foods Market, growing U.S. store count by 39 units, to 476 from 437 in 2017. While the company no longer shares much specific sales data, we estimate Whole Foods added $1.77 billion between new stores and same-store-sales growth, to reach $17.8 billion in sales, or just over an 11% increase for 2018.

Supernatural Channel Leads Growth Whole Foods is part of what we classify as the supernatural channel; large specialty stores with an emphasis on fresh foods. Sprouts Farmers Market, the second largest supernatural, added 30 stores, to reach 315 total units. We estimate Sprouts will add $588.8 million, for a 12.7% increase, to reach $5.2 billion in 2018.

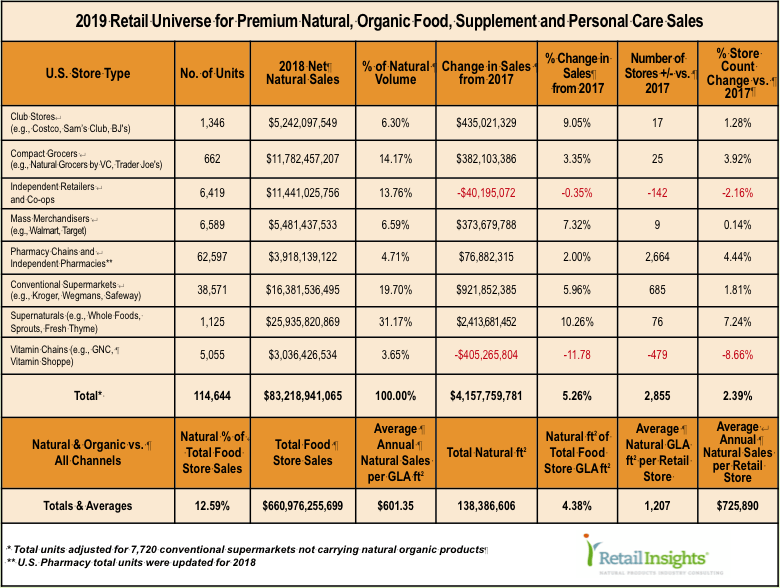

Altogether, Whole Foods, Sprouts, Earth Fare, Fresh Thyme and the other supernaturals we estimate will hit $25.9 billion in 2018, adding $2.4 billion in sales, for a 10.26% year-over-year increase, and capturing the leading 31.17% share of all natural organic sales in the U.S.

Supernaturals actually slowed the number of new store openings in 2018, to 76, down from 97 new stores in 2017. But each one of these new stores in 2018 was much bigger, averaging 33,830 square feet, a 50% increase from the 22,340 square-foot average new store in 2017. Perhaps this is because Amazon unleashed the new-store pipeline, which Whole Foods’s management had curbed prior to being acquired.

Supernaturals actually slowed the number of new store openings in 2018, to 76, down from 97 new stores in 2017. But each one of these new stores in 2018 was much bigger, averaging 33,830 square feet, a 50% increase from the 22,340 square-foot average new store in 2017. Perhaps this is because Amazon unleashed the new-store pipeline, which Whole Foods’s management had curbed prior to being acquired.Conventional Grocers Retain 2nd Place Market Share Conventional supermarkets such as Kroger, Publix, Safeway, and Wegmans, retained their 2nd place natural market share, at 19.7%, with $16.3 billion in natural organic sales. These traditional food stores added $921.8 million in natural organics, a 5.96% increase over 2017.

Compact Grocers Move Up to No. 3 Slot Compact grocers, those stores less than 20,000 square feet gross lease area (GLA)—just under half the 45,000 square foot average of the typical supermarket—snuck into 3rd place at a 14.17% share, and $11.78 billion in natural organic sales. Stores in this group include Natural Grocers by Vitamin Cottage, Trader Joe’s, and other compact, multi-unit chains with significant natural sales. Year-over-year growth in natural organic sales was a fairly modest 3.35%.

Independents and Co-ops Slip to No. 4 We saw a net loss in store count for independent natural products retailers and co-ops in 2018, closing a net 142 stores, or just over 2%. However, the remaining independents reported 1.6% average growth, meaning that net slippage in sales for the channel was just (-$40.1) million, or less than 1% (-0.35%.) Independents continue to account for $11.44 billion in sales, and a 13.76% share of the natural organic market. (Please see the 41st Annual Retailer Survey.)

Mass Merchandisers Hold Steady in 5th Place After the first four retail channels we track in the Retail Universe, natural market share drops into the single digits. Mass merchandisers such as Walmart and Target saw robust growth in natural organic, as both retailers reinvigorated their overall sales by spending heavily to increase online sales, in-store pickup and delivery services. Again, we see natural organic outpacing conventional growth, rising 7.32% in the mass channel, adding $373.6 million to reach $5.48 billion in sales, and a 6.59% natural market share.

Club Store Channel is Vibrant Close behind the mass channel, club stores captured a 6.3% market share, growing natural organic sales by 9.05%, or $435 million, to reach $5.24 billion. The largest slice of that growth—$352.7 million—came from Costco, which reported robust sales increases in fresh foods departments including produce and meats. During the year, Costco management regularly called out natural and organic as being the main drivers behind the growth of fresh foods.

Pharmacy Chains & Independent Pharmacies Independent pharmacies, pharmacy chain stores, and pharmacies within stores in other retail channels—such as within supermarkets and mass merchandisers—at 62,597 units, makes up the largest channel by store count in the Retail Universe. Most of these stores carry minimal natural products; mostly vitamins and supplements. Within the channel, Rite Aid pharmacies reduced the number of GNC store-within-a-store (SWS) sets to 2,242 units from 2,505 units in 2017. These approximately 500-square-foot sets drive significantly more natural volume than do pharmacies without them. The pullback in GNC SWS sets was a drag on pharmacy channel growth. During the year, the large pharmacy chain Walgreen Boots Alliance, acquired 1,932 Rite Aid units.

Overall, the pharmacy channel added $76.88 million in natural sales, up 2%, to capture a 7th place, 4.71% natural market share.

Vitamin Chains Feel the Pressure The vitamin chain channel continued to shed stores and sales in 2018. Vitamin World, which declared bankruptcy in 2017, reduced its store count to 143 from 156 in 2018. The Vitamin Shoppe treaded water, ending 2018 with 780 stores, down from 784 the year before.

GNC significantly reduced store counts by 384 corporate units, and 78 franchise units. Shedding an estimated $363 million in sales, and ending the year with 4,132 stores compared to 4,594 the prior year. With its U.S. prospects apparently waning, GNC is turning its sights on China, securing a $300 million strategic investment from Harbin Pharmaceutical Group for a joint venture in China.

Overall, vitamin chains lost $405.2 million in sales, an 11.78% decline, and closed 479 stores, an 8.66% decrease. Vitamin chain store natural market share, for 8th place, is 3.65%.

Online Sales Retailers have begun reporting their online percentage of sales. While in many cases, we don’t know the makeup of these sales, whether they consist of natural organic products or not, it is interesting to see how online is gaining relevance, and how retailers are adopting an “omni-channel” approach to serving their customers.

Walmart reports e-commerce makes up 1.4% of U.S. sales, or $4.56 billion, and for its Sam’s Club subsidiary, 1.3% of sales, or $764 million. Target’s e-commerce sales have increased to 5.5 percent of sales, or $3.9 billion, up from 4.3% of sales in 2017. GNC reports that its U.S. ecommerce revenue reached 7.2% of total sales, or $125.8 million. This, of course, would be a pure natural organic number, as it consists entirely of vitamins and supplements. And, Vitamin Shoppe reports its digital sales increased 26.2% in 2018.

The Natural Organic Retail Universe Natural and organic sales in the U.S. continue to outpace conventional foods, growing 2.6 times faster. One in eight dollars—$83.2 billion or 12.59% of the $660.9 billion in total food store sales—belongs to natural and organic products.

There are 138.3 million square feet dedicated to natural organic products in the U.S., or 4.38% of the 3.16 billion square feet of GLA retail store space we track in the Retail Universe. We can conclude from this that natural organic products are three times as efficient for retailers to carry in their stores as conventional foods, and we expect they will continue to add to their assortments.

Across the 114,644 stores we track in the Retail Universe, the average GLA retailers allocate to natural organic products is 1,207 square feet, which generates $725,890 annually, or $601.35 per square foot. All three of these metrics are at record levels.

Outlook for 2019 As 2018 came to a close, the Wall Street Journal reported that Amazon announced it would begin opening Whole Foods stores in lower-population-density suburban and rural areas in states such as Idaho, Utah, and Wyoming. As we said at the time of the acquisition, in August 2017, the better play for Amazon might be acquiring Sprouts Farmers Markets. Sprouts is already focused on these lower-population-density markets, has 315 stores, and wouldn’t have cost Amazon anywhere near the $13.7 billion it paid for Whole Foods. On top of this, reportedly 75% of Whole Foods’ customers were already Amazon Prime members. As a rationale at the time, industry analysts said acquiring Whole Foods would give Amazon a more complete picture of Prime members’ purchasing habits. Ah, well, when you have an $800 billion stock market capitalization, I guess $13 billion looks pretty much like a rounding error. JJ