Using insights derived from several surveys from 2018-2019, Nielsen determined that 5% of U.S. households are vegan or vegetarian and the rest are omnivores. Additionally, nearly 60% of U.S. consumers agree that having the right dietary balance of both animal and plant foods is important.

Plant Protein Takeaways:

- 21.6% of U.S. households are purchasing meat alternatives.

- Meat alternatives are shy of crossing the billion-dollar mark, coming in at $893 million sales in 2018.

- 62% of consumers are willing to reduce meat consumption due to environmental concerns.

- 43% of consumers say they would replace meat-based protein with plant-based protein.

- 12% of consumers say they would be willing to eat cell-cultured meat grown in a lab.

Related: Living a Plant-Based Life Plant-Based Living: Delicious Tips for Success The Plant Migration is Real

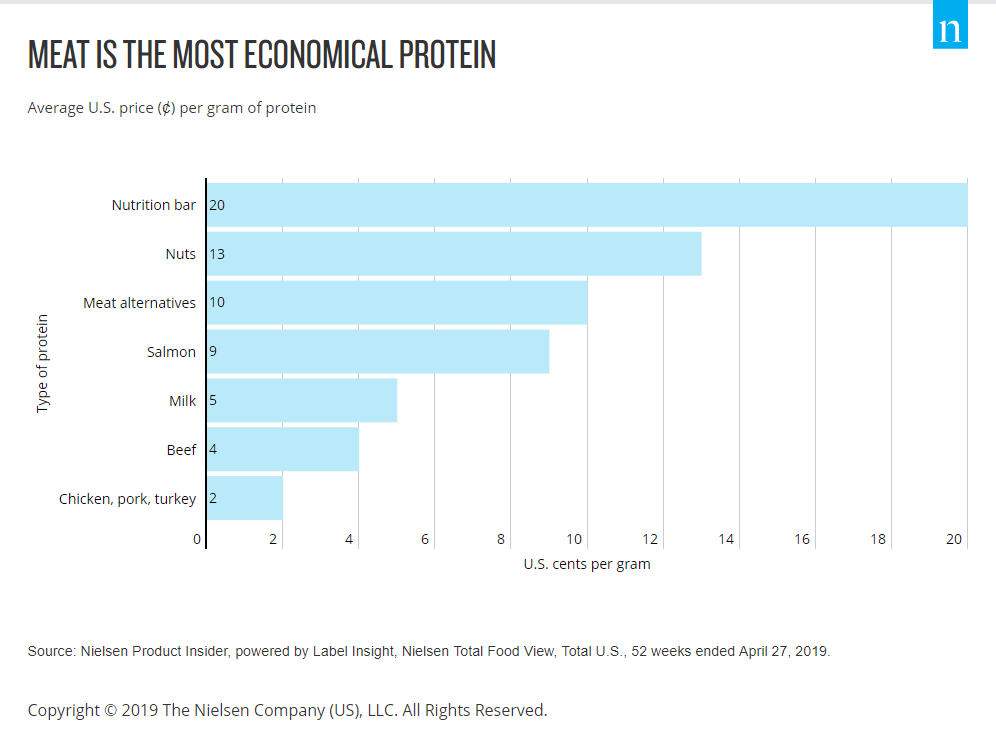

Even though there's a surge in meat alternatives, traditional protein staples still make up the vast majority of the industry, Nielsen notes. One reason, the report suggests, is relative affordability: Chicken, pork, and turkey cost 2 cents per gram--meat alternatives cost 10 cents, nuts 13 cents and nutrition bars 20 cents. Meat Protein Takeaways:

Meat Protein Takeaways:- Meat accounted for $95 billion in sales in 2018

- Meat from the deli department represents only 17% of total meat sales and 31% of U.S. dollar growth within meat overall.