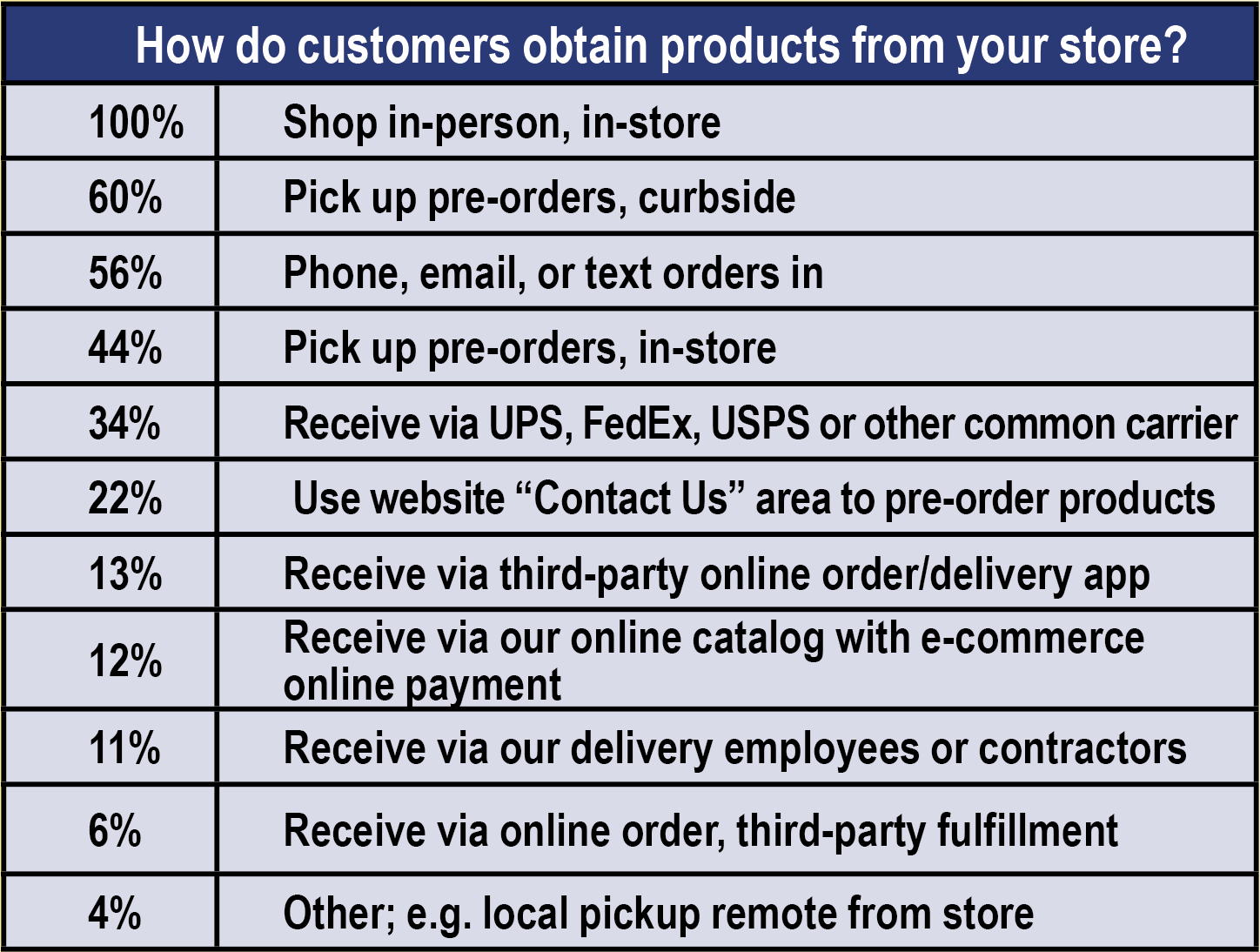

Six in 10 promote preorders picked up curbside while 56% fielded phone, email or text orders. Just under half (44%) let customers preorder and pick up in-store. About one-third (34%) support shipping or mailing orders via UPS, FedEx, or the U.S. Post Office. Less than one-quarter (22%) rely on their website’s “Contact Us” area to collect preorders.

Six in 10 promote preorders picked up curbside while 56% fielded phone, email or text orders. Just under half (44%) let customers preorder and pick up in-store. About one-third (34%) support shipping or mailing orders via UPS, FedEx, or the U.S. Post Office. Less than one-quarter (22%) rely on their website’s “Contact Us” area to collect preorders.A small minority (13%) outsource their online ordering to a third-party ordering and delivery platform, and even fewer (12%) afford their own online product catalog and facilitate e-commerce credit card payments. A bold few (11%) take on the liability of letting their own employees or contract workers deliver orders to customers’ homes.

A handful of stores (6%) don’t own the inventory that they allow a third-party warehouse to fulfill and ship, taking the painful hit to profit margins. And 4% of respondents have alternative solutions for customers to obtain products, such as setting up a pickup location remote from the store.

Retailers Weigh In Regarding the shift to online, survey respondents were mixed. One told us: “Because we already did direct to consumer sales, we had a very successful period during the COVID lockdown and after it. We redesigned our website during this time and that also increased our sales.”

Another shared, “Overall blessed to continue to serve our community, but it has been challenging…Most of our customers have remained loyal, but unfortunately we have lost some to online shopping too.”

That loss continues as consumers get comfortable online. “Last year was slow but steady as customers stayed in and ordered online,” one respondent shared. “This year business is down as a lot of customers have learned to shop online.“

For one, the online shift dealt a fatal blow, forcing the closure of their last store, which was no longer profitable.

And there’s more to know. All the results from the 2022 retailer survey will be available in the March 2022 issue ofWholeFoodsMagazine.