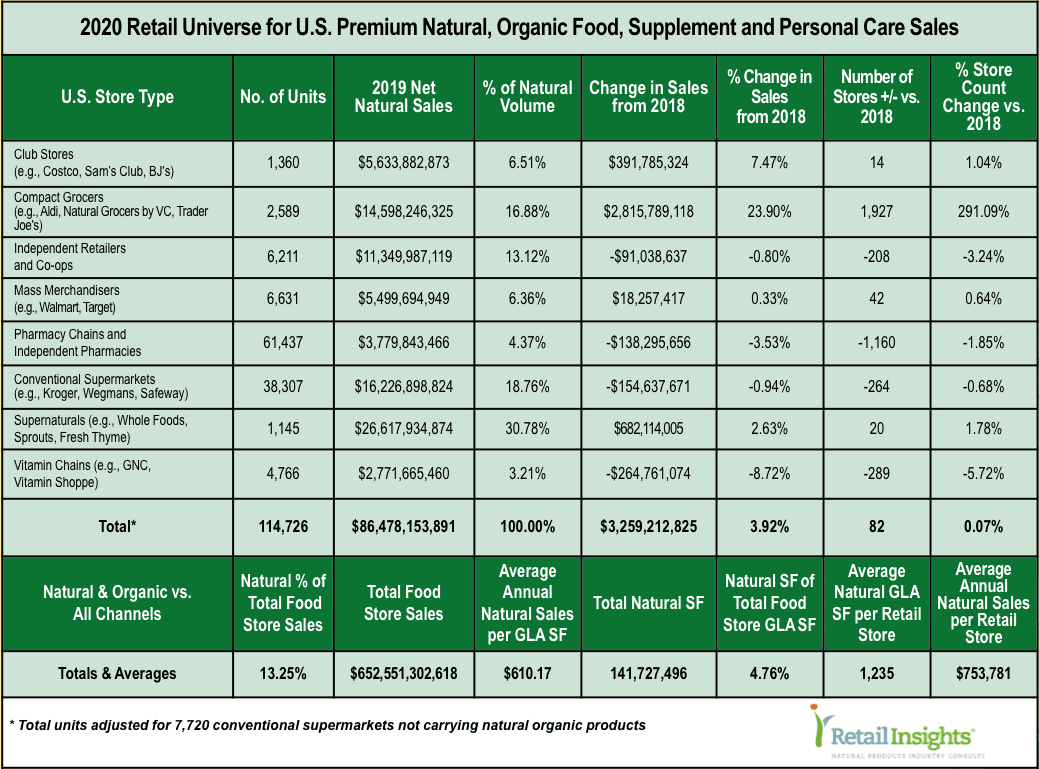

1. Supernaturals are still on topSupernatural chains such as Whole Foods Market and Sprouts still control the largest market share of natural products, at 30.78%, but growth in the channel in 2019 slowed to 2.63% from 10.26% in 2018, adding just $682 million vs. $2.4 billion the year before. Part of the reason is the channel added just 20 net new stores vs. 76 in 2018.

1. Supernaturals are still on topSupernatural chains such as Whole Foods Market and Sprouts still control the largest market share of natural products, at 30.78%, but growth in the channel in 2019 slowed to 2.63% from 10.26% in 2018, adding just $682 million vs. $2.4 billion the year before. Part of the reason is the channel added just 20 net new stores vs. 76 in 2018.Another factor is Whole Foods physical stores don’t appear to be growing. Although the chain added 11 stores in 2019, Amazon doesn’t break out Whole Foods’ specifics. But the stores make up nearly all the company’s “physical stores” category, which as of year-end September, 2019, had declined 1.32% vs. prior year, shedding $56 million.

Amazon does not give the physical stores credit for orders placed online and delivered, or picked up in-store, but that doesn’t change the fact that store traffic appears to be stagnating. Anecdotal evidence suggests regular Whole Foods shoppers are turned off to aisles crowded with Amazon online order pickers who snatch up the red snapper before they can. Further evidence: Amazon is leasing new food-store real estate, some in the same trade areas as Whole Foods. Reports suggest a hybrid concept, with shelf-stable dry goods ordered online and selected by Amazon pickers in a closed area adjacent to a fresh-foods retail space for shoppers, with the two orders married at checkout.

(Note: We have not adjusted for two recent supernatural bankruptcies: Fairway (14 stores) and Lucky’s Market (39 stores), some or all of which continue to operate and may be acquired. And, just as we go to press, Earth Fare announced it is closing all 49 of its stores. If all these stores cease operations, the supernatural channel growth we are reporting would be cut at least in half.)

2. Conventional SupermarketsAs you know, conventional grocers have been losing overall market share to other channels for years. We estimate total channel sales declined $8.4 billion, or 1.27%, to $652.5 billion in 2019 from $661 billion in 2018. Blame the loss at least in part on The Aldi Effect, and stay tuned for further conventional carnage, as the other German hard discounter, Lidl, ramps up its U.S. grocery efforts.

As part of that overall loss, natural organic sales in the conventional channel slid -0.94%, or -$154.6 million, to $16.2 billion in 2019 from $16.38 billion in 2018. Channel natural market share shrank by about a percentage point, to 18.76% from 19.7% last year. Kroger ended the year with 18 fewer stores, and with a net 246 other store closings elsewhere in the channel, conventionals now total 264 fewer units in 2019 vs. 2018.

Conventional supermarkets are the largest single food channel, against which we gauge overall natural organic market share. We estimate total natural organic products added $3.26 billion in 2019, reaching $86.5 billion and 13.25% of the $652.5 billion total food store sales. (See Retail Universe, opposite page) Because total conventional supermarket sales declined in 2019, natural organics have become a critical source of growth.

3. Compact Grocers, The Big Surprise?In 2012, Retail Insights coined the term “Compact Grocers” to signify food stores no larger than 20,000 square feet. While about half the size of a conventional supermarket, we believed then, as we do today, that stores like Aldi, Natural Grocers by Vitamin Cottage, and Trader Joe’s will have increasing influence on U.S. food retailing. So, this year’s results are no surprise to us.

Even though natural sales through Aldi are still a small portion of its total, multiplied by its 1,910 stores, we estimate these sales exceeded $2 billion in 2019. Store counts under the Compact Grocers channel ballooned to 2,589 units from 662 in 2018. Channel sales rose 23.9%, or $2.8 billion—the greatest increase of any of the eight retail channels we track—to $14.6 billion from $11.8 billion, and market share jumped to 16.88% from 14.17%, cementing Compact Grocers’ 3rd Place finish.

4. Independent Retailers & Co-opsGiven the intense online and bricks-and-mortar competition, independent retailers can be proud of their solid 4th Place market share, at 13.12%; less than one percentage point off the 13.76% market share of 2018. We continued to see smaller, older stores close, with the channel losing a net 208 stores, and -0.80%, or -$91 million. Still, the $11.3 billion independent channel sales fully double the $5.6 billion in the next-closest channel, Club Stores. (For a complete analysis of U.S. independent natural products retailer results, seeWholeFoods Magazine’s 2020 42nd Annual Retailer Survey.)

5. Club Store ChannelClub stores, including BJ’s Wholesale, Costco and Sam’s Club, grew 7.47%, adding $391.8 million in natural organic sales, and raising natural market share to 6.51% from 6.3% last year. Store count moved up by 14 units, to 1,360 units from 1,346 last year.

6. Mass Market ChannelMass market stores Target and Walmart grew natural organic sales 0.33%, adding a very modest $18 million in 2019, but natural market share slipped slightly, dipping to 6.36% from 6.59% last year. Mass merchants are finding growth in their smaller footprints: Target added 42 of its small-footprint City and Express stores, which average 28,000 square feet, reaching a total of 86 from 44 last year. Walmart added 13 of its 45,000-square-foot Neighborhood Markets and other small formats, to reach 813 units from 800 last year. At the same time, both chains closed some of their big stores; Target shut four of their Supertarget and four expanded-assortment large format units. Walmart closed 14 legacy discount big-box stores, but added nine Supercenters, which have a renewed focus on fresh, organic produce.

7. Pharmacy ChannelPharmacy chains, pharmacies within supermarkets, and independent pharmacies slipped -3.53% in 2019, shrinking natural organic sales by $138 million. Natural market share also drifted lower, to 4.37% from 4.71% in 2018.

Walgreen consolidated and closed some of the 1,932 Rite Aid stores it acquired in 2018, and reduced total store count by 1,204 units, to 9,285 from 10,489 last year. Walgreen pharmacy front end retail sales were also flat, altogether stripping $3.06 billion off its consolidated retail sales. Rite Aid removed GNC Live Well sets from 419 of its pharmacy store sets, and closed a net 56 pharmacies, for a net decrease of 1,160 stores in the pharmacy channel.

8. Vitamin ChainsThe vitamin chain channel continued to experience stress, shrinking by -$264.7 million—the largest decrease of all eight channels we track in the Retail Insights Universe. Natural market share decreased to 3.21% from 3.65% in 2018.

GNC continued closing U.S. stores, reducing count by 163 corporate and 87 franchise units. Vitamin Shoppe shrank by 28 stores, and Vitamin World by 11, reducing the total vitamin chain channel by 289 units.

Digital SalesRetailers are beginning to share their digital sales, with Target and GNC breaking out results. Digital sales reached 7.3% of Target’s total sales, or $5.3 billion. Of course, we don’t know what percentage of these are natural organic sales, but probably not much. GNC brought in 8.6% of its sales, or $179.5 million, through its digital portals. These, we know, are all natural organic product sales.

Overall Natural UniverseNatural organic products enjoyed 3.92% growth in 2019, adding $3.26 billion in sales, to $86.478 billion, and reaching a record 13.25% of the $652.6 billion total U.S. food store sales; one of the only categories feeding food store growth.

Average natural organic sales per store rose $27,891, to $753,781, from an average 1,235 square feet gross lease area, reaching $610.17 in annual sales per square foot; all records in the Retail Insights Retail Universe.

Altogether, 2,061 stores closed, and 233 opened across the eight U.S. retail channels we track. After adding 1,910 Aldi stores to our database, our new total store count increases by 82 units, to 114,726 from 114,644 last year. Total natural square footage increased 2.41%, to 141.7 million square feet, adding 3.3 million square feet to reach 4.76% of the 2.975 billion total U.S. retail store square footage in the Retail Insights Retail Universe.JJ