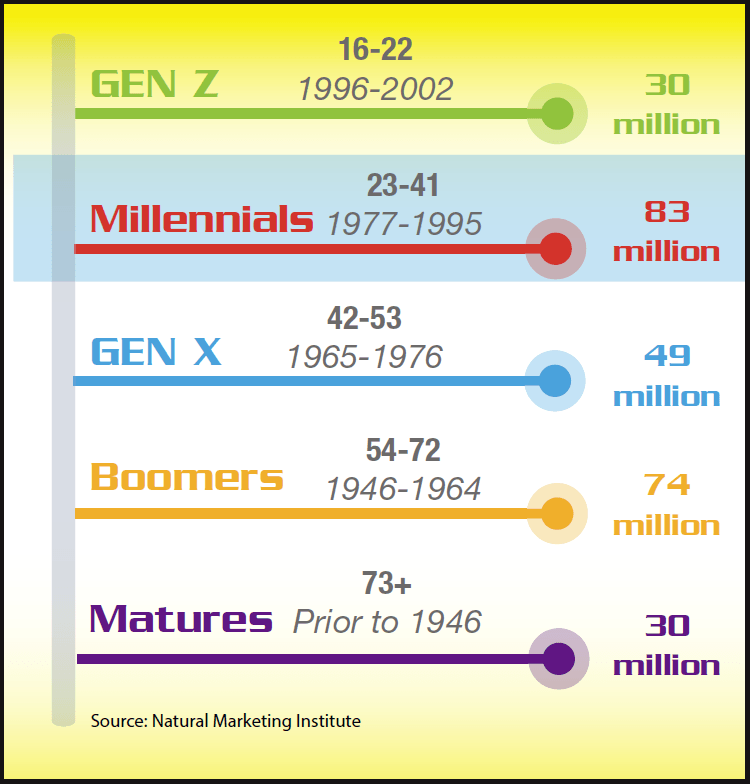

Despite a stereotype of being listless moochers, the millennial population is getting older, forging careers and starting families. Sensationalized stories like that of 30-year-old Michael Rotondo, whose parents went to court to evict him, help fuel the image. The fact remains, however, that millennials did grow up in the chaos of the Great Recession and although highly-educated, struggle to find fulfilling and prosperous careers. They are hustlers — by necessity — who generally distrust large institutions and hold fast to their ideals.

A study by The Brookings Institution called, “How Millennials Could Upend Wall Street and Corporate America” — a title many millennials would take pride in — states that 87.5% of millennials disagreed with the statement “Money is the best measure of success,” 64% would prefer a $40,000/year job they enjoyed over a $100,000/year job they found boring, and 83% agreed with the statement, “There is too much power concentrated in the hands of a few big companies” (3).

These are a good reflection of the values one can expect from a millennial customer. Millennials can also be pragmatic, understanding the inherent contradictions between these statements and living in today’s world; relying on devices from huge corporations like Apple and Google and purchasing everyday items from a juggernaut like Amazon. These are unmovable forces that create huge challenges in the retail environment, but natural product retailers have the potential to capture millennials by offering a community to be part of or a cause to support.

For example, our most recent Retailer of the Year, MaMa Jean’s Natural Market, offers conveniences like bulk herbs that draw in customers but also showcases products that support causes like wildlife conservation or female African artisans. More than that, however, MaMa Jean’s has rooted itself deeply in the community, a quintessentially local retailer that stands for something and is reliable. The trick is giving millennials a reason to show up.

Buying HabitsFood.When it comes to products millennials purchase, factors like transparency, environmental sustainability and animal welfare can be very important. That is why certifications and seals that identify products meeting particular standards have grown in popularity. Jeff Fromm of Millennial Marketing says in one of his “Millennial Minute” videos, “The reality is millennials don’t like secrets. They want to look behind the tent, so they’re more interested in the story behind the food, the ingredients that are on the package. Everything matters to them. Don’t be afraid to give them the information they are looking for” (4).

This is certainly accurate, but certified products that allow brands to claim a premium price, can strain the budget. Andrea Aguirre, a 28-year-old professional nanny and personal assistant who lives with a roommate in Henderson, NV, says there must be some compromise.

“When we can eat organic, we do because we are very strong believers of the idea behind being conscious of where your food comes from and where it’s grown,” Aguirre states. “If I could afford to, all the groceries we purchase would be organic, because it’s easier on the environment and ethically better.”

This is the pragmatism of doing the best they can with what they’ve got. Proximity and availability also have a lot to do with it. Being in Nevada gives Aguirre access to a great variety of fresh and unique products that are mostly inexpensive. “Out here it’s so easy to get cheap produce so we buy a lot of fruit and we’ll get vegetables we wouldn’t normally eat because they’re on sale and in season,” she says.

Fromm calls this navigation of availability, price, quality and ideals “day trading” (5). As he puts it, “They’re day traders — the ultimate day traders — so they want a good price, but they want a package that’s environmentally friendly, they want food that’s flavorful, but they don’t want to pay a whole lot extra for it. So, they’re day trading all the time.“ The combination of access and reasonable pricing also encourages food exploration. “Millennials want to travel to every region in the world, but they can’t always do it; don’t have the time or money,” explains Fromm (4). “But they do have the time and money to explore all kinds of flavorful and healthy foods.”

This means trying new recipes, incorporating unfamiliar produce and spices. Millennials are willing to take the risk because it’s a new experience.

While having access to affordable organic produce provokes excitement, meat may not always get the same attention. Aguirre is not vegetarian but explains she does not typically buy organic meat because it’s usually not on sale and she limits her meat consumption anyway.

“We try to limit the amount of meat we eat and there are meats we just don’t purchase, like steak, unless it’s a special occasion,” she explains. “We don’t buy a lot of red meat at all; ground beef is about it and we only buy it when it’s on sale. We eat mostly chicken and lately we’ve been eating a lot of tofu because it has been on sale and we do meatless Monday; just another way we try to limit our impact on the environment.”

While other millennial shoppers may put a priority on buying organic meat because of the perception of better standards, Aguirre is making a trade in which she spends less money on meat overall by purchasing less and choosing not to buy premium organic, then uses that money instead on meat alternatives and more affordable fresh produce.

According to Acosta, a sales and marketing agency in the consumer packaged goods industry, based in Jacksonville, FL, 26% of millennials are already vegan or vegetarian and plant-based meat alternatives have seen 11% year-over-year growth (6). However, 71% of people who purchase plant-based alternatives also eat meat. In fact, one in three millennial meals are meat-free.

Others have less choice in the kind of food they can eat. What is it like for millennials with dietary restrictions? Dominick Nero, a 27-year-old video editor writer for Esquire, who lives in Astoria, Queens, NY, for example, was recently diagnosed with irritable bowel syndrome and follows the low-FODMAP diet on the recommendation of a friend.

“That means no onions, no garlic or milk. The bigger thing was learning that I couldn’t even eat food I thought was good for me,” explains Nero. “For example, eating strawberries as a snack instead of potato chips — you would think that’s a really good alternative — but for someone like me, strawberries, blueberries and a lot of those high-sugar fruits are some of the worst things and could agitate and inflame my intestines.”

As millennials are getting older, many are realizing that certain foods are becoming less tolerable. Foods labeled gluten-free and low FODMAP are important guideposts, but retailers can also help guide customers to the right foods by educating their staff in charge of produce to understand what fruits and vegetables are low FODMAP.

Supplements.Do millennials buy supplements? The short answer is yes. However, the way they pick what supplements to take and how is more nuanced. According to the Council for Responsible Nutrition’s 2017 Consumer Survey, 80% of respondents between the ages of 18 and 34 (which straddles gen Z and millennial demos) find the dietary supplement industry trustworthy, the highest compared to older age groups. Among this age group, energy is the number one reason for purchasing a dietary supplement.

For example, Aguirre takes branch chain amino acids (BCAAs) every morning for energy. She also drinks a mix of barley grass powder in lieu of taking multivitamins. Nutricosmetics and weight management supplements are also part of her routine, such as biotin and glucomannan. “I take glucomannan every morning and then I don’t eat much until lunch time and then dinner, so this one is 100% for weight loss, everything else is just extra, for helping get into better physical shape or just look better or feel better overall,” she explains. Nero takes psyllium husk to aid his irritable bowel syndrome.

The way they and other millennials find supplements may also be different than older generations. “I really got into fitness and this YouTube vlogger recommended one of the supplements we use, the BCAAs,” explains Aguirre. “I saw this video that she put out about supplements she uses that actually work. I bought a different brand, but it drew my attention because of what was in it. I was looking for something that had vitamin C, for something that had B12, because that’s something I try to get as much as possible. Of course, I wanted one that didn’t have extra stuff like creatine in it because there are body-building supplements that are different from BCAAs.”

New sources of information like YouTube are an important resource for millennials and why many brands now use influencers from social media to promote their products. However, as you can see, Aguirre put in the effort to find what works best for her through personal research and found a different product. Nero also learned about how to support his IBS symptoms through personal research.

“One of the sites recommended that I make a food diary,” he explains. “When my symptoms got really bad, I started doing that and every day I would record everything I’d eaten, make a checklist and check off when I’m agitated or normal. Once I started keeping track of all that, things started to align. I started to see the stuff that was really screwing me up.”

The sad thing is that millennials tend to rely on personal research because of poor access to healthcare. Despite getting diagnosed by a gastrointestinal doctor, Nero’s physician wasn’t much help. “He sucked. It was hard to find a gastro doctor that was on my insurance,” explains Nero, who was a freelancer at that time. “He basically just concluded that I didn’t have intestinal cancer, so after that I got more serious [about what I ate]. Someone recommended that I try the low FODMAP diet.”

Word of mouth is another important factor. “The psyllium husk I used to buy a lot is Yerba Prima, but I recently got this new one,” says Nero. “My coworker has problems worse than mine and she recommended Heather’s IBS. I bought it on Amazon.”

Just as millennials are more adventurous with their food, they are also more likely to try devices, like vapes. Through her research, Aguirre discovered she may not be able to properly absorb vitamin B12 from conventional supplements.

“When I started my weight loss/fitness regimen, I just tried a bunch of different things and on a whim I read about B12 injections. They were part of this weight loss program I joined and immediately after my first injection, I felt totally different,” she explains. “I felt super energized and I didn’t understand why this was a thing, then I researched it and I read that some people just don’t absorb B12 well through their digestive tract. I had been taking a B Complex vitamin and it wasn’t doing anything for me and ended up being totally useless. After the injections I realized I definitely needed more B12 in my diet because I need to ingest it one way or another. So, we tried these B12 vapes and those ended up being very effective and good at boosting energy before or after a workout.”

Vaping is an emerging delivery format that is probably most prevalent in the phytocannabinoid space, where people can vape to get a concentrated dose of CBD. Getting vitamins like B12 from a vape has a lot of potential among millennials. Vaping in general has not really found a place in natural product retail, but vaping products that offer a unique delivery format of essential nutrients is something to consider and may attract a younger demographic.

The nature of most of the supplements mentioned above is that there is a tangible effect: energy, appetite suppression, digestive support. Millennials want to know that something is working if they are going to spend money on it. “Millennials want supplements that benefit them now — with results they can see and feel,” says Jessica Heitz, director of brand for OLLY, a brand that keeps millennials in mind. “We continue to see strong growth in sleep, stress, beauty, probiotic and energy supplements. Restful Sleep continues to be our #1 seller.”

Millennials also want something that can be seamlessly integrated into their lives, reducing waste of money and product. Who among us has started taking supplements only to stop at some point? Personalization is one way to optimize supplement use and ensure that one gets the most out of it.

Heitz sees this throughout the supplement space with millennials. “As millennials continue to search for ways to be their best selves in a 24/7 world, we’ve seen a rise in bio-hacking and adaptogens,” she says. “Products in both segments support millennials’ belief that health and wellness should be tailored to the individual, and we expect supplements that optimize performance and resilience to continue to grow.”

Part of integrating supplements seamlessly into one’s life is choosing the right delivery formats. A great example is Aguirre utilizing the green barley powder instead of taking multivitamins and finding the ideal way to get her required B12. Brands are seeing the value in this. “We believe that convenience and portability are essential for millennials,” says Heitz. “They need products that will integrate into their busy lifestyles with ease. As a result, we’ve also recently launched on-the-go packaging for our gummy products to ensure our consumers can easily take their OLLYs with them while traveling!”

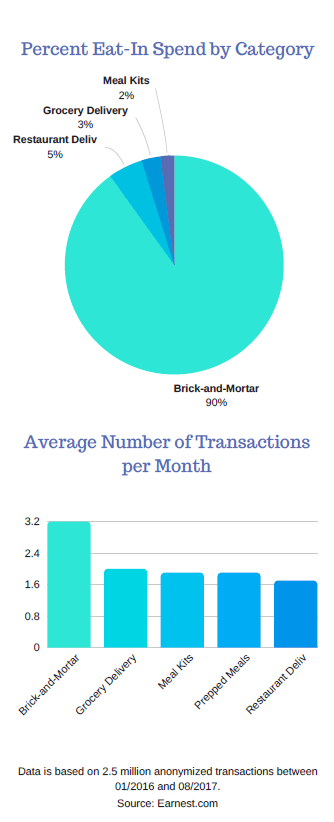

Where Millennials ShopDespite the attention online grocery delivery and meal kits have been getting in the press, millennials overwhelmingly shop for their groceries at brick-and-mortar stores. This is according to Earnest, which analyzed 2.5 million transactions between January 2016 and August 2017 using data drawn from loan applications where applicants averaged age 32 (7). Data showed that 90% of eat-in food spending is still at traditional grocery stores, which are visited an average of three times per month with an average transaction of $50. Compare this to 2.8% for grocery delivery and 2% for meal kits (See Figure 2).

Grocery shopping is experiential in nature. There is a sense of exploration when shopping in the produce section to see what’s in season and discover new flavors. “Last year we tried two different melons,” says Aguirre. “One we didn’t like, but the other one was really great. Just stuff you don’t see at most grocery stores. Now we started eating baby broccoli.”

Aguirre lives near a Nevada shopping center that includes a Smith’s (owned by Kroger) and Sprouts Farmer’s Market. Nero lives in Astoria, Queens just down the street from an organic market. Across the street from that is another affiliated store that sells dietary supplements and other health products. Nero shops at both as well as online. Aguirre typically shops for produce at Sprouts and then uses Smith’s for other groceries, but it also depends on what kind of deals she can find at each retailer.

When it comes to shopping for supplements, it’s a different story. After doing some personal research or getting a specific recommendation, millennials typically know exactly what they are looking for and will order straight from their computer. “Generally, it’s way more convenient to buy things online because you can save the supplements you use on a regular basis and it just comes every month,” says Aguirre. The auto-buy feature on ecommerce provides what experts call a frictionless experience.

“Brands like Uber and Airbnb are wildly popular with millennials, why? [Because] they have little equity in old schemas, and those brands are taking friction out of experiences,” explains Fromm.

The conveniences of ecommerce are hard to match for a supplement retailer, but millennials aren’t averse to stepping into a store if they have the opportunity. The proximity of his supplement retailer has allowed Nero to explore and even ask questions despite a general reluctance to seek advice.

Millennials will figure out what they need and search it out, but with the sheer selection, assistance is certainly welcome. “Sometimes I will [seek assistance],” says Nero. “When I was looking for a fiber supplement, I didn’t know exactly what kind to get. One time I was looking for a gluten-free, IBS-friendly protein powder and [the staff] helped me with that.” Millennials are also very aware of the way huge corporations like Amazon are hurting small businesses and aren’t married to ecommerce if they have a reliable retailer they can turn to and feel good about supporting, especially if they are local and independent. They do their best to hold onto their values while also having to navigate the realities of everyday life and make compromises when it is financially prudent or simply more convenient.

Millennials also want the brands and the people they are buying from to represent a set of values. They appreciate when a retailer only sells natural, non-GMO and organic products. They also like to support brands that have labor standards like Fair Trade. B Corp is another important certification in the industry that fits millennial values in both product standards and labor standards. OLLY, for example, officially became a B Corp this year. “We understand that work/life balance and a strong sense of purpose are driving factors in happiness and job satisfaction for millennials, so we wanted to ensure that OLLY’s culture reflected those values,” says Heitz.

Making those values clear is also important. Again, making things frictionless, quick to find and understand. Many brands now target millennials in this way. “I’ve noticed several trends across the board, specifically toward attracting millennials. The first one is keeping the design clean and simple,” says Jared Powell, principal at Frontier Label, a label design and printing service based in Greenville, SC. “This is really important because millennials really focus on rapid communication and want to know what a product is quickly, and if you can’t tell at a glance because the design is overly complex or busy, then the millennial consumer is just going to move on.”

“Clean and simple works great for supplements, if they’re trying to push, for example, a protein powder with no additional fillers,” adds Powell. “Being able to, at a glance, know that this is free of GMOs or made with organic milk.”

This is a notable advantage of natural products, that they inherently have fewer ingredients. Millennials love to see small, simple lists of ingredients and it’s great for design as well. “For a lot of these natural products, having minimal ingredients, or very pure ingredients, is important because that ingredients list on the label can be very legible, very short and one can create a label design that draws attention to that,” says Powell. “You can pair that really well with bold colors. The simpler the design, the more out there you can be with your colors.”

This strategy can work for retailers as well, and some already aim at this simplicity, giving customers less work to do by setting down certain rules. Full Circle Market, based in Winchester, KY, for example, has a set definition for “natural” in its store — no artificial colors, sweeteners or preservatives, high fructose corn syrup, hydrogenated oils, or MSG. In a video on the WholeFoods Magazine website Laura Sheehan, founder and owner of Full Circle says, “I opened Full Circle Market in 2001 with the mission to have a store where folks didn’t have to come in and read labels.” (8)

This creates a sense of trust that a retailer has properly vetted their stock and whatever they choose to buy will be a quality product. High standards are important because if a new customer has been buying a certain product on Amazon and they happen to step into your store looking for it and it’s not on your shelf, you may have a good reason to not stock it. Amazon doesn’t vet the thousands of supplements on its site and you can use this as an opportunity to say, “Unfortunately, that product did not meet our standards, but I would recommend this product which is cleaner and has the same purpose.”

This kind of interaction sows trust between you and the customer and they will be more likely to come back and try more of your stock. All good retailers also take the time to find new and innovative products that their current customers will love and will hopefully help them win over new customers. Quality standards are first and foremost but let’s not underestimate the power of design.

“We wanted to make sure that our products were counter-worthy — a seamless addition to their existing home or office aesthetic, rather than part of the medicine cabinet,” explains OLLY’s Heitz. “Our marketing campaigns reflect this as well — we utilize visually disruptive creative and lean into the lifestyle benefits that our consumers are seeking.”

Good design also helps with organic exposure. “Whatever the design is, it really needs to be photogenic,” says Powell. “With the crazy popularity of Instagram, products are showing up and being photographed frequently, so it has got to look good and that’s going to speak to the quality of the print, the label and the materials that went into it because that’s just going to be put out there more than it ever has before, and millennials really do care about cultivating online or social media presence.”

Independent natural product retailers offer a lot of value with expertise and customer service that is unmatched by large chains and ecommerce, but aesthetics must be a factor if you want to attract younger people. Thankfully, according to WholeFoods’ 40th Annual Retailer Survey, expanding and remodeling of stores has been possible for retailers (9). Sixteen percent of respondents expanded or remodeled their space during the survey period, adding an average of 1,225 square feet to their store. Another 21% has plans to remodel or expand the size of their stores.

“Independents planning to expand appear to have their finger on the pulse of today’s consumer, with 15% of expanding retailers expecting to grow the prepared foods departments including juice bar, café, deli, bakery, or grab-and-go cases,” reported WholeFoods Magazine. “Vitamins, herbs, and supplements, as well as personal, body care and cosmetics departments are in the expansion plans of 11% of expanding retailers.”

You want a beautiful store with beautiful products because when a millennial has a great experience at a store or with a product, they will want to share it on social media. You want your store to be a destination. A prepared foods section such as deli or café helps with that, encouraging millennials to come in during their lunch breaks or spend their time there working on their resumes and job applications. Stocking cool products with engaging designs for customers to discover also adds to that sense of experience, making your store a place a millennial can look forward to shopping in.WF

(Next month: Gen Z)

(Last month: Gen X)

Sponsored by:

References

- F. Dews. “11 Facts about the Millennial Generation.” https://www.brookings.edu/blog/brookings-now/2014/06/02/11-facts-about-the-millennial-generation/

- R. Fry. “5 facts About Millennial Households.” http://www.pewresearch.org/fact-tank/2017/09/06/5-facts-about-millennial-households/

- M. Winograd and M. Hais. “How Millennials Could Upend Wall Street and Corporate America.” https://www.brookings.edu/research/how-millennials-could-upend-wall-street-and-corporate-america/

- “The Millennial Minute: Food Trends Part Two.” https://www.youtube.com/watch?v=eLYkuGTm-cI

- “The Millennial Minute: Food Trends Part One.” https://www.youtube.com/watch?v=uEqe3OURPdg

- “Fresh Meat and Plant-Based Meat Alternatives on the Rise, According to New Acosta Research.” https://www.prnewswire.com/news-releases/fresh-meat-and-plant-based-meat-alternatives-on-the-rise-according-to-new-acosta-research-300606013.html

- “How Much Do People Spend in Each Sector of the Food Economy?” https://www.earnest.com/blog/food-economy-spending-data/

- “Retailer Spotlight: Full Circle Farms,” https://wholefoodsmagazine.com/multimedia/video/retailer-spotlight-full-circle-farms/

- “2018 40th Annual Natural Retailer Survey Overview.” https://wholefoodsmagazine.com/supplements/features-supplements/2018-40th-annual-retailer-survey-overview/