Challenge 1: Rising cost of doing business

“Increasing costs of doing business are disrupting the entire retail supply chain,” reports Joe Tarnowski, VP of Thought Leadership & Global Media, RangeMe & ECRM. “Consumers and manufacturers alike are feeling the impact, and this is shaping how each behaves.” On the supply side, he says, “suppliers are finding it more difficult and expensive to source the raw materials and packaging they need, and in some cases, these increased costs and supply chain bottlenecks are resulting in them not having available inventory for retailers.”Challenge 2: Increased availability of natural & organic

“Independent natural retailers used to be the only place where shoppers could reliably find natural and better-for-you products,” says Jeff Crumpton, SPINS Product Marketing Manager, Retail. “With national chains, big box, club, and convenience stores including these high-growth products as part of their assortments, shoppers can now find and discover natural focused products in many more places. Independent natural product retailers therefore are tasked with continually identifying new products and differentiating their assortment to stay aligned with values-driven shoppers.”Challenge 3: Inflation alters shopping habits

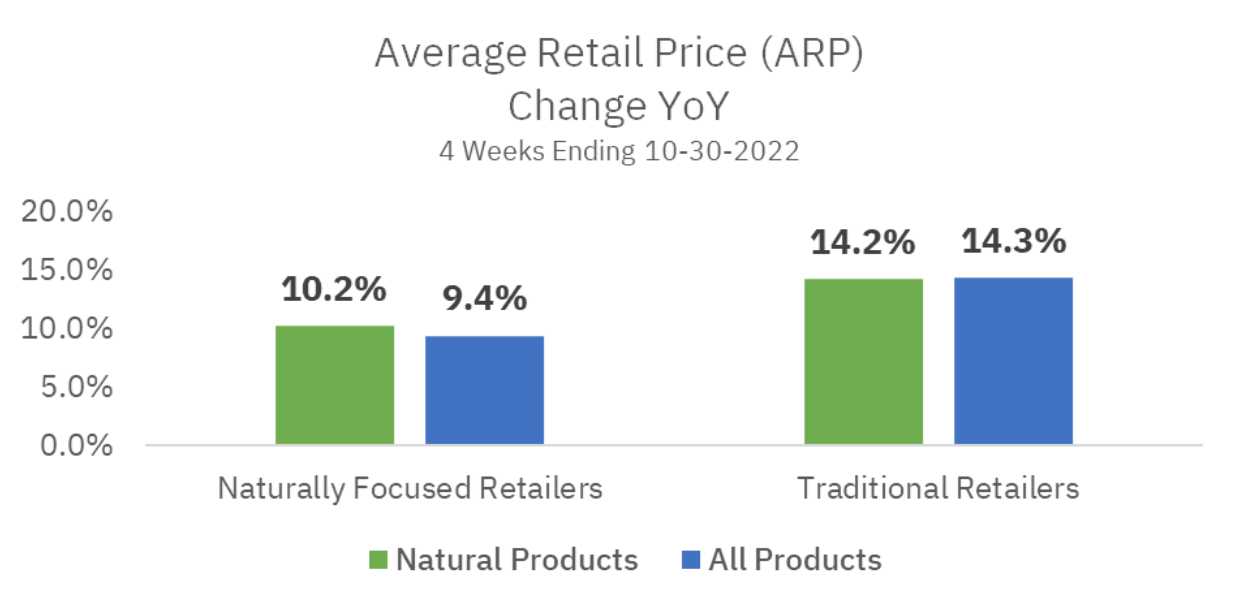

Speaking of value, David Williams, EVP of Business Development, Cornerstone Consulting, Inc., notes that rising prices are driving shoppers to lower-cost options and outlets, and online options continue to erode brick and mortar sales. Tarnowski agrees. “On the consumer side of the supply chain, inflation is leading shoppers to make choices such as reducing purchase frequency, foregoing some products altogether, or seeking lower-cost alternatives.”Looking at pricing and promotions, Crumpton says, “Natural product retailers have been more deliberate with price increases than mainstream retailers, yet every portion of the industry must contend with rising prices coupled with less frequent and more shallow promotions. Naturally focused retailers have held price increases lower than their mainstream retail counterparts to lessen the impact of overall higher price points on some natural products.” (See Figure 1.)

Challenge 4: Inventory management

Issues related to sourcing raw materials and packaging needs are resulting in out-of-stocks at the shelf, says Tarnowski. Karen Frame, CEO & Founder of Makeena (a rewards app that helps mission-driven brands and shoppers discover and engage with one another), puts the issue in perspective: “Out-of-stocks are some of the most expensive retailer problems. When a shelf is empty it can turn a consumer off. Sometimes for good.”Retailers are stuck in the middle. “Retailers are trying to appease shoppers, manage supplier relationships, keep products on the shelf, and still make a profit,” Tarnowski says. “Now more than ever, it’s important for natural products retailers to have access to more options when it comes to product sourcing to keep their categories well-stocked with products that deliver value and variety to shoppers who are increasingly seeking it.”

Challenge 5: Lack of product innovation

As noted above, product variety can help set independents apart, but: “With supply chains stressed over the last few years, there has been an overall decline in new product innovation as brands have prioritized production of their best-selling products to meet shopper demand,” says Crumpton. “Naturally focused brands have been less impacted by this contraction, continuing to launch new and innovative products driving growth in the market. With all retailers recognizing this growth potential, naturally focused retailers must differentiate and innovate their assortment to align to shopper values.”Once new brands are in the store, Frame says, getting those products discovered by existing and new consumers can be a challenge. She points in-store concerns, including the difficulty conducting staff demos in a tight space, and lingering impacts of the pandemic, with shoppers leery of tastings.

Challenge 6: Staffing issues

“Lack of shopper engagement at retail is driving down purchases and visits. Shoppers don’t ask questions like they used to, and if they do, retailers lack the staff and resources to answer them confidently,” says Williams. “This appears to be driven by two main forces: One is that most shoppers search for product information while physically in-store and the other being that store staff turnover is high.” Also worrisome, Williams adds: “In the ‘old days,’ in-store staff in a natural product stores were passionate believers in the products and lifestyle, in many cases that is no longer the case.” For a deeper dive into the state of staffing for independents, read*!?*! Staffing. You’re not aloneonwww.WholeFoodsMagazine.com.Challenge 7: Managers juggling too much

There is a skepticism and resistance to new technologies, Frame contends, but those very technologies are designed to make the job of being an independent retailer easier. And some retailers try to build their own tech solutions , she adds, which pulls them away from doing what they do best: Selling products.Solutions to Support Independent Retailers

Find your community

“Social media, LinkedIn in particular, is an underutilized free resource that natural products retailers can use to discover new brands and connect with others who can provide valuable advice,” suggests Tarnowski. “The key is to be consistently active on these platforms by posting regular content and participating in discussions. Over time, they will build up an engaged following that can provide valuable insights for their business.”Frame seconds that. “Research on LinkedIn what other retailers are writing about or are doing.” And for more retailer connections: “Join a community or two or three of retailers.”

INFRA is dedicated to supporting the success of natural independents Frame also suggests embracing tech tools that are designed to help retailers. To ensure a good fit, she advises:

-

“Focus on tech that allows better bandwidth.

-

Negotiate with tech and other service providers. There’s always room.

-

Ask for a trial period.

-

Blend the consumers’ physical and digital experiences.

-

Work with groups like KPMG, Deloitte, and McKinsey, who can help source tech providers.

-

Get involved with XRC Labs and TechStars (JPMorgan Chase’s upcoming cohort in Atlanta is an example of this). Both have highly vetted retail-focused up-and-coming startups in their cohorts that are providing innovating tech solutions for retailers.”

Tune into consumers’ shifting wants and needs

“SPINS offers a full range of products and solutions to enable independent retailers to understand high-growth product attribute trends which align to today’s shopper values while their competitive differentiators are protected from other mainstream retailers,” says Crumpton. Among them:-

A robust business intelligence suite of reporting tools helps retailers quickly understand the trends that are leading growth to gain a greater share of the market.

-

A catalog management solution to inform category and content management and populate eCommerce platforms.

-

Growth consulting to understand complex shopper insights and determine how to attract and retain key demographics.

Consider private label

“Inflation is a hot topic as shoppers continue to be confronted with rising prices in energy, housing, and food,” says Crumpton. “During these times of economic uncertainty, shoppers increase their trial of store brands. Independent natural product retailers have an excellent opportunity to feature their private label portfolio and provide shoppers with innovative, high-quality products at a lower price point towards becoming a basket staple now and in the future.” (ReadPrivate Label: An Innovative Optiononwww.WholeFoodsMagazine.com to discover 4 Ways Private Label is Evolving & Advancing and Tips for Private Label Success.)Get the winning assortment

“ECRM and its product discovery platform, RangeMe, enable natural products retailers to discover, connect, and purchase products from a vast selection of brands at no cost to the buyer,” says Tarnowski. “Both solutions help retail buyers focus their sourcing efforts on the areas that will have the biggest impact on their categories and for their shoppers. There are more than 200,000 brands on RangeMe and retail buyers can sort and search these products using various filters and keywords to quickly and easily discover the products that best match their needs.”For example, Tarnowski says, more than 67,000 brands are found under the search term “natural,” representing 262,112 products. The search term “organic” results in 48,208 brands and just under 175,000 products. “ECRM’s category-specific, highly curated meetings connect retailers and brands in private face-to-face meetings by matching the buyer’s category needs and objectives with the brands’ products and capabilities. Together, ECRM and RangeMe are a one-stop shop for a buyer’s sourcing needs in a market where time and resource constraints are a challenge.”

Educate and engage in store

Smart Shelf Tags can help drive sales. Based on SPINS retail sales data for Fresh Thyme Market (WholeFoodsMagazine's2022 Retailer of the Year) released in 2022, products merchandised with Smart Shelf Tags outperformed their respective categories by more than three times. “It comes as no surprise that partnering with our suppliers to provide our shoppers with great product information at the shelf would increase sales” said Jonathan Lawrence, Fresh Thyme Senior Director of Grocery and Natural Living, in a release announcing the analysis.New for 2023, Cornerstone announced another tool for retailers: “We are partnering with Merryfield to add digital promotions to our Smart Shelf Tag solution,” Williams shared. “Smart Shelf Tags combined with Merryfield’s digital promotions/offers will be marketed under our ‘Learn & Earn’ banner. That means suppliers will be able to easily and inexpensively add shopper-facing digital offers to their Smart Shelf Tags. Combining great product information with digital promotions (incentives), we can help retailers (and brands) engage, educate, and incentivize their shoppers to drive incremental sales.

“This is a killer solution to deal with many issues,” Willams continues. “We can now:

-

help reduce consumer costs

-

minimize the need for shoppers to search for product content online, which leads to online purchase diversion

-

better engage shoppers in-store, and train in-store staff to make them more knowledgeable about products they sell.”

Zooey Deschanel, Merryfield Co-founder and Chief Creative Officer, added, “It’s much harder than it should be for people to find accurate and trustworthy information about food and other everyday products they want to buy for their families. With Merryfield’s new Learn & Earn program, we can bring honest, on-demand information to people right in store aisles and pair it with new digital product incentives. Inflation is impacting what people can buy and where they shop. Every bit of savings will help people.”

Build loyalty

Makeena focuses on helping consumers discover, locate, and save on better-for-you/better-for-the-planet brands and their products. With this focus, Makeena aims to empower shoppers to live healthier lives on a cleaner planet. And for brands and retailers, Makeena delivers business analytics and shopper profile data to expand their presence in the market and increase business. Makeena can help in the following ways, says Frame:- Becoming the retailer’s loyalty platform.

- Providing retailers with granular shopper data, revealing where else customers are shopping, what’s in their basket at these other stores, etc.;

- Attracting and/or activating existing customers who may be shopping elsewhere, to discover new brands and products on shelf, increasing trial, velocity, and cart size; and/or

- Using Makeena’s app with special offers only available at that retailer’s stores.