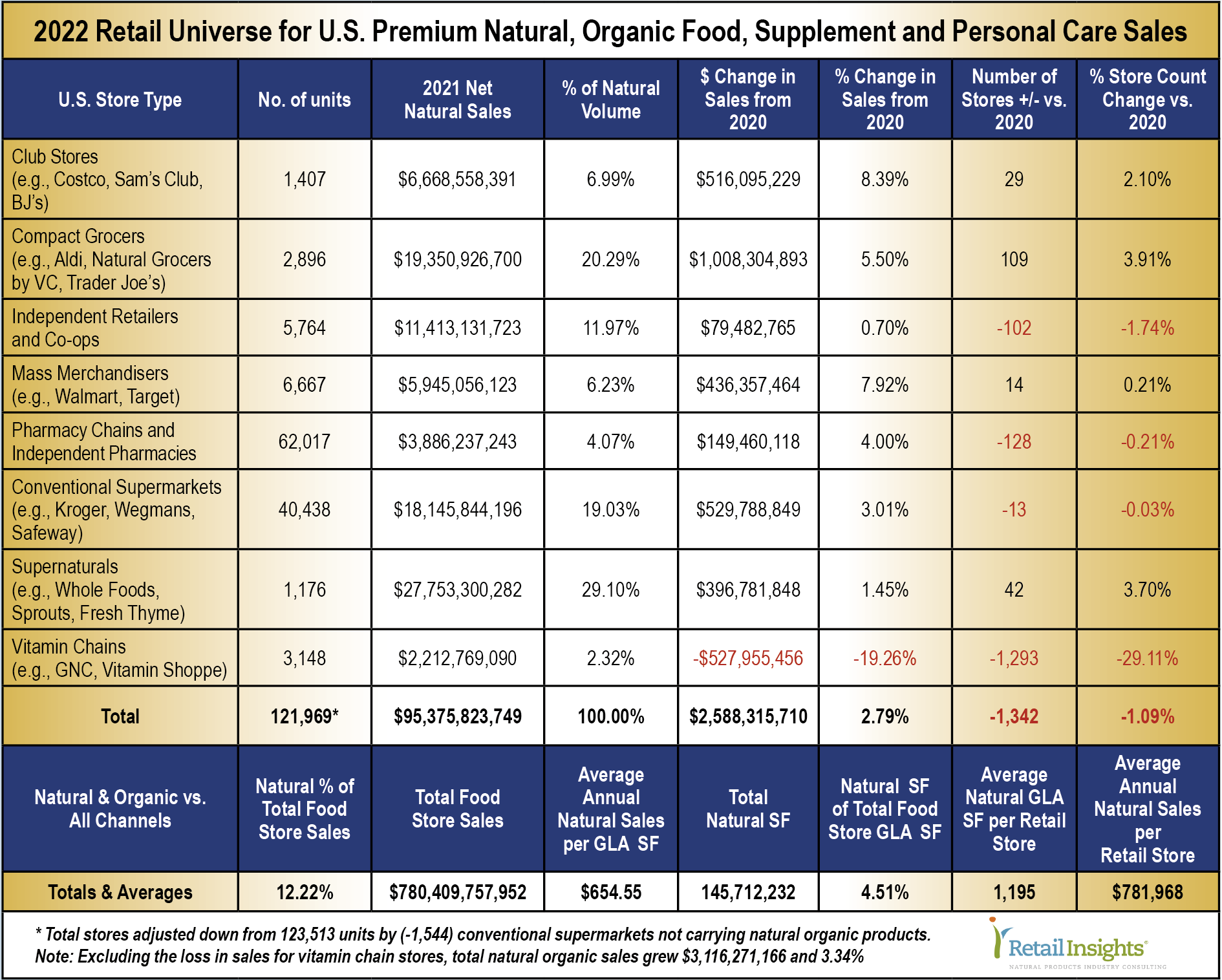

Club Stores: Highest 8.39% Growth Rate Big-box membership club stores like BJ’s Wholesale, Costco, and Sam’s Club grew natural organic sales over 8% in 2021, adding more than a half-billion dollars while store counts rose over 2%. The channel maintains its fifth-place position, with a 7% natural market share, leading the back half of the natural pack.

Citing little customer interest in curbside pickup, Costco said it discontinued its pilot program after a short test. The reason appears to be the type of shopping Costco member do, which is large-pack-size stock-ups, not fill-in quick trips. It is also likely customers enjoy the treasure hunt experience, combing through Costco’s relatively small 3,800 SKUs, compared to 15,000 at the typical conventional supermarket. Digital has grown to 8% of the company’s sales, about a third of which are for deliveries of large equipment such as refrigerators, freezers and televisions.

Compact Grocers: Add a Cool $1 Billion—Largest Dollar Growth For more than a decade, Retail Insights has identified and tracked the Compact Grocer sector, made up of stores no larger than 20,000 square feet. Easier to site and operate than conventional supermarkets, natural organic specialists such as Natural Grocers by Vitamin Cottage and Trader Joe’s, as well as insurgent Aldi, have quickly made natural organic inroads, adding over $1 billion in 2021—the largest dollar gain of all eight retail channels we follow—to reach $19.3 billion and a 5.5% natural market share.

Aldi continues its push towards 2,500 stores, adding 79 last year to reach 2,152 units, followed by Trader Joe’s, which added 22 stores to reach 552. While Trader Joe’s has long featured natural organic, it is Aldi that is stealing a march, quietly adding dozens of private label premium natural organic items, at not-to-be-beaten prices.

Natural Grocers logged a 3.8% increase in same-store sales in its recently completed fiscal first quarter of 2022. The company says 73% of sales come from members of its {N}Power loyalty program, who spend about $25 per visit, compared to non-members who shop less frequently, and spend about $53 per monthly visit.

Independent Retailers and Co-ops: Managing Growth with Fewer Stores Independents closed just over 100 stores last year, but growth in the remaining stores outstripped this loss, eking out a $79 million gain, or 0.7%, and holding onto fourth-place natural market share of 11.97%. The independent channel, which we cover in-depth in this issue inWholeFoods 44th Annual Retailer Survey, remains resilient despite the pandemic and fierce competition from brick-and-mortar and online channels.

While a small percentage of independents closed in 2021, the remaining group of retailers appears optimistic about growth in 2022. A large part of the reason is the richer shopping experience they provide, encouraging customers to engage with knowledgeable staff, and to receive authoritative nutritional guidance, all in a soothing and uplifting atmosphere. Those predicting the demise of independents may have to wait a while longer.

Mass Merchandisers: Gaining Momentum The pandemic was kind to the likes of Target and Walmart. Surging traffic into these stores, driven by federal stimulus and unemployment insurance dollars, had knock-on effects for natural organic sales, increasing over $400 million, for the second-highest percentage channel increase of 7.92%.

The majority of these gains come from the vitamin and supplements department, with relatively little coming from foods. Target has made a move to upgrade its food offerings, with its Simply Balanced natural brand focused on plant-based ingredients, and more recently, Good & Gather, a premium private label offering featuring dairy, meat and fresh produce.

Pharmacy: Surfing the COVID Vaccine Wave The big pharmacy chains, CVS and Walgreen, reported their strongest comparable-store sales in decades, as consumers streamed in for multiple vaccinations, and who then spent money on front-end purchases. Boosted primarily by their vitamin and supplement departments, pharmacies added nearly $150 million in natural organic sales; a 4% increase, retaining the channel’s 4% natural organic market share.

Conventional Supermarkets: Hard Comparisons to 2020, but Nicely Up Conventional supermarkets like Albertson’s, Kroger, Publix, Safeway and Wegmans had a high sales hurdle to beat the 2020 windfall from shoppers hoarding groceries. The sector grew about 3% overall, which raised natural organic sales more than $500 million, securing the channel’s third-place, 19% natural market share.

In its recent quarterly conference call, Kroger noted shoppers continued to cook and entertain at home, up to and through the holidays, in larger groups, leading management to believe the change to food-at-home is structural and not temporary. Kroger cited its $10 billion digital business, roughly 8% of its non-fuel total sales.

In its recent call, Albertson’s noted the return of deli sales, with fresh foods outpacing the growth of center store sales by five percentage points, and growing faster than the rest of the store. Management credited the continuing trend of consuming food-at-home. Albertson’s uses third-party delivery providers, as do most other major conventional supermarket chains. Discussing delivery company DoorDash, management said it has begun allowing customers to combine their store orders with a restaurant meal from outside the store, in a program called “Double Dash.” The wisdom of this decision remains to be seen, as it by definition must cannibalize Albertson’s own prepared foods program it is now touting.

Supernaturals: Slowing Growth; Still No. 1 Productivity in the supernatural channel, which includes stores like EarthFare, Fresh Thyme, Sprouts and Whole Foods Markets, slipped last year. The sector added 42 stores, a 3.7% increase, yet sales rose a more modest 1.45%, indicating a slowdown in productivity. Overall channel sales increased just under $400 million, retaining its natural organic industry-leading market share of 29%.

The segment leader, Amazon’s Whole Foods Market, saw monthly store visits drop by more than 20% in early 2021 compared to 2019, and only partially recover to down 5.2% by last December, according to Placer.ai. Amazon groups Whole Foods with its other brick-and-mortar stores, which include 23 Amazon Fresh stores—a conventional-style supermarket. Altogether, Amazon’s “physical stores” suffered a 15.5% decline in sales during the first quarter of 2021.

For the full-year 2021, “physical store” sales totaled about $17 billion—not much more than the $16-plus billion Whole Foods Market was doing on its own when Amazon bought it in 2017. Shoppers do order online from Whole Foods, which Amazon counts as “online sales,” not physical stores. We have added 20% to Whole Foods’ estimated in-store sales to reflect the online business, but it must make Amazon’s bean counters less than happy to pay premium real-estate rents for Whole Foods’ prime locations to function as generic order-fulfillment centers. Not that it matters much when your stock market capitalization is $1.6 trillion.

Sprouts Farmers Markets management noted, in its recent investor call on the third quarter, that comparable store sales were down 5.4% vs. a year ago, and down 2.1% vs. the same period in 2019. CEO Jack Sinclair explained part of the reason was losing 25% of its transactions as the pandemic hit in the second quarter of 2020. In addition, the company stopped its deep-discount, loss-leader advertising, which improved profit margins, but shrank transactions further by firing “coupon-clipper” customers who shopped exclusively for deals.

The company is also forecasting negative comparable store sales down 3% to 5% for the current fourth quarter, as it anniversaries these two major events. In a strategic shift, Sprouts is building stores about 20% smaller—closer to 23,000 square feet than 28,000—which cost less to build, and forecast to be as productive as the larger legacy stores. Sprouts describes itself as a “complementary shop;” a second or third store shoppers visit after their primary shop. Management says getting the message out about Sprouts' lower prices, particularly on fresh produce, plays a big role in the company regaining its momentum.

Vitamin Chains: The Agony of a Dying Business Model For years we’ve seen the big vitamin chains slowly reduce store counts after withdrawing from the public markets to go private. Although Vitamin Shoppe added a few stores last year, the channel was swamped by closures of nearly 1,300 GNC stores. The sector shed more than $500 million in sales—a 19% decrease. This reduced overall natural industry retail sales by 16%, cutting topline growth of 3.34% by more than a half-percentage point, to 2.79%, and reducing yearly growth to $2.6 billion from what likely would have been a $3.3 billion increase had these stores stayed open.

Natural Organic: A Growing Piece of the Food Pie Food retailers in all eight channels continue to deepen their presence in the natural organic space. As the pandemic proved, the superior nutrition and immune support natural organic products provide bodes well for our future.JJ

This year's survey was sponsored by Nutrasource.

This year's survey was sponsored by Nutrasource.